JCPenney 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

examine prior periods where federal and state NOL and tax credit carryforwards were generated, and make adjustments up to the amount of the NOL and

credit carryforward amounts.

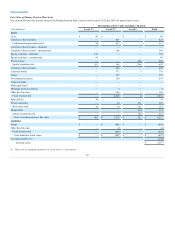

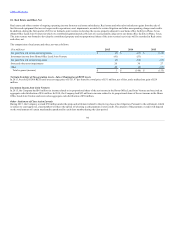

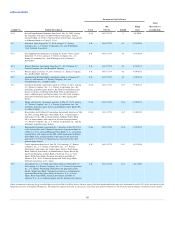

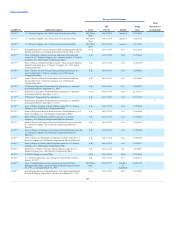

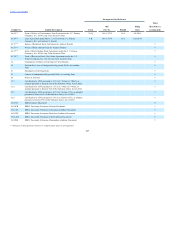

Income taxes received/(paid), net

$ (5)

$ (30)

$ 81

Interest received/(paid), net

(369)

(401)

(414)

Property contributed to joint venture

—

30

—

Increase/(decrease) in other accounts payable related to purchases of property and

equipment

1

(14)

(29)

Financing costs withheld from proceeds of long-term debt

—

7

70

Purchase of property and equipment and software through capital leases and a note

payable

1

3

4

Issuance costs withheld from proceeds of common stock issued

—

—

24

Return of shares of Martha Stewart Living Omnimedia, Inc. previously acquired by the

Company

—

—

36

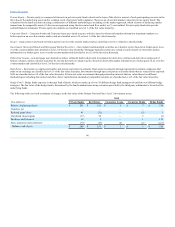

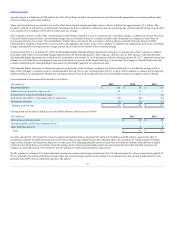

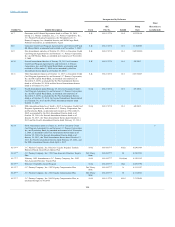

On August 16, 2012, Macy’s, Inc. and Macy’s Merchandising Group, Inc. (together the Plaintiffs) filed suit against JCP in the Supreme Court of the State of

New York, County of New York, alleging that the Company tortiously interfered with, and engaged in unfair competition relating to, a 2006 agreement

between Macy’s and Martha Stewart Living Omnimedia, Inc. (MSLO) by entering into a partnership agreement with MSLO in December 2011. The Plaintiffs

sought primarily to prevent the Company from implementing our partnership agreement with MSLO as it related to products in the bedding, bath, kitchen

and cookware categories. The suit was consolidated with an already-existing breach of contract lawsuit by the Plaintiffs against MSLO, and a bench trial

commenced on February 20, 2013. On October 21, 2013, the Company and MSLO entered into an amendment of the partnership agreement, providing in part

that the Company will not sell MSLO-designed merchandise in the bedding, bath, kitchen and cookware categories. On January 2, 2014, MSLO and Macy's

announced that they had settled the case as to each other, and MSLO was subsequently dismissed as a defendant. On June 16, 2014, the court issued a ruling

against the Company on the remaining claim of intentional interference, and held that Macy’s is not entitled to punitive damages. The court referred other

issues related to damages to a Judicial Hearing Officer. On June 30, 2014, the Company appealed the court’s decision, and Macy’s cross-appealed a portion of

the decision. On February 26, 2015, the appellate court affirmed the trial court's rulings concerning the claim of intentional interference and lack of punitive

damages, and reinstated Macy's claims for intentional interference and unfair competition that had been dismissed during trial. On June 17, 2015, Macy’s

appealed the court’s order that the Judicial Hearing Officer proceed with the damages phase of the proceedings on the tortious interference claim. On

November 24, 2015, the Judicial Hearing Officer issued a recommendation on the amount of damages to be awarded to Macy’s. Both parties have objected to

the damages recommendation. On December 1, 2015, the appellate court heard oral argument on Macy's appeal of the trial court's order referring issues

related to damages to the Judicial Hearing Officer and the parties are awaiting a decision. While no assurance can be given as to the ultimate outcome of this

matter, we believe that the final resolution of this action will not have a material adverse effect on our results of operations, financial position, liquidity or

capital resources.

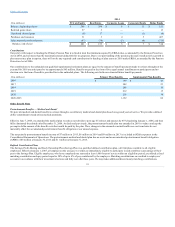

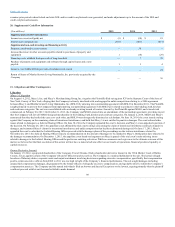

On January 19, 2012, a purported shareholder of the Company, Everett Ozenne, filed a shareholder derivative lawsuit in the 193rd District Court of Dallas

County, Texas, against certain of the Company’s Board of Directors and executives. The Company is a nominal defendant in the suit. The lawsuit alleged

breaches of fiduciary duties, corporate waste and unjust enrichment involving decisions regarding executive compensation, specifically that compensation

paid to certain executive officers from 2008 to 2011 was too high in light of the Company’s financial performance. The suit sought damages including

unspecified compensatory damages, disgorgement by the former officers of allegedly excessive compensation, and equitable relief to reform the Company’s

compensation practices. The Company and the named individuals filed an Answer and Special Exceptions to the lawsuit, arguing primarily that the plaintiff

could not proceed with his suit because he failed to make demand

98