JCPenney 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

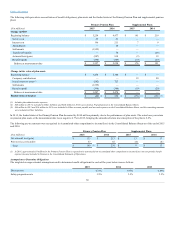

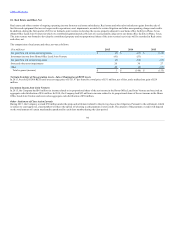

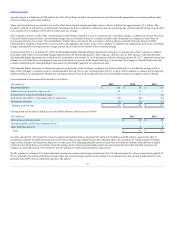

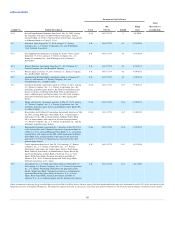

Real estate and other consists of ongoing operating income from our real estate subsidiaries. Real estate and other also includes net gains from the sale of

facilities and equipment that are no longer used in operations, asset impairments, accruals for certain litigation and other non-operating charges and credits.

In addition, during the first quarter of 2014, we formed a joint venture to develop the excess property adjacent to our home office facility in Plano, Texas

(Home Office Land Joint Venture) in which we contributed approximately 220 acres of excess property adjacent to our home office facility in Plano, Texas.

The joint venture was formed to develop the contributed property and our proportional share of the joint venture's activities will be recorded in Real estate

and other, net.

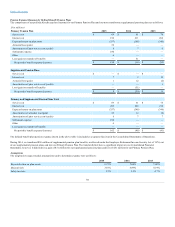

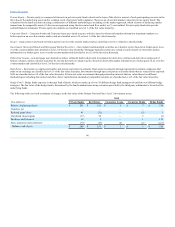

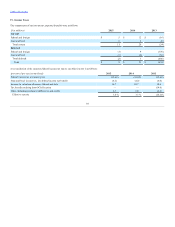

The composition of real estate and other, net was as follows:

Net gain from sale of non-operating assets

$ (9)

$ (25)

$ (132)

Investment income from Home Office Land Joint Venture

(41)

(53)

—

Net gain from sale of operating assets

(9)

(92)

(17)

Store and other asset impairments

20

30

27

Other

42

(8)

(33)

Total expense/(income)

$ 3

$ (148)

$ (155)

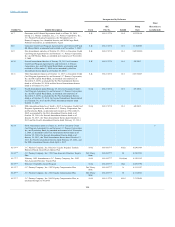

In 2013, we sold 205,000 REIT units at an average price of $151.97 per share for a total price of $31 million, net of fees, and a realized net gain of $24

million.

In 2015, the Company had $41 million in income related to its proportional share of the net income in the Home Office Land Joint Venture and received an

aggregate cash distribution of $36 million. In 2014, the Company had $53 million in income related to its proportional share of the net income in the Home

Office Land Joint Venture and received an aggregate cash distribution of $58 million.

During 2015, the Company accrued $50 million under the proposed settlement related to the pricing class action litigation. Pursuant to the settlement, which

is subject to court approval, class members will have the option of selecting a cash payment or store credit. The amount of the payment or credit will depend

on the total amount of certain merchandise purchased by each class member during the class period.

94