JCPenney 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

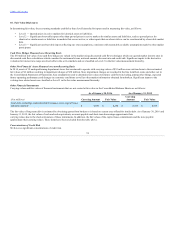

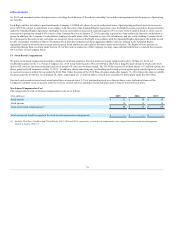

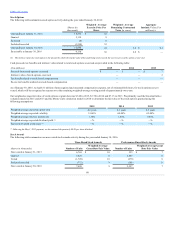

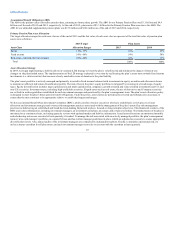

As of January 30, 2016, we had $50 million of unrecognized compensation expense related to unearned employee stock awards, which will be recognized

over the remaining weighted-average vesting period of approximately two years. The aggregate market value of shares vested during 2015, 2014 and 2013

was $16 million, $4 million and $25 million, respectively, compared to an aggregate grant date fair value of $27 million, $9 million and $42 million,

respectively.

In addition to the grants above, on March 19, 2015, we granted approximately 2.5 million phantom units as part of our management incentive compensation

plan, which are similar to RSUs in that the number of units granted was based on the price of our stock, but the units will be settled in cash based on the value

of our stock on the vesting date, limited to $15.54 per phantom unit. The fair value of the awards is remeasured at each reporting period and was $7.26 per

share as of January 30, 2016. Compensation expense, which is variable, is recognized over the vesting period with a corresponding liability, which is

recorded in Other accounts payable and accrued expenses and Other liabilities in our Consolidated Balance Sheets, of $17 million as of January 30, 2016.

Awards granted include approximately 154,000 fully vested RSUs to directors during 2015 with a fair value of $8.64 per RSU award.

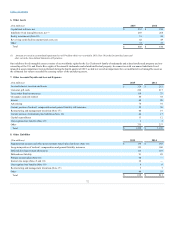

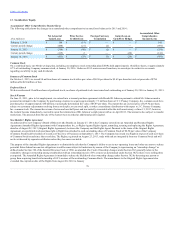

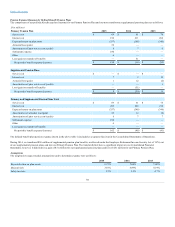

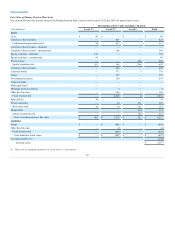

We conduct a major part of our operations from leased premises that include retail stores, store distribution centers, warehouses, offices and other facilities.

Almost all leases will expire during the next 20 years; however, most leases will be renewed, primarily through an option exercise, or replaced by leases on

other premises. We also lease data processing equipment and other personal property under operating leases of primarily three to five years. Rent expense, net

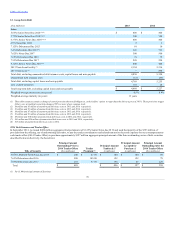

of sublease income, was as follows:

Real property base rent and straight-lined step rent expense

$ 221

$ 233

$ 237

Real property contingent rent expense (based on sales)

7

8

5

Personal property rent expense

39

53

65

Total rent expense

$ 267

$ 294

$ 307

Less: sublease income(1)

(11)

(13)

(16)

Net rent expense

$ 256

$ 281

$ 291

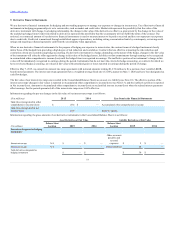

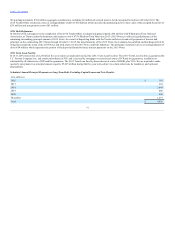

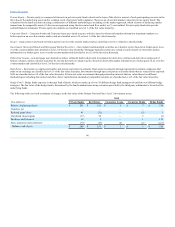

As of January 30, 2016, future minimum lease payments for non-cancelable operating leases, including lease renewals determined to be reasonably assured

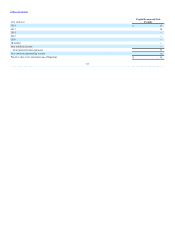

and capital leases, including our note payable, were as follows:

2016 $ 227

2017 200

2018 169

2019 146

2020 129

Thereafter 1,816

Less: sublease income (27)

Total minimum lease payments $ 2,660

81