JCPenney 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

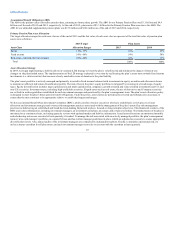

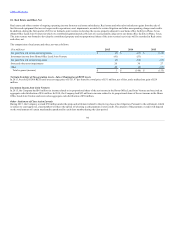

Private equity is composed of interests in private equity funds valued on the basis of the relative interest of each participating investor in the

fair value of the underlying assets and/or common stock of privately held companies. There are no observable market values for private equity funds. The

valuations for the funds are derived using a combination of different methodologies including (1) the market approach, which consists of analyzing market

transactions for comparable assets, (2) the income approach using the discounted cash flow model, or (3) cost method. Private equity funds also provide

audited financial statements. Private equity investments are classified as level 3 of the fair value hierarchy.

– Corporate bonds and Corporate loans are valued at a price which is based on observable market information in primary markets or a

broker quote in an over-the-counter market, and are classified as level 2 or level 3 of the fair value hierarchy.

– swap contracts are based on broker quotes in an over-the-counter market and are classified as level 2 of the fair value hierarchy.

Government and municipal securities are valued at a price based on a broker quote in an

over-the-counter market and classified as level 2 of the fair value hierarchy.Mortgage backed securities are valued at a price based on observable market

information or a broker quote in an over-the-counter market and classified as level 2 of the fair value hierarchy.

non-mortgage asset backed securities, collateral held in short-term investments for derivative contract and derivatives composed of

futures contracts, option contracts and other fix income derivatives valued at a price based on observable market information or a broker quote in an over-the-

counter market and classified as level 2 of the fair value hierarchy.

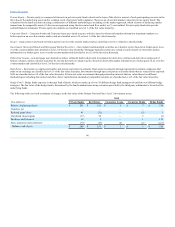

Real estate is comprised of public and private real estate investments. Real estate investments through registered investment companies that

trade on an exchange are classified as level 1 of the fair value hierarchy. Investments through open end private real estate funds that are valued at the reported

NAV are classified as level 2 of the fair value hierarchy. Private real estate investments through partnership interests that are valued based on different

methodologies including discounted cash flow, direct capitalization and market comparable analysis are classified as level 3 of the fair value hierarchy.

Hedge funds exposure is through fund of funds, which are made up of over 30 different hedge fund managers diversified over different hedge

strategies. The fair value of the hedge fund is determined by the fund's administrator using valuation provided by the third party administrator for each of the

underlying funds.

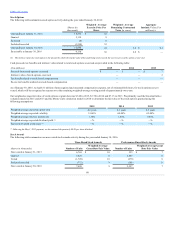

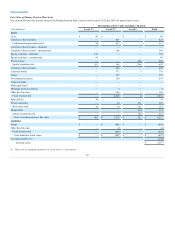

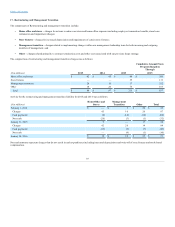

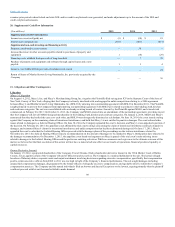

The following tables set forth a summary of changes in the fair value of the Primary Pension Plan’s level 3 investment assets:

Balance, beginning of year $ 281

$ 153

$ 5

$ 7

$ 314

Transfers, net —

—

—

—

—

Realized gains/(loss) 41

(23)

—

(3)

3

Unrealized (losses)/gains (17)

38

—

2

(1)

Purchases and issuances 18

2

—

1

119

Sales, maturities and settlements (75)

(19)

(2)

(2)

(221)

Balance, end of year $ 248

$ 151

$ 3

$ 5

$ 214

90