JCPenney 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

to information technology, administrative costs related to our home office and district and regional operations, real and personal property and other taxes

(excluding income taxes) and credit/debit card fees.

Advertising costs, which include newspaper, television, Internet search marketing, radio and other media advertising, are expensed either as incurred or the

first time the advertisement occurs. For cooperative advertising programs offered by national brands that require proof of advertising to be provided to the

vendor to support the reimbursement of the incurred cost, we offset the allowances against the related advertising expense. Programs that do not require proof

of advertising are monitored to ensure that the allowance provided by each vendor is a reimbursement of costs incurred to advertise for that particular

vendor’s label. Total advertising costs, net of cooperative advertising vendor reimbursements of $32 million, $1 million and $4 million for 2015, 2014 and

2013, respectively, were $792 million, $886 million and $919 million, respectively. In 2015, a change in certain cooperative advertising programs resulted

in more vendor reimbursements being recognized as a reduction of our advertising expense rather than offsetting cost of goods sold.

We account for income taxes using the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences

attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss

and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which

those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in

income in the period that includes the enactment date. A valuation allowance is recorded to reduce the carrying amounts of deferred tax assets unless it is

more likely than not such assets will be realized. We recognize accrued interest and penalties related to unrecognized tax benefits in income tax expense in

our Consolidated Statements of Operations.

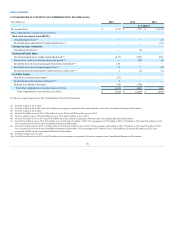

Basic earnings/(loss) per share (EPS) is computed by dividing net income/(loss) by the weighted-average number of common shares outstanding during the

period. Diluted EPS is computed by dividing net income/(loss) by the weighted-average number of common shares outstanding during the period plus the

number of additional common shares that would have been outstanding if the potentially dilutive shares had been issued. Potentially dilutive shares include

stock options, unvested restricted stock units and awards and a warrant outstanding during the period, using the treasury stock method. Potentially dilutive

shares are excluded from the computations of diluted EPS if their effect would be anti-dilutive.

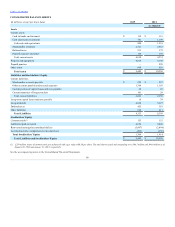

Cash and cash equivalents include cash short-term investments that are highly liquid investments with original maturities of three months or less. Cash short-

term investments consist primarily of short-term U.S. Treasury money market funds and a portfolio of highly rated bank deposits and are stated at cost, which

approximates fair market value due to the short-term maturity. Cash in banks and in transit also include credit card sales transactions that are settled early in

the following period.

Inventories are valued at the lower of cost (using the first-in, first-out or “FIFO” method) or market. For department stores, regional warehouses and store

distribution centers, we value inventories using the retail method. Under the retail method, retail values of merchandise groups are converted to a cost basis

by applying the specific average cost-to-retail ratio related to each merchandise grouping. For Internet, we use standard cost, representing average vendor

cost, to determine lower of cost or market.

Physical inventories are taken on a staggered basis at least once per year at all store and supply chain locations, inventory records are adjusted to reflect

actual inventory counts and any resulting shortage (shrinkage) is recognized. Following inventory counts, shrinkage is estimated as a percent of sales, based

on the most recent physical inventory, in combination with current events and historical experience. We have loss prevention programs and policies in place

that are intended to mitigate shrinkage.

65