JCPenney 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

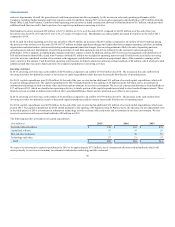

negative evidence that is difficult to overcome in determining that a valuation allowance is not needed against deferred tax assets.

This assessment is completed on a taxing jurisdiction basis and takes into account several types of evidence, including the following:

• Nature, frequency, and severity of current and cumulative financial reporting losses. A pattern of recent losses is heavily weighted as a source of

negative evidence. In certain circumstances, historical information may not be as relevant due to a change in circumstances.

• Sources of future taxable income. Future reversals of existing temporary differences are heavily weighted sources of objectively verifiable positive

evidence. Projections of future taxable income, exclusive of reversing temporary differences, are a source of positive evidence only when the

projections are combined with a history of recent profits and can be reasonably estimated. Otherwise, these projections are considered inherently

subjective and generally will not be sufficient to overcome negative evidence that includes cumulative losses in recent years, particularly if the

projected future taxable income is dependent on an anticipated turnaround to profitability that has not yet been achieved. In such cases, we

generally give these projections of future taxable income no weight for the purposes of our valuation allowance assessment.

• Tax planning strategies. If necessary and available, tax-planning strategies would be implemented to accelerate taxable amounts to utilize expiring

net operating loss carryforwards. These strategies would be a source of additional positive evidence and, depending on their nature, could be heavily

weighted.

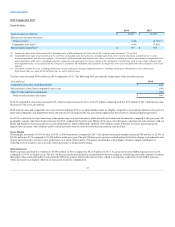

In the second quarter of 2013, our net deferred tax position, exclusive of any valuation allowance, changed from a net deferred tax liability to a net deferred

tax asset. In our assessment of the need for a valuation allowance, we heavily weighted the negative evidence of cumulative losses in recent periods and the

positive evidence of future reversals of existing temporary differences. Although a sizable portion of our losses in recent years were the result of charges

incurred for restructuring and other special items, even without these charges we still would have incurred significant losses. Accordingly, we considered our

pattern of recent losses to be relevant to our analysis. Considering this pattern of recent losses and the uncertainties associated with projected future taxable

income exclusive of reversing temporary differences, we gave no weight to projections showing future U.S. taxable income for purposes of assessing the need

for a valuation allowance. As a result of our assessment, we concluded that, beginning in the second quarter of 2013, our estimate of the realization of

deferred tax assets would be based solely on future reversals of existing taxable temporary differences and tax planning strategies that we would make use of

to accelerate taxable income to utilize expiring carryforwards.

Future book pre-tax losses will require additional valuation allowances to offset the deferred tax assets created. A sustained period of profitability is required

before we would change our need for a valuation allowance against our net deferred tax assets.

See Note 19 to the Consolidated Financial Statements for more information regarding income taxes and also Risk Factors, Item 1A.

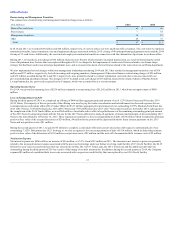

In establishing our reserves for liabilities associated with underground storage tanks, we maintain and periodically update an inventory listing of potentially

impacted sites. The estimated cost of remediation efforts is based on our historical experience, as well as industry and other published data. With respect to

our former drugstore operations, we accessed extensive databases of environmental matters, including data from the Environmental Protection Agency, to

estimate the cost of remediation. Our experience, as well as relevant data, was used to develop a range of potential liabilities, and a reserve was established at

the time of the sale of our drugstore business. The reserve is adjusted as payments are made or new information becomes known. Reserves for asbestos

removal are based on our known liabilities in connection with approved plans for store modernization, renovations or dispositions of store locations.

We believe the established reserves, as adjusted, are adequate to cover estimated potential liabilities.

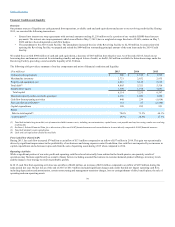

We maintain a qualified funded defined benefit pension plan (Primary Pension Plan) and smaller non-qualified unfunded supplemental defined benefit plans.

The determination of pension expense is the result of actuarial calculations that are based on important assumptions about pension assets and liabilities. The

most important of these are the expected rate of return on

45