JCPenney 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

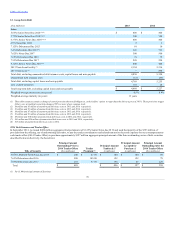

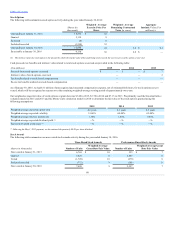

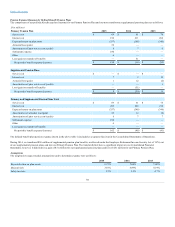

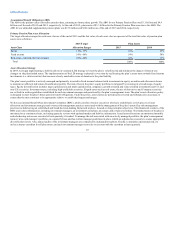

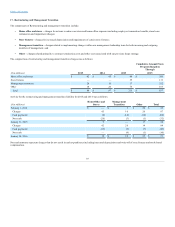

The following table provides a reconciliation of benefit obligations, plan assets and the funded status of the Primary Pension Plan and supplemental pension

plans:

Beginning balance $ 5,254 $ 4,477 $ 191 $ 219

Service cost 69 61 — —

Interest cost 196 211 7 9

Amendments — 20 — —

Settlements (1,555)

—

—

—

Transfer of benefits — 56 — (56)

Actuarial loss/(gain) (247) 818 (3) 39

Benefits (paid) (390) (389) (19) (20)

Balance at measurement date $ 3,327 $ 5,254 $ 176 $ 191

Beginning balance $ 5,474 $ 5,140 $ — $ —

Company contributions — — 19 20

Actual return on assets(1) (242) 723 — —

Settlements (1,555) — — —

Benefits (paid) (390) (389) (19) (20)

Balance at measurement date $ 3,287 $ 5,474 $ — $ —

$ (40) (2) $ 220 (2) $ (176) (3) $ (191) (3)

In 2015, the funded status of the Primary Pension Plan decreased by $260 million primarily due to the performance of plan assets. The actual one-year return

on pension plan assets at the measurement date was a negative 4.7% in 2015, bringing the annualized return since inception of the plan to 8.8%.

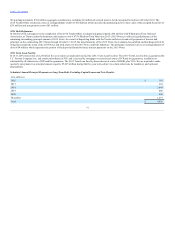

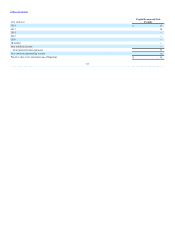

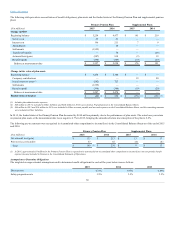

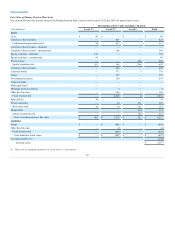

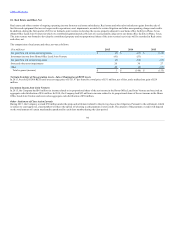

The following pre-tax amounts were recognized in Accumulated other comprehensive income/(loss) in the Consolidated Balance Sheets as of the end of 2015

and 2014:

Net actuarial loss/(gain) $ 333

$ 213

$ 13

$ 17

Prior service cost/(credit) 57 65

(4) (4)

Total $ 390 (1) $ 278

$ 9

$ 13

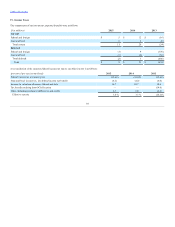

The weighted-average actuarial assumptions used to determine benefit obligations for each of the years below were as follows:

Discount rate

4.73%

3.87%

4.89%

Salary progression rate

3.9%

3.5%

3.5%

86