JCPenney 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

assets and the discount rate assumptions. These assumptions require significant judgment and a change in any one of them could have a material impact on

pension expense reported in our Consolidated Statements of Operations and Consolidated Statements of Comprehensive Income/(Loss), as well as in the

assets, liability and equity sections of the Consolidated Balance Sheets.

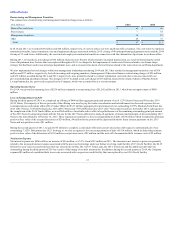

The following table reflects our expected rate of return and discount rate assumptions:

Expected return on plan assets 6.75%

7.00%

7.00%

Discount rate for pension expense 3.87%

4.89%

4.19%

Discount rate for pension obligation 4.73%

3.87%

4.89%

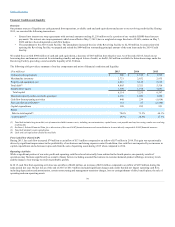

For the Primary Pension Plan, we apply our expected return on plan assets using fair market value as of the annual measurement date. The fair market value

method results in greater volatility to our pension expense than the more commonly used calculated value method (referred to as smoothing of assets). Our

Primary Pension Plan asset base consists of a mix of equities (U.S., non-U.S. and private), fixed income (investment-grade and high-yield), real estate (private

and public) and alternative asset classes.

The expected return on plan assets is based on the plan’s long-term asset allocation policy, historical returns for plan assets and overall capital market returns,

taking into account current and expected market conditions. The expected return assumption for 2015 was reduced from 7.00% to 6.75% given our new asset

allocation targets and updated expected capital markets return assumptions.

The discount rate used to measure pension expense each year is the rate as of the beginning of the year (i.e., the prior measurement date). The discount rate, as

determined by the plan actuary, is based on a hypothetical AA yield curve represented by a series of bonds maturing over the next 30 years, designed to

match the corresponding pension benefit cash payments to retirees.

For 2015, the discount rate to measure pension expense was 3.87% compared to 4.89% in 2014. The discount rate to measure the pension obligations

increased to 4.73% as of January 30, 2016 from 3.87% as of January 31, 2015.

The sensitivity of pension expense to a plus or minus one-half of one percent of expected return on assets is a decrease or increase in pension expense of

approximately $16 million. An increase in the discount rate of one-half of one percent would increase the 2016 pension expense by approximately $3

million and a decrease in the discount rate of one-half of one percent would decrease pension expense by approximately $4 million.

Funding requirements for our Primary Pension Plan are determined under Employee Retirement Income Security Act of 1974 (ERISA) rules, as amended by

the Pension Protection Act of 2006. As a result of the funded status of the Primary Pension Plan, we are not required to make cash contributions in 2016.

Refer to Note 4 to the Consolidated Financial Statements.

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which

reflect our current view of future events and financial performance. Words such as "expect" and similar expressions identify forward-looking statements,

which include, but are not limited to, statements regarding sales, gross margin, selling, general and administrative expenses, earnings, cash flows and

liquidity. Forward-looking statements are based only on the Company's current assumptions and views of future events and financial performance. They are

subject to known and unknown risks and uncertainties, many of which are outside of the Company's control, that may cause the Company's actual results to

be materially different from planned or expected results. Those risks and uncertainties include, but are not limited to, general economic conditions, including

inflation, recession, unemployment levels, consumer confidence and

46