JCPenney 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

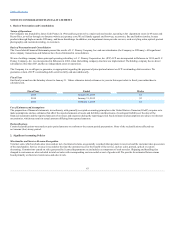

In February 2016, the FASB issued ASC Topic 842, , which will require lessees to recognize most

leases on their balance sheets as lease liabilities with corresponding right-of-use assets. While many aspects of lessor accounting would remain the same, the

new standard would make some changes, such as eliminating today’s real estate-specific guidance. As a globally converged standard, lessees and lessors

would be required to classify most leases using a principle generally consistent with that of International Accounting Standards. The standard also would

change what would be considered the initial direct costs of a lease. The standard would be effective for annual periods beginning after December 15, 2018

and interim periods within that year and must be adopted by on a modified retrospective method, with elective reliefs, which requires application of the new

guidance for all periods presented. We are currently evaluating the effect that adopting this new accounting guidance will have on our financial condition,

results of operations or cash flows.

In November 2015, the FASB issued ASU 2015-17, which requires all deferred tax

assets and liabilities to be classified as noncurrent on the balance sheet instead of separating deferred taxes into current and noncurrent amounts. The new

standard will also no longer require allocating valuation allowances between current and noncurrent deferred tax assets because those allowances also will be

classified as noncurrent. The guidance is effective for financial statements issued for annual periods beginning after December 15, 2016, and interim periods

within those annual periods and the guidance can adopt the guidance either prospectively or retrospectively. We do not expect the adoption of this standard

to have a material impact on our financial condition, results of operations or cash flows.

In July 2015, the FASB issued ASU 2015-11, , which simplifies the subsequent

measurement of inventory by requiring inventory to be measured at the lower of cost and net realizable value. Under current guidance, net realizable value is

one of several calculations an entity needs to make to measure inventory at the lower of cost or market. However, companies will continue to apply their

existing impairment models to inventories that are accounted for using last-in first-out (LIFO) and the retail inventory method (RIM). The guidance, which

can be early adopted, is effective for fiscal years beginning after December 15, 2016, including interim periods within those fiscal years and the guidance

must be applied prospectively after the date of adoption. We do not expect the adoption of this standard to have a material impact on our financial condition,

results of operations or cash flows.

In April 2015, the FASB issued ASU 2015-05,

which amends its guidance on internal use software to clarify how customers in cloud computing arrangements

should determine whether the arrangement includes a software license. The guidance also eliminates the existing requirement for customers to account for

software licenses they acquire by analogizing to the guidance on leases. Instead, these arrangements are to be accounted for as licenses of intangible assets.

The guidance, which can be early adopted, is effective for annual periods, including interim periods within those annual periods, beginning after December

15, 2015. We do not expect the adoption of this standard to have a material impact on our financial condition, results of operations or cash flows.

In April 2015, the FASB Issued ASU 2015-4, , to provide a practical expedient related to the measurement date of defined

benefit plan assets and obligations. The practical expedient allows employers with fiscal year-end dates that do not coincide with a calendar month-end (e.g.,

companies with a 52/53-week fiscal year) to measure pension and post-retirement benefit plan assets and obligations as of the calendar month-end date

closest to the fiscal year-end. Companies that choose to apply the expedient are required to adjust the measurement of defined benefit plan assets and

obligations for any contributions or significant events (such as a plan amendment, settlement, or curtailment that calls for a remeasurement pursuant to

existing requirements) that occur between the month-end measurement date and an entity’s fiscal year-end (the “intervening period”). The standard is

effective for annual reporting periods beginning after December 15, 2015, including interim periods therein and early adoption is permitted. If elected, the

practical expedients must be applied prospectively. We do not expect the adoption of this standard to have a material impact on our financial condition,

results of operations or cash flows.

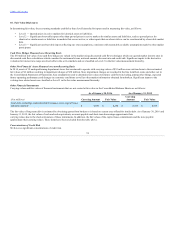

In April 2015, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2015-03,

(ASU 2015-03). ASU 2015-03 requires debt issuance costs related to a recognized

debt liability to be presented in the balance sheet as a direct deduction from the carrying value of that debt liability, consistent with debt discounts. The

recognition and measurement guidance for debt issuance costs are not affected by ASU 2015-03. The amendments in this ASU are effective retrospectively

for fiscal years, and

70