JCPenney 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

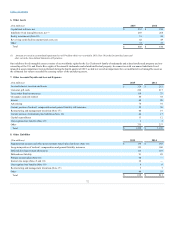

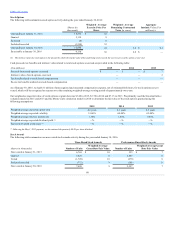

The Company has a $2,350 million senior secured asset-based credit facility (2014 Credit Facility), comprised of a $2,350 million revolving line of credit

(Revolving Facility). During 2015, the Company amended the 2014 Credit Facility to increase the Revolving Facility from $1,850 million to $2,350 million,

and in connection with upsizing the Revolving Facility, the Company prepaid and retired the $494 million outstanding principal amount of the $500

million term loan under the 2014 Credit Facility. The 2014 Credit Facility matures on June 20, 2019.

The 2014 Credit Facility is secured by a perfected first-priority security interest in substantially all of our eligible credit card receivables, accounts receivable

and inventory. The Revolving Facility is available for general corporate purposes, including the issuance of letters of credit. Pricing under the Revolving

Facility is tiered based on our utilization under the line of credit. JCP’s obligations under the 2014 Credit Facility are guaranteed by J. C. Penney Company,

Inc.

The borrowing base under the Revolving Facility is limited to a maximum of 85% of eligible accounts receivable, plus 90% of eligible credit card

receivables, plus 90% of the liquidation value of our inventory, net of certain reserves. Letters of credit reduce the amount available to borrow by their face

value. In addition, the maximum availability is limited by a minimum excess availability threshold which is the lesser of 10% of the borrowing base or $200

million, subject to a minimum threshold requirement of $150 million.

As of the end of 2015, we had no borrowings outstanding under the Revolving Facility. In addition, as of the end of 2015, we had $1,848 million available

for borrowing, of which $280 million was reserved for outstanding standby and import letters of credit, none of which have been drawn on, leaving $1,568

million for future borrowings. The applicable rate for standby and import letters of credit was 2.50% and 1.25%, respectively, while the required commitment

fee was 0.375% for the unused portion of the Revolving Facility.

75