JCPenney 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

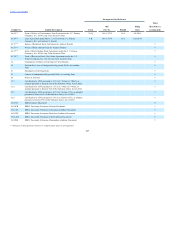

Table of Contents

complaint which was granted in part and denied in part by the court on September 29, 2015. Defendants filed an answer to the complaint on November 6,

2015. We believe the lawsuit is without merit and we intend to vigorously defend it. While no assurance can be given as to the ultimate outcome of this

matter, we believe that the final resolution of this action will not have a material adverse effect on our results of operations, financial position, liquidity or

capital resources.

JCP is a defendant in a class action proceeding entitled filed on April 15, 2011 in the U.S. District Court, Southern District

of California. The lawsuit alleges that JCP violated the California Labor Code in connection with the alleged forfeiture of accrued and vested vacation time

under its “My Time Off” policy. The class consists of all JCP employees who worked in California from April 5, 2007 to the present. Plaintiffs amended the

complaint to assert additional claims under the Illinois Wage Payment and Collection Act on behalf of all JCP employees who worked in Illinois from

January 1, 2004 to the present. After the court granted JCP’s motion to transfer the Illinois claims, those claims are now pending in a separate action in the

U.S. District Court, Northern District of Illinois, entitled . The lawsuits seek compensatory damages, penalties, interest,

disgorgement, declaratory and injunctive relief, and attorney’s fees and costs. Plaintiffs in both lawsuits filed motions, which the Company opposed, to

certify these actions on behalf of all employees in California and Illinois based on the specific claims at issue. On December 17, 2014, the California court

granted plaintiffs’ motion for class certification. Pursuant to a motion by the Company, the California court decertified the class on December 9, 2015. On

February 12, 2016, Plaintiff and the Company each filed motions for partial summary judgment with the California court. The Illinois court denied without

prejudice plaintiffs' motion for class certification pending the filing of an amended complaint. Plaintiffs filed their amended complaint in the Illinois lawsuit

on April 14, 2015 and the Company has answered. On July 2, 2015, the Illinois plaintiffs renewed their motion for class certification, which the Company has

opposed. We believe these lawsuits are without merit and we intend to continue to vigorously defend these lawsuits. While no assurance can be given as to

the ultimate outcome of these matters, we believe that the final resolution of these actions will not have a material adverse effect on our results of operations,

financial position, liquidity or capital resources.

JCP is a defendant in a class action proceeding entitled filed on February 8, 2012 in the U.S. District Court, Central

District of California. The lawsuit alleges that JCP violated California’s Unfair Competition Law and related state statutes in connection with its advertising

of sale prices for private label apparel and accessories. The lawsuit seeks restitution, damages, injunctive relief, and attorney’s fees and costs. On May 18,

2015, the court granted plaintiff's request for certification of a class consisting of all people who, between November 5, 2010 and January 31, 2012, made

purchases in California of JCP private or exclusive label apparel or accessories advertised at a discount of at least 30% off the stated original or regular price

(excluding those who only received such discount by using coupon(s)), and who have not received a refund or credit for their purchases. The parties have

reached a settlement agreement, subject to court approval, and in accordance with the term of the settlement, we have established a $50 million reserve to

settle class members' claims.

We are subject to various other legal and governmental proceedings involving routine litigation incidental to our business. Accruals have been established

based on our best estimates of our potential liability in certain of these matters, including certain matters discussed above, all of which we believe aggregate

to an amount that is not material to the Consolidated Financial Statements. These estimates were developed in consultation with in-house and outside

counsel. While no assurance can be given as to the ultimate outcome of these matters, we currently believe that the final resolution of these actions,

individually or in the aggregate, will not have a material adverse effect on our results of operations, financial position, liquidity or capital resources.

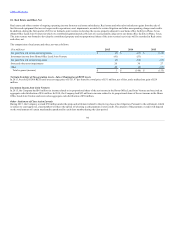

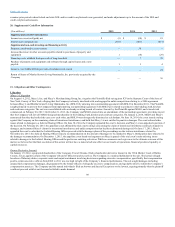

As of January 30, 2016, we estimated our total potential environmental liabilities to range from $20 million to $25 million and recorded our best estimate of

$23 million in Other accounts payable and accrued expenses and Other liabilities in the Consolidated Balance Sheet as of that date. This estimate covered

potential liabilities primarily related to underground storage tanks, remediation of environmental conditions involving our former drugstore locations and

asbestos removal in connection with approved plans to renovate or dispose of our facilities. We continue to assess required remediation and the adequacy of

environmental reserves as new information becomes available and known conditions are further delineated. If we were to incur losses at the upper end of the

estimated range, we do not believe that such losses would have a material effect on our financial condition, results of operations or liquidity.

100