JCPenney 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

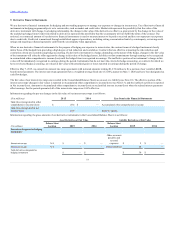

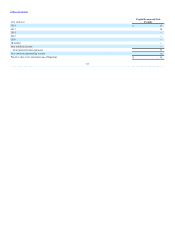

In determining fair value, the accounting standards establish a three level hierarchy for inputs used in measuring fair value, as follows:

• Level 1 — Quoted prices in active markets for identical assets or liabilities.

• Level 2 — Significant observable inputs other than quoted prices in active markets for similar assets and liabilities, such as quoted prices for

identical or similar assets or liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market

data.

• Level 3 — Significant unobservable inputs reflecting our own assumptions, consistent with reasonably available assumptions made by other market

participants.

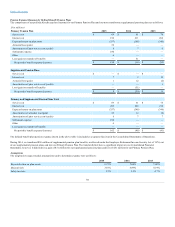

The $30 million fair value of our cash flow hedges are valued in the market using discounted cash flow techniques which use quoted market interest rates in

discounted cash flow calculations which consider the instrument's term, notional amount, discount rate and credit risk. Significant inputs to the derivative

valuation for interest rate swaps are observable in the active markets and are classified as Level 2 in the fair value measurement hierarchy.

In 2014, assets of 19 underperforming department stores that continued to operate with carrying values of $32 million were written down to their estimated

fair values of $2 million resulting in impairment charges of $30 million. Store impairment charges are recorded in the line item Real estate and other, net in

the Consolidated Statements of Operations. Key assumptions used to determine fair values were future cash flows including, among other things, expected

future operating performance and changes in economic conditions as well as other market information obtained from brokers. Significant inputs to the

valuing store related assets are classified as Level 3 in the fair value measurement hierarchy.

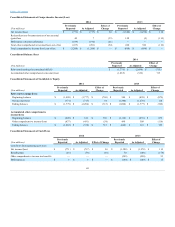

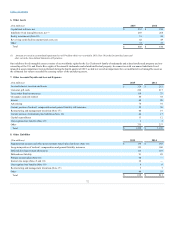

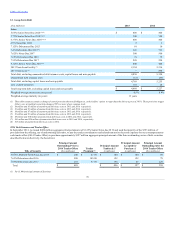

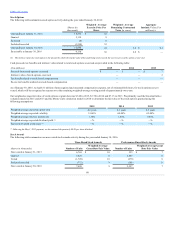

Carrying values and fair values of financial instruments that are not carried at fair value in the Consolidated Balance Sheets are as follows:

Total debt, excluding unamortized debt issuance costs, capital leases

and notes payable

$ 4,830

$ 4,248

$ 5,350

$ 4,834

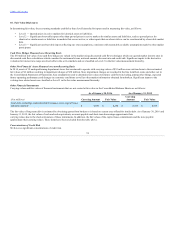

The fair value of long-term debt is estimated by obtaining quotes from brokers or is based on current rates offered for similar debt. As of January 30, 2016 and

January 31, 2015, the fair values of cash and cash equivalents, accounts payable and short-term borrowings approximate their

carrying values due to the short-term nature of these instruments. In addition, the fair values of the capital lease commitments and the note payable

approximate their carrying values. These items have been excluded from the table above.

We have no significant concentrations of credit risk.

74