JCPenney 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

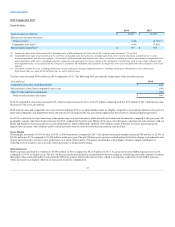

roll-out of approximately 60 new Sephora inside JCPenney locations. Our plan is to fund these expenditures with cash flow from operations and existing cash

and cash equivalents.

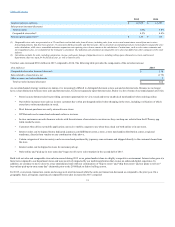

In 2015, cash flows from financing activities were an outflow of $562 million compared to an outflow of $294 million for the same period last year.

During 2015, we prepaid and retired the $494 million outstanding principal amount of the term loan under the 2014 Credit Facility. Through 2015, we repaid

$33 million on our capital leases and note payable and $22 million on the 2013 Term Loan. In addition, we incurred $4 million of financing costs relating to

the 2014 Credit Facility.

During 2014, we closed on our offering of $400 million aggregate principal amount of 2019 Notes and used the majority of the $393 million of proceeds

from the offering, net of underwriting discounts, to pay $362 million for the tender consideration and related transaction fees and expenses for our

contemporaneous tender offers to purchase approximately $327 million aggregate principal amount of our outstanding 2015 Notes, 2016 Notes and 2017

Notes. Subsequent to the completion of the tender offers, we used approximately $64 million of available cash to effect a legal defeasance of the remaining

outstanding principal amount of $60 million on our 2015 Notes by depositing funds with the Trustee for the 2015 Notes sufficient to make all payments of

interest and principal on the outstanding Notes to October 15, 2015, the stated maturity of the 2015 Notes. These transactions resulted in a loss on

extinguishment of debt of $34 million which includes the premium paid over face value of the Securities of $29 million, $4 million for the portion of the

deposited funds for future interest payments on the 2015 Notes and reacquisition costs of $1 million.

During 2014, in conjunction with entering into our 2014 Credit Facility, we used the $500 million of proceeds from the term loan under the 2014 Credit

Facility, in addition to $150 million of cash on hand, to pay down the $650 million cash borrowings that were outstanding under the previous revolving

credit facility. In addition, we incurred $60 million of financing costs relating to the 2014 Credit Facility. Through 2014, we repaid $26 million on our

capital leases and note payable, $23 million on our 2013 Term Loan and $2 million on the term loan under the 2014 Credit Facility.

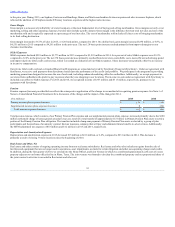

Our primary sources of liquidity are cash generated from operations, available cash and cash equivalents and access to our revolving credit facility. Our cash

flows may be impacted by many factors including the economic environment, consumer confidence, competitive conditions in the retail industry and the

success of our strategies. For 2016, we believe that our existing liquidity will be adequate to fund our capital expenditures and working capital needs;

however, in accordance with our long-term financing strategy, we may access the capital markets opportunistically.

The Company has a $2,350 million asset-based senior secured credit facility (2014 Credit Facility) that is comprised of a $2,350 million revolving line of

credit (Revolving Facility). As of the end of 2015, we had no borrowings outstanding under the Revolving Facility. In addition, as of the end of 2015, based

on our borrowing base, we had $1,848 million available for borrowing under the facility, of which $280 million was reserved for outstanding standby and

import letters of credit, none of which have been drawn on, leaving $1,568 million for future borrowings. The applicable rate for standby and import letters of

credit were 2.50% and 1.25%, respectively, while the commitment fee was 0.375% for the unused portion of the Revolving Facility.

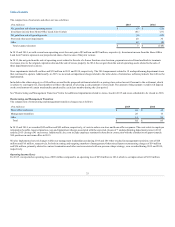

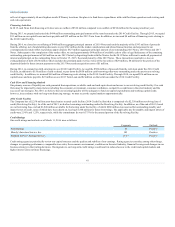

Our credit ratings and outlook as of March 11, 2016 were as follows:

Corporate Outlook

Fitch Ratings B Positive

Moody’s Investors Service, Inc. B3 Positive

Standard & Poor’s Ratings Services CCC+ Positive

Credit rating agencies periodically review our capital structure and the quality and stability of our earnings. Rating agencies consider, among other things,

changes in operating performance, comparable store sales, the economic environment, conditions in the retail industry, financial leverage and changes in our

business strategy in their rating decisions. Downgrades to our long-term credit ratings could result in reduced access to the credit and capital markets and

higher interest costs on future financings.

41