JCPenney 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

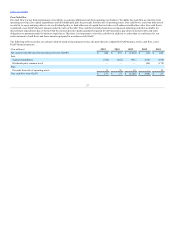

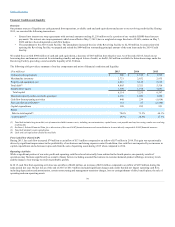

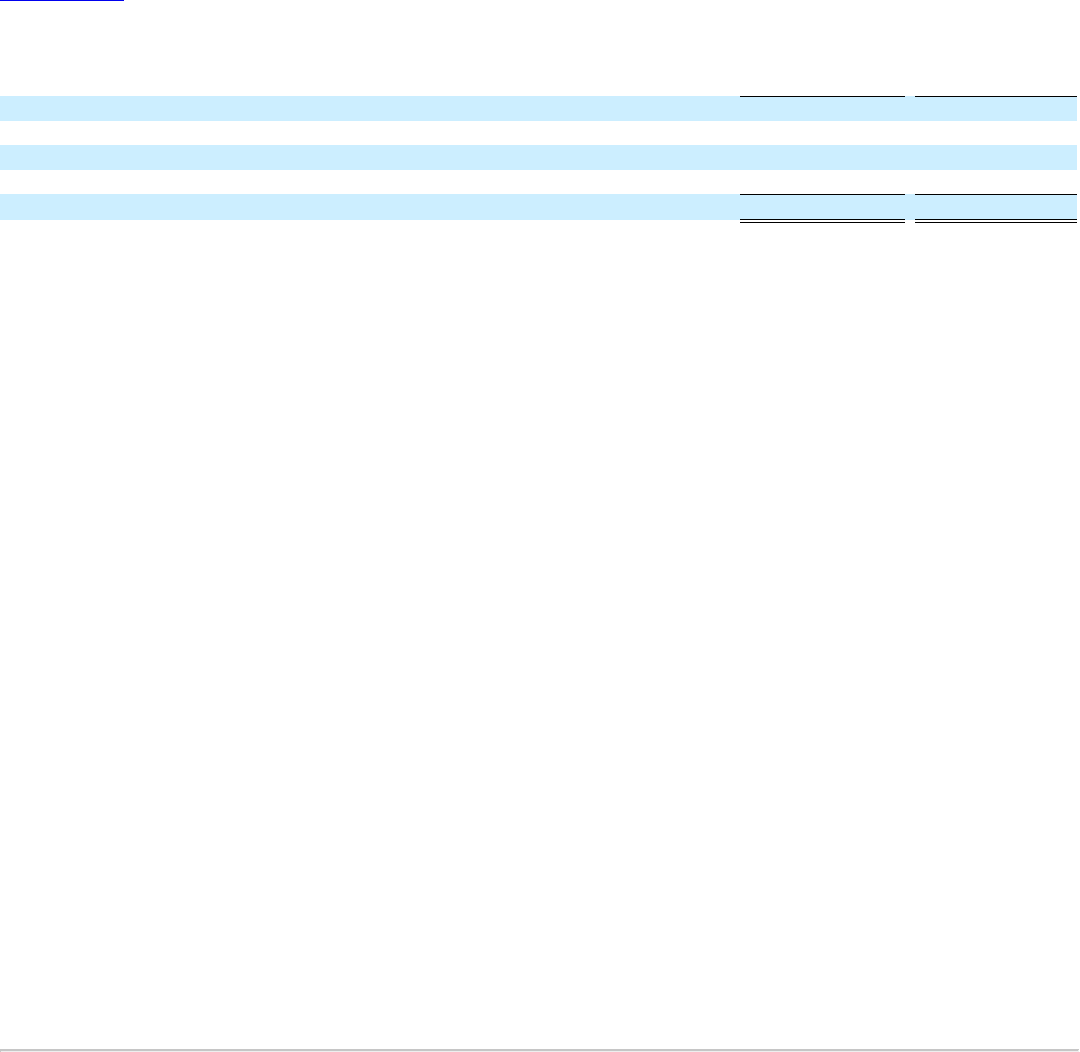

The composition of restructuring and management transition charges was as follows:

Home office and stores

$ 45

$ 48

Store fixtures

—

55

Management transition

16

37

Other

26

75

Total

$ 87

$ 215

In 2014 and 2013, we recorded $45 million and $48 million, respectively, of costs to reduce our store and home office expenses. The costs relate to employee

termination benefits, lease termination costs and impairment charges associated with the 2015 closing of 40 underperforming department stores and the 2014

closing of 33 such stores. Additionally, the costs include employee termination benefits in connection with the elimination of positions in our home office.

During 2013, we recorded a total charge of $55 million related to store fixtures which related to increased depreciation as a result of shortening the useful

lives of department store fixtures that were replaced throughout 2013, to charges for the impairment of certain store fixtures related to our former shops

strategy that had been used in our prototype department store, and to an asset write down of store fixtures related to the renovations in our Home department.

We also implemented several changes within our management leadership team during 2014 and 2013 that resulted in management transition costs of $16

million and $37 million, respectively, for both incoming and outgoing members of management. Other miscellaneous restructuring charges of $26 million

and $75 million recorded during 2014 and 2013, respectively, were primarily related to contract termination costs and other costs associated with our

previous marketing and shops strategy. The charges in 2013 included a non-cash charge of $36 million related to the return of shares of Martha Stewart

Living Omnimedia, Inc. previously acquired by the Company, which was accounted for as a cost investment.

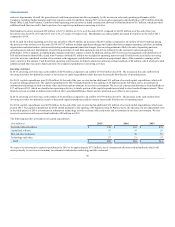

For 2014, we reported an operating loss of $254 million compared to an operating loss of $1,242 million in 2013, which was an improvement of $988

million.

During the third quarter of 2014, we completed an offering of $400 million aggregate principal amount of our 8.125% Senior Unsecured Notes due 2019

(2019 Notes). The majority of the net proceeds of the offering were used to pay the tender consideration and related transaction fees and expenses for our

contemporaneous cash tender offers (2014 Tender Offers) for $327 million aggregate principal amount of our outstanding 6.875% Medium-Term Notes due

2015 (2015 Notes), 7.65% Debentures due 2016 (2016 Notes) and 7.95% Debentures due 2017 (2017 Notes) (the Securities). In October 2014, subsequent to

the completion of the 2014 Tender Offers, we used $64 million of available cash to effect a legal defeasance of the remaining outstanding principal amount

of the 2015 Notes by depositing funds with the Trustee for the 2015 Notes sufficient to make all payments of interest and principal on the outstanding 2015

Notes to the stated maturity of October 15, 2015. These transactions resulted in a loss on extinguishment of debt of $34 million which included the premium

paid over face value of the accepted Securities of $29 million, $4 million for the portion of the deposited funds for future interest payments on the 2015

Notes and reacquisition costs of $1 million.

During the second quarter of 2013, we paid $355 million to complete a cash tender offer and consent solicitation with respect to substantially all of our

outstanding 7.125% Debentures due 2023. In doing so, we also recognized a loss on extinguishment of debt of $114 million, which included the premium

paid over face value of the debentures of $110 million, reacquisition costs of $2 million and the write-off of unamortized debt issuance costs of $2 million.

Net interest expense was $406 million, an increase of $54 million, or 15.3%, from $352 million in 2013. The increase in net interest expense was primarily

related to the increased interest expense associated with the previous borrowings under our former revolving credit facility (2013 Credit Facility), the $2.25

billion five-year senior secured term loan that was entered into in May 2013 (2013 Term Loan), the 2014 Term Loan and the additional debt that was

outstanding during the third quarter of 2014 as a result of the timing of our debt transactions. In addition, during the second quarter of 2014, the Company

expensed $9 million of capitalized debt issue costs associated with our previous credit facility that was replaced by our 2014 Credit Facility.

37