JCPenney 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

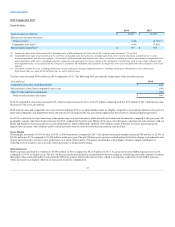

value of the asset. Impairment losses totaling $0 million, $30 million and $18 million in 2015, 2014 and 2013, respectively, were recorded in the

Consolidated Statement of Operations in the line item Real estate and other, net.

While we do not believe there is a reasonable likelihood that there will be a material change in our estimates or assumptions used to calculate long-lived

asset impairments, if actual results are not consistent with our current estimates and assumptions, we may be exposed to additional impairment charges, which

could be material to our results of operations.

We assess the recoverability of indefinite-lived intangible assets at least annually during the fourth quarter of our fiscal year or whenever events or changes in

circumstances indicate that the carrying amount of the indefinite-lived intangible asset may not be fully recoverable. Examples of a change in events or

circumstances include, but are not limited to, a decrease in the market price of the asset, a history of cash flow losses related to the use of the asset or a

significant adverse change in the extent or manner in which an asset is being used. For our 2015 annual impairment test, we tested our indefinite-lived

intangible assets utilizing the relief from royalty method to determine the estimated fair value for each indefinite-lived intangible asset. The relief from

royalty method estimates our theoretical royalty savings from ownership of the intangible asset. Key assumptions used in this model include discount rates,

royalty rates, growth rates, sales projections and terminal value rates. Discount rates, royalty rates, growth rates and sales projections are the assumptions most

sensitive and susceptible to change as they require significant management judgment. Discount rates used are similar to the rates estimated by the weighted

average cost of capital considering any differences in company-specific risk factors. Royalty rates are established by management based on comparable

trademark licensing agreements in the market. Operational management, considering industry and company-specific historical and projected data, develops

growth rates and sales projections associated with each indefinite-lived intangible asset. Terminal value rate determination follows common methodology of

capturing the present value of perpetual sales estimates beyond the last projected period assuming a constant weighted average cost of capital and long-term

growth rates.

While we do not believe there is a reasonable likelihood that there will be a material change in our estimates or assumptions used to calculate indefinite-lived

asset impairments, if actual results are not consistent with our current estimates and assumptions, we may be exposed to additional impairment charges, which

could be material to our results of operations.

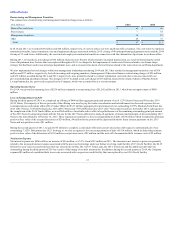

We are primarily self-insured for costs related to workers’ compensation and general liability claims. The liabilities represent our best estimate, using

generally accepted actuarial reserving methods through which we record a provision for workers’ compensation and general liability risk based on historical

experience, current claims data and independent actuarial best estimates, including incurred but not reported claims and projected loss development factors.

These estimates are subject to the frequency, lag and severity of claims. We target this provision above the midpoint of the actuarial range, and total

estimated claim liability amounts are discounted using a risk-free rate. We do not anticipate any significant change in loss trends, settlements or other costs

that would cause a significant fluctuation in net income. However, a 10% variance in the workers’ compensation and general liability reserves at year-end

2015, would have affected our SG&A expenses by approximately $21 million.

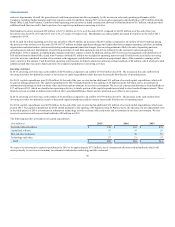

We account for income taxes using the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences

attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss

and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which

those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in

income in the period that includes the enactment date. A valuation allowance is recorded to reduce the carrying amounts of deferred tax assets unless it is

more likely than not such assets will be realized.

In assessing the need for a valuation allowance, we consider both positive and negative evidence related to the likelihood of the realization of the deferred

tax assets based on future events. Our accounting for deferred tax consequences represents our best estimate of those future events. If based on the weight of

available evidence, it is more likely than not (defined as a likelihood of more than 50%) the deferred tax assets will not be realized, we record a valuation

allowance. The weight given to both positive and negative evidence is commensurate with the extent to which the evidence may be objectively verified. As

such, it is generally difficult for positive evidence regarding projected future taxable income, exclusive of reversing taxable temporary differences, to

outweigh objective negative evidence of recent losses. Cumulative losses in recent years is a significant piece of

44