JCPenney 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

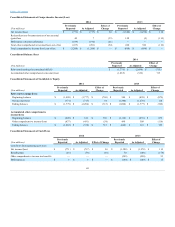

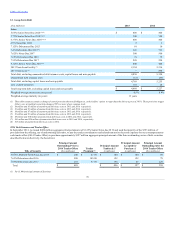

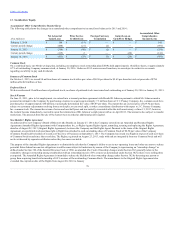

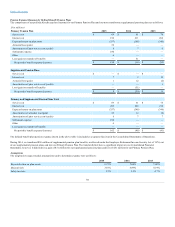

5.65% Senior Notes Due 2020(1) (2)

$ 400

$ 400

5.75% Senior Notes Due 2018(1) (3)

300

300

6.375% Senior Notes Due 2036(1) (4)

400

400

6.9% Notes Due 2026

2

2

7.125% Debentures Due 2023

10

10

7.4% Debentures Due 2037(5)

326

326

7.625% Notes Due 2097

500

500

7.65% Debentures Due 2016

78

78

7.95% Debentures Due 2017

220

220

8.125% Senior Notes Due 2019 (6)

400

400

2013 Term Loan Facility (7)

2,194

2,216

2014 Term Loan (8)

—

498

Total debt, excluding unamortized debt issuance costs, capital leases and note payable

4,830

5,350

Unamortized debt issuance costs

(61)

(95)

Total debt, excluding capital leases and note payable

4,769

5,255

Less: current maturities

101

28

Total long-term debt, excluding capital leases and note payable

$ 4,668

$ 5,227

Weighted-average interest rate at year end

6.5%

6.4%

Weighted-average maturity (in years)

13 years

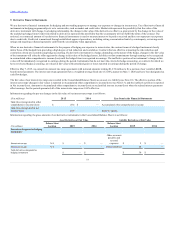

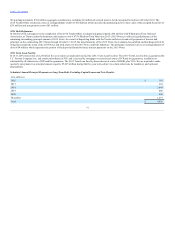

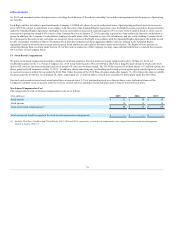

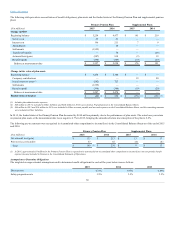

In September 2014, we issued $400 million aggregate principal amount of 8.125% Senior Notes due 2019 and used the majority of the $393 million of

proceeds from the offering, net of underwriting discounts, to pay the tender consideration and related transaction fees and expenses for our contemporaneous

cash tender offers (2014 Tender Offers) to purchase approximately $327 million aggregate principal amount of the three outstanding series of debt securities

described below (collectively, the Securities).

6.875% Medium-Term Notes due 2015

$ 200

$ 67.50

$ 140

$ 140

$ 60

7.65% Debentures due 2016

200

105.00

122

122

78

7.95% Debentures due 2017

285

97.50

194

65

220

Total

$ 685

$ 456

$ 327

$ 358

76