JCPenney 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

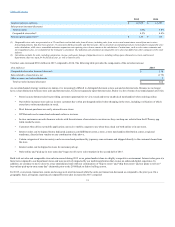

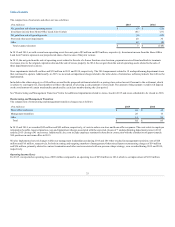

Our net deferred tax assets, which include the future tax benefits of our net operating loss carryforwards, are subject to a valuation allowance. At January 31,

2015, the federal and state valuation allowances were $586 million and $198 million, respectively. Future book pre-tax losses will require additional

valuation allowances to offset the deferred tax assets created. Until such time that we achieve sufficient profitability to allow removal of most of our

valuation allowance, utilization of our loss carryforwards will result in a corresponding decrease in the valuation allowance and offset our tax provision

dollar for dollar.

Each period we are required to allocate our income tax expense or benefit to continuing operations and other items such as other comprehensive income and

stockholder’s equity. In accordance with these rules when we have a loss in continuing operations and a gain in other comprehensive income, as arose in

2013, we are required to recognize a tax benefit in continuing operations up to the amount of tax expense that we are required to report in other

comprehensive income. In 2014, we experienced losses in both continuing operations and other comprehensive income. Under the allocation rules we are

required to recognize the valuation allowance allocable to the tax benefit attributable to these losses in each component of comprehensive income.

Accordingly, included in the total valuation allowance of $784 million noted above is $190 million of valuation allowance which offsets the deferred tax

benefit attributable to the actuarial loss reported in other comprehensive income.

For 2014, we recorded a net tax expense of $23 million. The net tax expense included $7 million related to the amortization of certain indefinite-lived

intangible assets, $10 million for state and foreign jurisdictions where loss carryforwards are limited or unavailable and $6 million for federal and state audit

settlements.

For 2013, we recorded a net tax benefit of $430 million resulting in an effective tax rate of (25.2)%. The net tax benefit consisted of net federal, foreign and

state tax benefits of $182 million, a $250 million tax benefit resulting from actuarial gains in other comprehensive income, offset by $2 million of tax

expense related to the amortization of certain indefinite-lived intangible assets. The $250 million tax benefit recorded on the loss in continuing operations

was offset by income tax expense in other comprehensive income of $250 million.

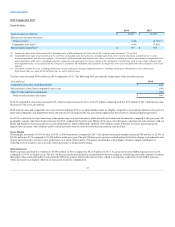

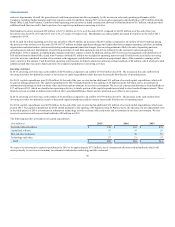

In 2014, EBITDA was a positive $377 million, an improvement of $1,018 million compared to a negative EBITDA of $641 million in the prior year

corresponding period. Excluding restructuring and management transition charges, the impact of our Primary Pension Plan expense/(income), the net gain on

the sale of non-operating assets, the proportional share of net income from the Home Office Land Joint Venture and certain net gains, adjusted EBITDA was

positive, improving $890 million to an adjusted EBITDA of $280 million for 2014 compared to a negative adjusted EBITDA of $610 million for the prior

year corresponding period.

Overall, EBITDA and adjusted EBITDA improved significantly in 2014 as compared to the corresponding prior year periods as we were able to improve sales,

achieve higher margins and reduce our operating costs.

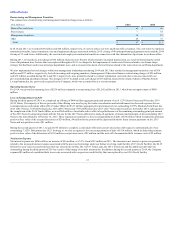

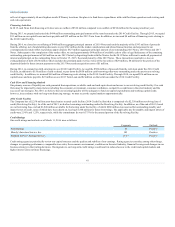

In 2014, we reported a loss of $717 million, or $2.35 per share, compared with a loss of $1,278 million, or $5.13 per share, in 2013. Excluding the impact of

restructuring and management transition charges, the impact of our Primary Pension Plan expense, the loss on extinguishment of debt, the net gain on sale of

non-operating assets, the proportional share of net income from joint venture, certain net gains and the tax impact resulting from other comprehensive income

allocation, adjusted net income/(loss) (non-GAAP) went from a loss of $1,405 million, or $5.64 per share, in 2013 to a loss of $778 million, or $2.55 per

share, in 2014.

38