JCPenney 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

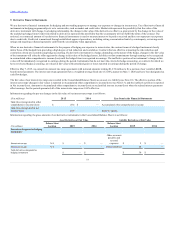

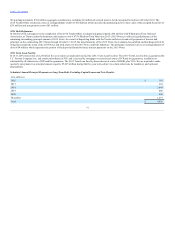

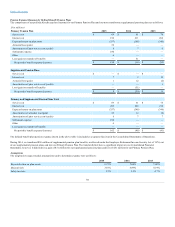

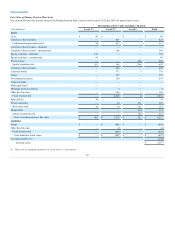

We provide retirement pension benefits, postretirement health and welfare benefits, as well as 401(k) savings, profit-sharing and stock ownership plan

benefits to various segments of our workforce. Retirement benefits are an important part of our total compensation and benefits program designed to retain

and attract qualified, talented employees. Pension benefits are provided through defined benefit pension plans consisting of a non-contributory qualified

pension plan (Primary Pension Plan) and, for certain management employees, non-contributory supplemental retirement plans, including a 1997 voluntary

early retirement plan. Retirement and other benefits include:

Primary Pension Plan – funded

Supplemental retirement plans – unfunded

Postretirement benefits – medical and dental

Defined contribution plans:

401(k) savings, profit-sharing and stock ownership plan

Deferred compensation plan

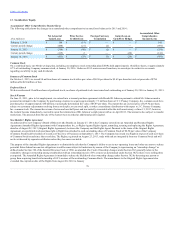

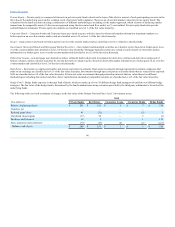

The Primary Pension Plan is a funded non-contributory qualified pension plan, initiated in 1966 and closed to new entrants on January 1, 2007. The plan is

funded by Company contributions to a trust fund, which are held for the sole benefit of participants and beneficiaries.

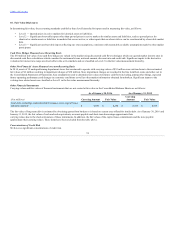

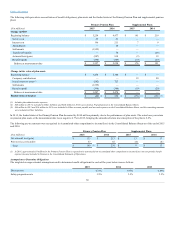

We have unfunded supplemental retirement plans, which provide retirement benefits to certain management employees. We pay ongoing benefits from

operating cash flow and cash investments. The plans are a Supplemental Retirement Program and a Benefit Restoration Plan. Participation in the

Supplemental Retirement Program is limited to employees who were annual incentive-eligible management employees as of December 31, 1995. Benefits for

these plans are based on length of service and final average compensation. The Benefit Restoration Plan is intended to make up benefits that could not be

paid by the Primary Pension Plan due to governmental limits on the amount of benefits and the level of pay considered in the calculation of benefits. The

Supplemental Retirement Program is a non-qualified plan that was designed to allow eligible management employees to retire at age 60 with retirement

income comparable to the age 65 benefit provided under the Primary Pension Plan and Benefit Restoration Plan. In addition, the Supplemental Retirement

Program offers participants who leave between ages 60 and 62 benefits equal to the estimated social security benefits payable at age 62. The Supplemental

Retirement Program also continues Company-paid term life insurance at a declining rate until it is phased out at age 70. Employee-paid term life insurance

through age 65 is continued under a separate plan (Supplemental Term Life Insurance Plan for Management Profit-Sharing Employees).

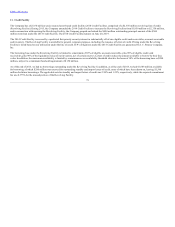

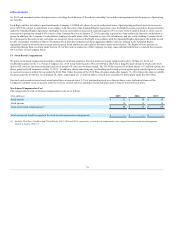

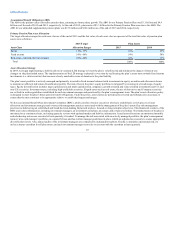

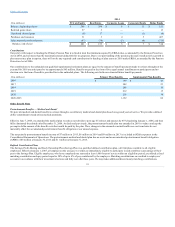

In August 2015, as a result of a plan amendment, we offered approximately 31,000 retirees and beneficiaries in the Primary

Pension Plan who commenced their benefit between January 1, 2000 and August 31, 2012 the option to receive a lump-sum

settlement payment. In addition, we offered approximately 8,000 participants in the Primary Pension Plan who separated from

service and had a deferred vested benefit as of August 31, 2012 the option to receive a lump-sum settlement payment.

Approximately 12,000 retirees and beneficiaries elected to receive voluntary lump-sum payments to settle the Primary Pension

Plan's obligation to them. In addition, approximately 1,900 former employees having deferred vested benefits elected to

receive lump-sums. The lump-sum settlement payments totaling $717 million were made by the Company on November 5, 2015 using assets from the

Primary Pension Plan.

On December 7, 2015, the Company completed the purchase of a group annuity contract that transferred to The Prudential Insurance Company of America

the pension benefit obligation of approximately 18,000 retirees totaling $838 million.

Actuarial loss of $180 million was recognized as settlement expense as a result of the lump-sum offer payment and the purchase of the group annuity

contract.

83