JCPenney 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

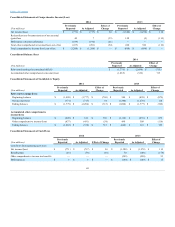

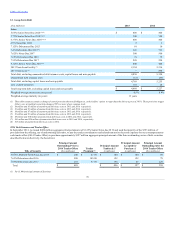

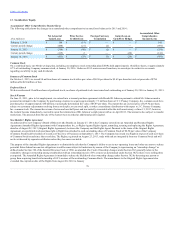

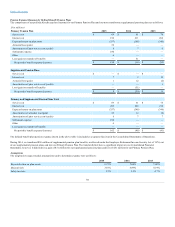

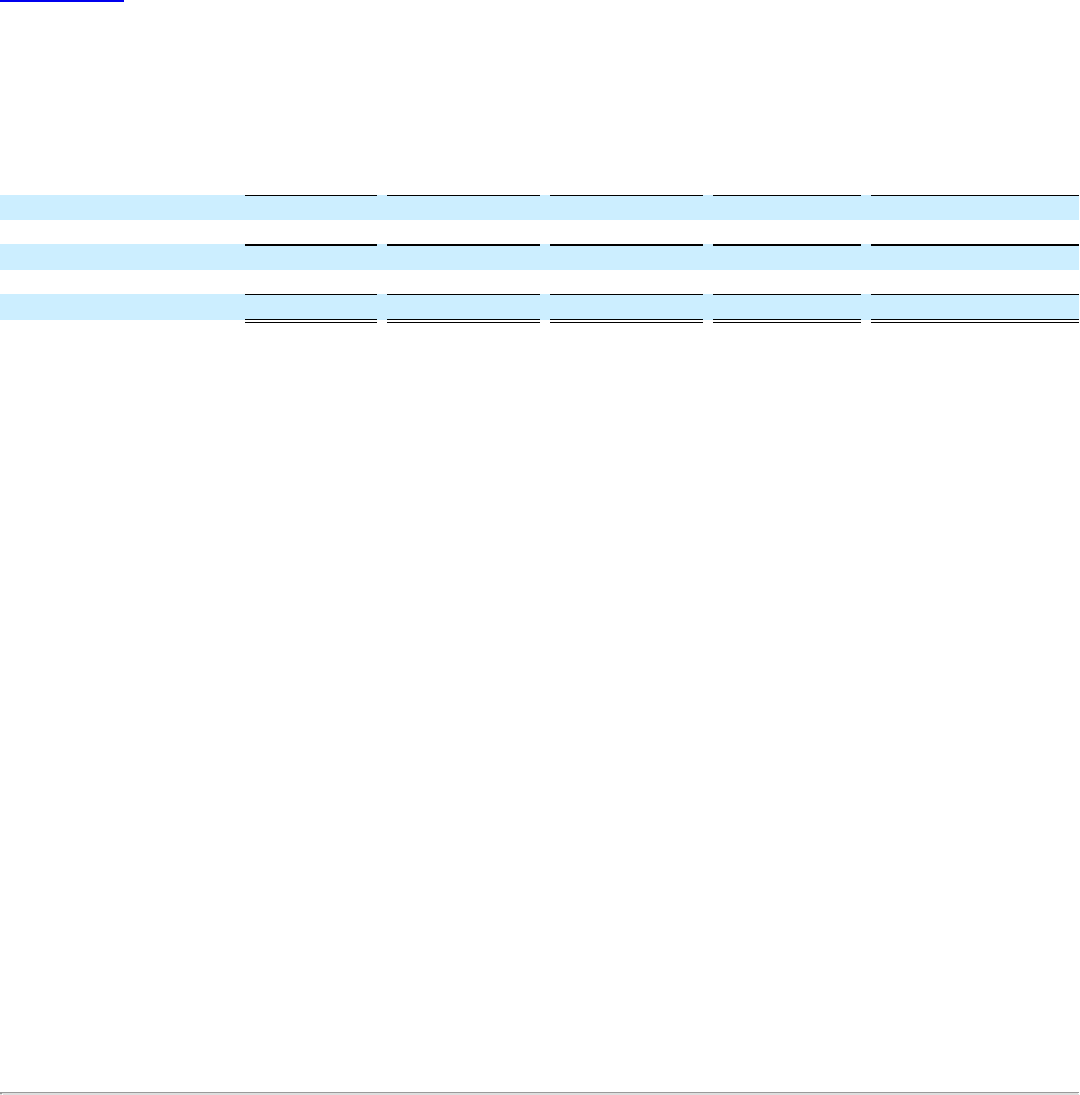

The following table shows the changes in accumulated other comprehensive income/(loss) balances for 2015 and 2014:

February 1, 2014

$ 160

$ (19)

$ —

$ —

$ 141

Current period change

(468)

(21)

(2)

—

(491)

January 31, 2015

$ (308)

$ (40)

$ (2)

$ —

$ (350)

Current period change

(115)

2

—

(28)

(141)

January 30, 2016

$ (423)

$ (38)

$ (2)

$ (28)

$ (491)

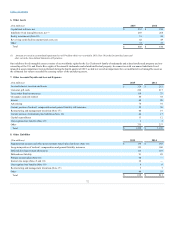

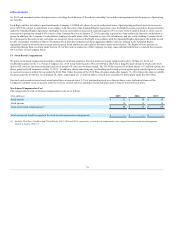

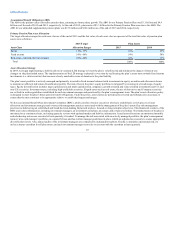

On a combined basis, our 401(k) savings plan, including our employee stock ownership plan (ESOP), held approximately 14 million shares, or approximately

4.7% of outstanding Company common stock, at January 30, 2016. Under our 2013 senior secured term loan, we are subject to restrictive covenants

regarding our ability to pay cash dividends.

On October 1, 2013, we issued 84 million shares of common stock with a par value of $0.50 per share for $9.65 per share for total net proceeds of $786

million after $24 million of fees.

We have authorized 25 million shares of preferred stock; no shares of preferred stock were issued and outstanding as of January 30, 2016 or January 31, 2015.

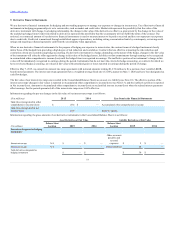

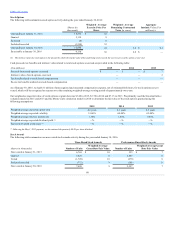

On June 13, 2011, prior to his employment, we entered into a warrant purchase agreement with Ronald B. Johnson pursuant to which Mr. Johnson made a

personal investment in the Company by purchasing a warrant to acquire approximately 7.3 million shares of J. C. Penney Company, Inc. common stock for a

purchase price of approximately $50 million at a mutually determined fair value of $6.89 per share. The warrant has an exercise price of $29.92 per share,

subject to customary adjustments resulting from a stock split, reverse stock split, or other extraordinary distribution with respect to J. C. Penney Company,

Inc. common stock. The warrant has a term of seven and one-half years and was initially exercisable after the sixth anniversary, or June 13, 2017; however,

the warrant became immediately exercisable upon the termination of Mr. Johnson’s employment with us in April 2013. The warrant is also subject to transfer

restrictions. The proceeds from the sale of the warrant were recorded as additional paid-in capital.

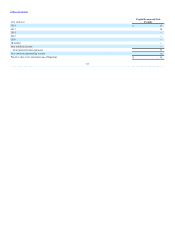

As authorized by our Company’s Board of Directors (the Board), on January 27, 2014, the Company entered into an Amended and Restated Rights

Agreement (Amended Rights Agreement) with Computershare Inc., as Rights Agent (Rights Agent), amending, restating and replacing the Rights Agreement,

dated as of August 22, 2013 (Original Rights Agreement), between the Company and the Rights Agent. Pursuant to the terms of the Original Rights

Agreement, one preferred stock purchase right (a Right) was attached to each outstanding share of Common Stock of $0.50 par value of the Company

(Common Stock) held by holders of record as of the close of business on September 3, 2013. The Company has issued one Right in respect of each new share

of Common Stock issued since the record date. The Rights, registered on August 23, 2013, trade with and are inseparable from our Common Stock and will

not be evidenced by separate certificates unless they become exercisable.

The purpose of the Amended Rights Agreement is to diminish the risk that the Company's ability to use its net operating losses and other tax assets to reduce

potential future federal income tax obligations would become subject to limitations by reason of the Company's experiencing an "ownership change" as

defined under Section 382 of the Internal Revenue Code of 1986, as amended (the Code). Ownership changes under Section 382 generally relate to the

cumulative change in ownership among stockholders with an ownership interest of 5% or more (as determined under Section 382's rules) over a rolling three

year period. The Amended Rights Agreement is intended to reduce the likelihood of an ownership change under Section 382 by deterring any person or

group from acquiring beneficial ownership of 4.9% or more of the outstanding Common Stock. The amendments to the Original Rights Agreement also

extended the expiration date of the Rights from August 20, 2014 to January

78