JCPenney 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

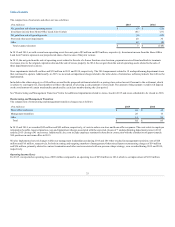

We have experienced inflation and deflation related to our purchase of certain commodity products. We do not believe that changing prices for commodities

have had a material effect on our Net Sales or results of operations. Although we cannot precisely determine the overall effect of inflation and deflation on

operations, we do not believe inflation and deflation have had

a material effect on our financial condition or results of operations.

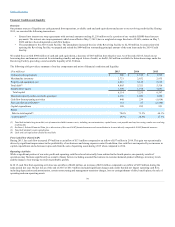

The preparation of our financial statements in conformity with accounting principles generally accepted in the United States requires that we make estimates

and use assumptions that in some instances may materially affect amounts reported in the accompanying Consolidated Financial Statements. In preparing

these financial statements, we have made our best estimates and judgments based on history and current trends, as well as other factors that we believe are

relevant at the time of the preparation of our Consolidated Financial Statements. Historically, actual results have not differed materially from estimates;

however, future events and their effects cannot be determined with certainty and as a result, actual results could differ from our assumptions and estimates.

See Note 2 to the Consolidated Financial Statements for a description of our significant accounting policies.

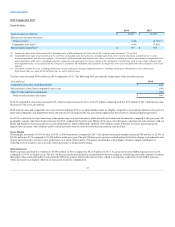

Inventories are valued primarily at the lower of cost (using the first-in, first-out or “FIFO” method) or market, determined under the Retail Inventory Method

(RIM) for department stores, store distribution centers and regional warehouses and standard cost, representing average vendor cost, for merchandise we sell

through the Internet at jcpenney.com. Under RIM, retail values of merchandise groups are converted to a cost basis by applying the specific average cost-to-

retail ratio related to each merchandise grouping. RIM inherently requires management judgment and certain estimates that may significantly impact the

ending inventory valuation at cost, as well as gross margin. The most significant estimates are permanent reductions to retail prices (markdowns) and

permanent devaluation of inventory (markdown accruals) used primarily to clear seasonal merchandise or otherwise slow-moving inventory and inventory

shortage (shrinkage).

Permanent markdowns and markdown accruals are designated for clearance activity and are recorded at the point of decision, when the utility of inventory

has diminished, versus the point of sale. Factors considered in the determination of permanent markdowns and markdown accruals include current and

anticipated demand, customer preferences, age of the merchandise and style trends. Under RIM, permanent markdowns and markdown accruals result in the

devaluation of inventory and the corresponding reduction to gross margin is recognized in the period the decision to markdown is made. Shrinkage is

estimated as a percent of sales for the period from the last physical inventory date to the end of the fiscal period. Physical inventories are taken at least

annually and inventory records are adjusted accordingly. The shrinkage rate from the most recent physical inventory, in combination with current events and

historical experience, is used as the standard for the shrinkage accrual rate for the next inventory cycle. Historically, our actual physical inventory count

results have shown our estimates to be reliable. Based on prior experience, we do not believe that the actual results will differ significantly from the

assumptions used in these estimates.

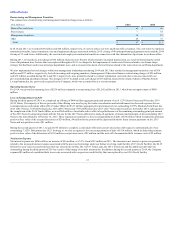

We evaluate recoverability of long-lived assets, such as property and equipment, whenever events or changes in circumstances indicate that the carrying

value may not be recoverable, such as historical operating losses or plans to close stores and dispose of or sell long-lived assets before the end of their

previously estimated useful lives. Additionally, annual operating performance of individual stores are periodically analyzed to identify potential

underperforming stores which may require further evaluation of the recoverability of the carrying amounts. If our evaluations, performed on an undiscounted

cash flow basis, indicate that the carrying amount of the asset may not be recoverable, the potential impairment is measured as the excess of carrying value

over the fair value of the impaired asset. The impairment calculation requires us to apply estimates for future cash flows and use judgments for qualitative

factors such as local market conditions, operating environment, mall performance and other trends. We estimate fair value based on either a projected

discounted cash flow method using a discount rate that is considered commensurate with the risk inherent in our current business model or appraised value,

as appropriate.

We recognize impairment losses in the earliest period that it is determined a loss has occurred. The carrying value is adjusted to the new carrying value and

any subsequent increases in fair value are not recorded. If it is determined that the estimated remaining useful life of the asset should be decreased, the

periodic depreciation expense is adjusted based on the new carrying

43