JCPenney 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

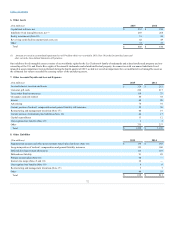

Table of Contents

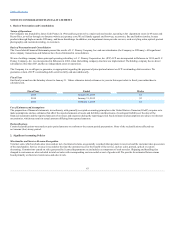

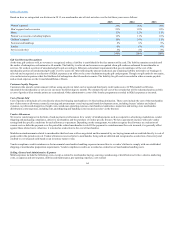

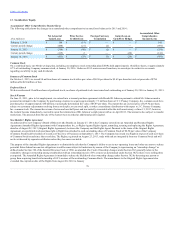

Our risk-free interest rate is based on zero-coupon U.S. Treasury yields in effect at the date of grant with the same period as

the expected option life.

The dividend assumption is based on our current expectations about our dividend policy.

Employee stock options and time-based and performance-based restricted stock awards typically vest over periods ranging from one to three years and

employee stock options have a maximum term of 10 years. Estimates of forfeitures are incorporated at the grant date and are adjusted if actual results are

different from initial estimates. For awards that have performance conditions, the probability of achieving the performance condition is evaluated each

reporting period, and if the performance condition is expected to be achieved, the related compensation expense is recorded over the service period. In

addition, certain performance-based restricted stock awards may be granted where the number of shares may be increased to the maximum or reduced to the

minimum threshold based on the results of the performance metrics in accordance with the terms established at the time of the award. In the event that

performance conditions are not achieved and the awards do not vest, compensation expense is reversed. For market based awards, we record expense over the

service period, regardless of whether or not the market condition is achieved.

Awards with graded vesting that only have a time vesting requirement and awards that vest entirely at the end of the vesting requirement are expensed on a

straight-line basis for the entire award. Expense for awards with graded vesting that incorporate a market or performance requirement is attributed separately

based on the vesting for each tranche.

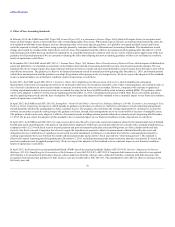

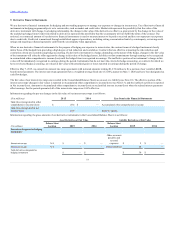

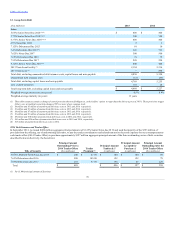

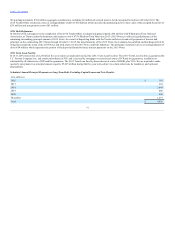

In 2015, the Company elected to change its method of recognizing pension expense. Previously, for the primary and supplemental pension plans, net

actuarial gains or losses in excess of 10% of the greater of the fair value of plan assets or the plans’ projected benefit obligation (the corridor) were recognized

over the remaining service period of plan participants (eight years for the primary pension plan). Under the Company’s new accounting method, the

Company recognizes changes in net actuarial gains or losses in excess of the corridor annually in the fourth quarter each year (MTM Adjustment). The

remaining components of pension expense, primarily service and interest costs and assumed return on plan assets, will be recorded on a quarterly basis. While

the historical policy of recognizing pension expense was considered acceptable, the Company believes that the new policy is preferable as it eliminates the

delay in recognition of actuarial gains and losses outside the corridor.

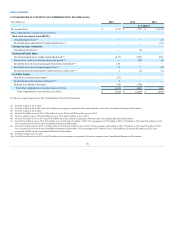

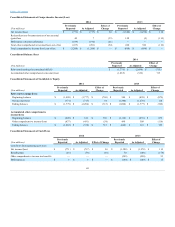

This change has been reported through retrospective application of the new policy to all periods presented. The impacts of all adjustments made to the

financial statements are summarized below:

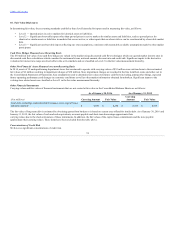

Pension $ 6

$ (48)

$ (54)

$ 137

$ (41)

$ (178)

Income/(loss) before income taxes (748)

(694)

54

(1,886)

(1,708)

178

Income tax expense/(benefit) 23

23

—

(498)

(430)

68

Net income/(loss) $ (771)

$ (717)

54

$ (1,388)

(1,278)

$ 110

Basic earnings/(loss) per common share $ (2.53)

$ (2.35)

$ 0.18

$ (5.57)

$ (5.13)

$ 0.44

Diluted earnings/(loss) per common share $ (2.53)

$ (2.35)

$ 0.18

$ (5.57)

$ (5.13)

$ 0.44

68