JCPenney 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

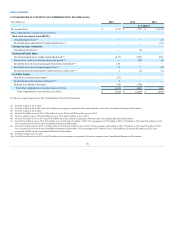

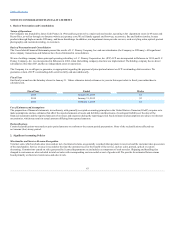

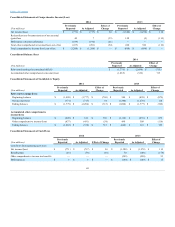

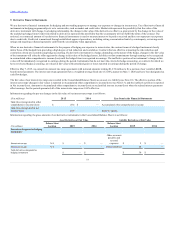

Based on how we categorized our divisions in 2015, our merchandise mix of total net sales over the last three years was as follows:

Women’s apparel

25%

26%

26%

Men’s apparel and accessories

22%

22%

22%

Home

12%

12%

11%

Women’s accessories, including Sephora

12%

11%

10%

Children’s apparel

10%

10%

11%

Footwear and handbags

8%

8%

9%

Jewelry

6%

6%

6%

Services and other

5%

5%

5%

100%

100%

100%

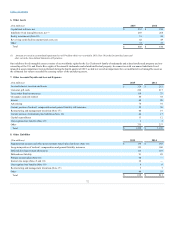

At the time gift cards are sold, no revenue is recognized; rather, a liability is established for the face amount of the card. The liability remains recorded until

the earlier of redemption, escheatment or 60 months. The liability is relieved and revenue is recognized when gift cards are redeemed for merchandise or

services. We escheat a portion of unredeemed gift cards according to Delaware escheatment requirements that govern remittance of the cost of the

merchandise portion of unredeemed gift cards over five years old. After reflecting the amount escheated, any remaining liability (referred to as breakage) is

relieved and recognized as a reduction of SG&A expenses as an offset to the costs of administering the gift card program. Though our gift cards do not expire,

it is our historical experience that the likelihood of redemption after 60 months is remote. The liability for gift cards is recorded in other accounts payable

and accrued expenses on the Consolidated Balance Sheets.

Customers who spend a certain amount with us using our private label card or registered third party credit cards receive JCP Rewards® certificates,

redeemable for merchandise or services in our stores the following two months. We estimate the net cost of the rewards that will be redeemed and record this

as cost of goods sold as rewards points are accumulated. Other administrative costs of the loyalty program are recorded in SG&A expenses as incurred.

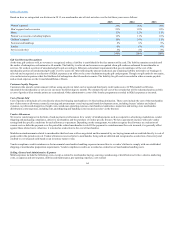

Cost of goods sold includes all costs directly related to bringing merchandise to its final selling destination. These costs include the cost of the merchandise

(net of discounts or allowances earned), sourcing and procurement costs, buying and brand development costs, including buyers’ salaries and related

expenses, royalties and design fees, freight costs, warehouse operating expenses, merchandise examination, inspection and testing, store merchandise

distribution center expenses, including rent, and shipping and handling costs incurred on sales via the Internet.

We receive vendor support in the form of cash payments or allowances for a variety of reimbursements such as cooperative advertising, markdowns, vendor

shipping and packaging compliance, defective merchandise and the purchase of vendor specific fixtures. We have agreements in place with each vendor

setting forth the specific conditions for each allowance or payment. Depending on the arrangement, we either recognize the allowance as a reduction of

current costs or defer the payment over the period the related merchandise is sold. If the payment is a reimbursement for costs incurred, it is generally offset

against those related costs; otherwise, it is treated as a reduction to the cost of merchandise.

Markdown reimbursements related to merchandise that has been sold are negotiated and documented by our buying teams and are credited directly to cost of

goods sold in the period received. Vendor allowances received prior to merchandise being sold are deferred and recognized as a reduction of inventory and

credited to cost of goods sold based on an inventory turnover rate.

Vendor compliance credits reimburse us for incremental merchandise handling expenses incurred due to a vendor’s failure to comply with our established

shipping or merchandise preparation requirements. Vendor compliance credits are recorded as a reduction of merchandise handling costs.

SG&A expenses include the following costs, except as related to merchandise buying, sourcing, warehousing or distribution activities: salaries, marketing

costs, occupancy and rent expense, utilities and maintenance, pre-opening expenses, costs related

64