JCPenney 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

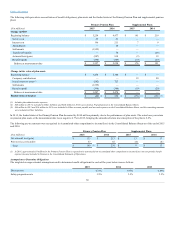

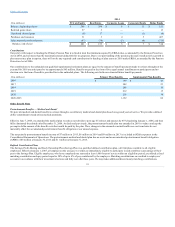

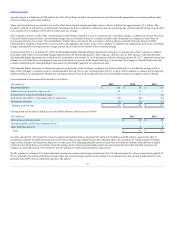

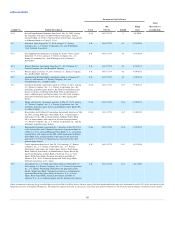

Our deferred tax assets and liabilities were as follows:

Merchandise inventory

$ 39

$ 35

Accrued vacation pay

22

24

Gift cards

90

76

Stock-based compensation

77

76

Deferred equity adjustment

11

—

State taxes

15

25

Workers’ compensation/general liability

85

87

Accrued rent

37

35

Litigation exposure

32

—

Mirror savings plan

15

18

Pension and other retiree obligations

96

—

Net operating loss and tax credit carryforwards

1,072

1,100

Other

65

51

Total deferred tax assets

1,656

1,527

Valuation allowance

(1,025)

(784)

Total net deferred tax assets

631

743

Depreciation and amortization

(741)

(851)

Pension and other retiree obligations

—

(3)

Tax benefit transfers

(56)

(59)

Long-lived intangible assets

(28)

(21)

Total deferred tax liabilities

(825)

(934)

Total net deferred tax liabilities

$ (194)

$ (191)

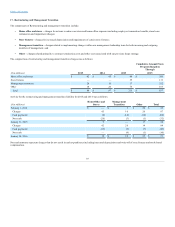

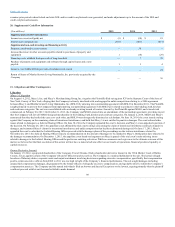

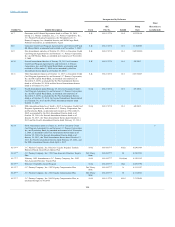

Deferred tax assets and liabilities included in our Consolidated Balance Sheets were as follows:

Other current assets

$ 231

$ 172

Other long-term liabilities

(425)

(363)

Total net deferred tax liabilities

$ (194)

$ (191)

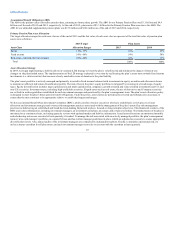

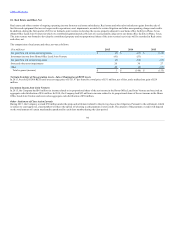

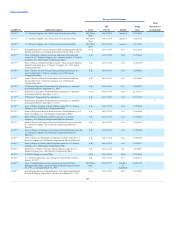

As of January 30, 2016, a valuation allowance of $1,025 million has been recorded against our deferred tax assets. In assessing the need for the valuation

allowance, we considered both positive and negative evidence related to the likelihood of realization of the deferred tax assets. As a result of our assessment,

we concluded that, beginning in the second quarter of 2013, our estimate of the realization of deferred tax assets would be based solely on the future reversals

of existing taxable temporary differences and tax planning strategies that we would make use of to accelerate taxable income to utilize expiring net operating

loss (NOL) and tax credit carryforwards.

In accordance with accounting standards, we are required to allocate a portion of our tax provision between operating losses and Accumulated other

comprehensive income/(loss). As a result, in 2013, we recorded a $250 million tax benefit in the Consolidated Statements of Operations offset by income tax

expense on actuarial gains recorded in Other comprehensive income/(loss). In 2015 and 2014, the company did not benefit any of its operating loss and

incurred an actuarial loss in Other comprehensive income/(loss), the tax benefit on which was fully offset by a valuation allowance within Other

comprehensive income/(loss).

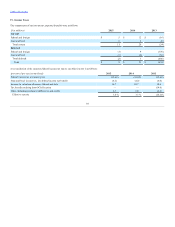

For U.S. federal income tax purposes, we have $2.6 billion of gross NOL carryforwards that expire in 2032 through 2035 and $62 million of tax credit

carryforwards that expire at various dates through 2035. These NOL carryforwards include an

96