GameStop 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

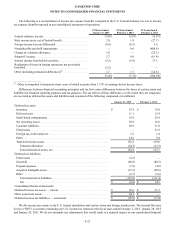

risk premium to reflect the inherent risk of holding astandalone intangible asset. The discount rate used in the analysis reflects a

hypothetical market participant’s weighted-average cost of capital, current market rates and the risks associated with the projected

cash flows.

We completed the annual impairment tests of indefinite-lived intangible assets as of the first day of the fourth quarter of fiscal

2014 and fiscal 2013 and concluded that none of our indefinite-lived intangible assets were impaired.

During the third quarter of fiscal 2012, our management determined that sufficient indicators of potential impairment existed

to require an interim impairment test of our Micromania trade name. As aresultofthe interim impairment test of the Micromania

trade name, we recorded a$44.9 million impairment charge during the third quarter of fiscal 2012. The impairment charge in fiscal

2012 is recorded in asset impairments in our consolidated statements of operations and is reflected in the operating results of our

Europe segment. There were no impairments of indefinite-lived intangible assets in connection with the completion of our annual

impairment test for fiscal 2012.

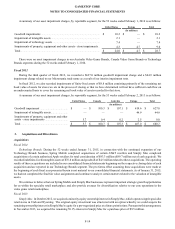

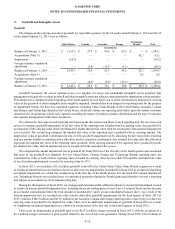

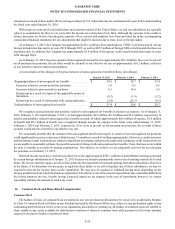

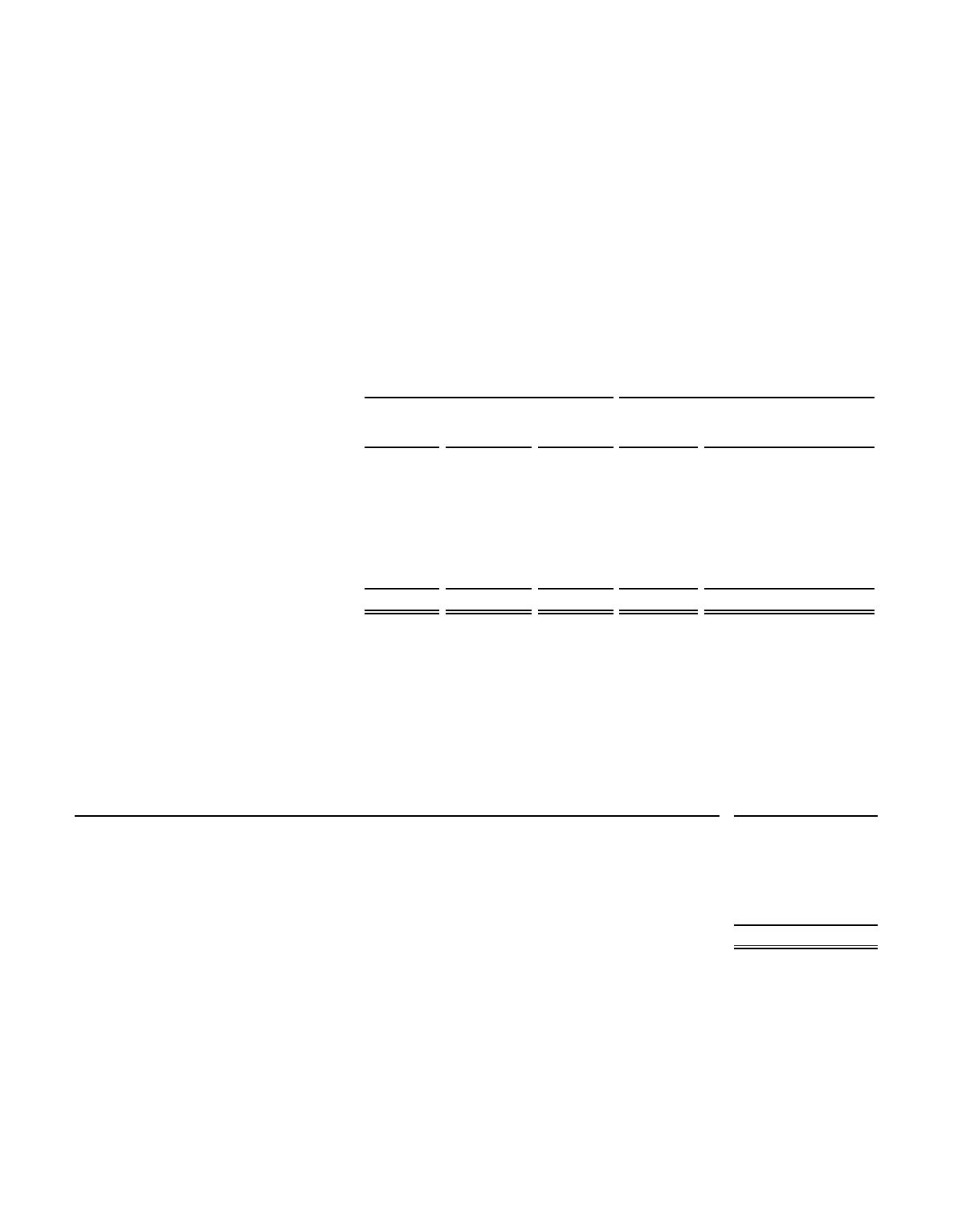

The gross carrying amount and accumulated amortization of our intangible assets other than goodwill as of January 31, 2015

and February 1, 2014 were as follows(in millions):

As of January 31, 2015 As of February 1, 2014

Gross

Carrying

Amount (1)

Accumulated

Amortization

Net

Carrying

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Intangible assets with indefinite lives:

Trade names ............................................... $45.4 $—$45.4 $54.2 $—$54.2

Dealer agreements...................................... 134.0—134.057.2—57.2

Intangible assets with finitelives:

Key money................................................. 91.5 (41.8)49.7 113.6(44.4)69.2

Other .......................................................... 32.7 (24.0)8.740.9(27.2)13.7

Total.............................................................. $303.6 $(65.8)$ 237.8 $265.9 $(71.6)$ 194.3

___________________

(1) The change in the gross carrying amount of intangible assets from February 1, 2014 to January 31, 2015 is primarily due to

acquisitions (Note 3) andthe impact of exchange rate fluctuations.

Intangible asset amortization expense for the fiscal years ended January 31, 2015, February 1, 2014 and February 2, 2013

was $12.0 million, $14.0 million and $14.3 million, respectively.

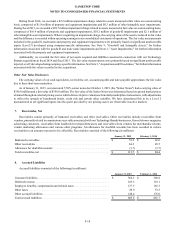

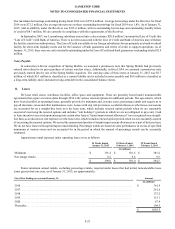

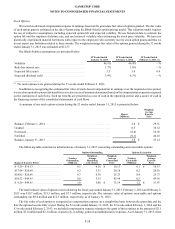

The estimated aggregate intangible asset amortization expense for the next fivefiscal years is as follows (in millions):

Fiscal Year Ending on or around January 31,

Projected Amortization

Expense

2016.......................................................................................................................................................... $10.2

2017.......................................................................................................................................................... 8.1

2018.......................................................................................................................................................... 7.4

2019.......................................................................................................................................................... 7.1

2020.......................................................................................................................................................... 6.2

$39.0

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-21

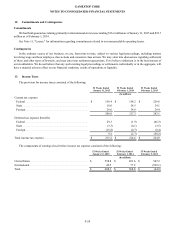

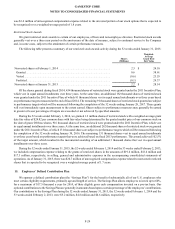

10. Debt

Issuance of 5.50% Senior Notes due 2019

On September 24, 2014, we issued $350.0 million aggregate principal amount of unsecured 5.50% senior notes due October 1,

2019 (the "Senior Notes"). The Senior Notes bear interest at the rate of 5.50% per annum with interest payable semi-annually in

arrears on April 1and October 1ofeach year beginning on April 1, 2015. The Senior Notes were sold in aprivate placement and

will not be registered under theU.S. Securities Act of 1933. The Senior Notes were offered in the U.S. to “qualified institutional

buyers” pursuant to the exemption from registration under Rule 144A of the Securities Act and in exempted offshore transactions

pursuant to Regulation Sunder theSecuritiesAct.