GameStop 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

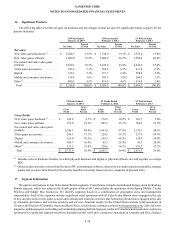

Segment results for Europe include retail operations in 10 European countries and e-commerce operations in five countries. The

Technology Brands segment includes retail operations in the United States. We measure segment profit using operating earnings,

which is defined as income from continuing operations before intercompany royalty fees, net interest expense and income taxes.

Transactions between reportable segments consist primarily of royalties, management fees, intersegment loans and related interest.

There were no intersegment sales during the 52 weeks ended January 31, 2015, the 52 weeks ended February 1, 2014 or the 53

weeks ended February 2, 2013.

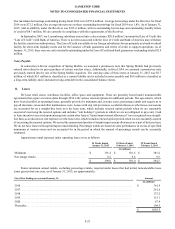

Information on segments and the reconciliation of segment profit to earnings (loss) before income taxes are as follows (in

millions):

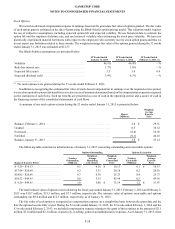

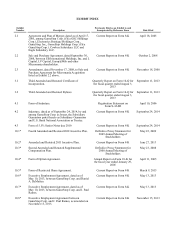

As of and for the Fiscal Year Ended January 31, 2015

United

States Canada Australia Europe

Technology

Brands Consolidated

Net sales ........................................................... $6,193.5 $476.4 $644.7 $1,652.8 $328.6 $9,296.0

Segment operating earnings ............................. 483.228.338.035.932.9618.3

Interest income ................................................. 0.7

Interest expense ................................................ (10.7)

Earnings before income taxes .......................... 608.3

Other Information:

Goodwill........................................................... 1,143.329.572.178.966.61,390.4

Other long-lived assets ..................................... 328.618.446.4214.1 185.9793.4

Total assets ....................................................... 2,740.3252.1 382.5527.2 344.24,246.3

Income tax expense (benefit) ........................... 198.14.2 8.4(6.7)11.2 215.2

Depreciation and amortization ......................... 102.53.8 9.630.87.7 154.4

Capital expenditures......................................... 92.3 5.111.219.931.1159.6

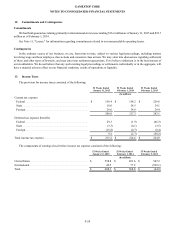

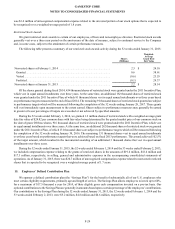

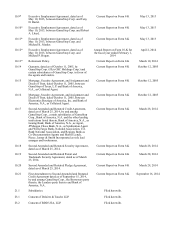

As of and for the Fiscal Year Ended February 1, 2014

United

States Canada Australia Europe

Technology

Brands Consolidated

Net sales........................................................... $6,160.4 $468.8 $613.7 $1,733.8 $62.8 $9,039.5

Segment operating earnings (loss)................... 465.326.637.544.3(0.2)573.5

Interest income ................................................ 0.9

Interest expense ............................................... (5.6)

Earning before income taxes ........................... 568.8

Other Information:

Goodwill .......................................................... 1,143.333.881.394.262.11,414.7

Other long-lived assets .................................... 320.020.840.4269.3 76.6 727.1

Total assets....................................................... 2,320.7228.7 389.2972.2 180.64,091.4

Income tax expense ......................................... 173.211.68.8 21.0 —214.6

Depreciation and amortization ........................ 115.44.4 10.5 35.3 0.9166.5

Capital expenditures ........................................ 85.7 6.96.7 21.4 4.9125.6

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-31