GameStop 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

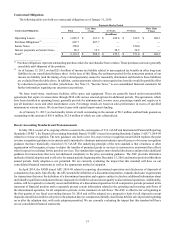

$250 million in general unsecured obligations and $500 million in unsecured obligations to finance acquisitions valued at $500

million or more.

The per annum interest rate under the Revolver is variable and is calculated by applying amargin (1) for prime rate loans of

0.25% to 0.75% above the highest of (a) the prime rate of the administrative agent, (b) the federal funds effective rate plus 0.50%

or (c) the London Interbank Offered (“LIBO”) rate for a30-dayinterest period as determined on such day plus 1.00%, and (2) for

LIBO rate loans of 1.25% to 1.75% above the LIBO rate. The applicable margin is determined quarterly as afunction of our

average daily excess availability under the facility.Inaddition, we are required to pay acommitment fee of 0.25% for any unused

portion of the total commitment under the Revolver.AsofJanuary 31, 2015, the applicable margin was 0.25% for prime rate loans

and 1.25% for LIBO rate loans.

The Revolver provides for customary events of default with corresponding grace periods, including failure to pay any principal

or interest when due, failure to comply with covenants, any material representation or warranty made by us or the borrowers

proving to be false in any material respect, certain bankruptcy,insolvencyorreceivership events affecting us or our subsidiaries,

defaults relating to certain other indebtedness, imposition of certain judgments and mergers or the liquidation of the Company or

certain of its subsidiaries. During fiscal 2014, we cumulatively borrowed and subsequently repaid $626.0 million under the

Revolver.Our maximum borrowings outstanding during fiscal 2014 were $255.0 million. During fiscal 2013 and fiscal 2012, we

borrowed and repaid $130.0 million and $81.0 million, respectively,under the Revolver.Average borrowings under the Revolver

for fiscal 2014 were $71.2 million. Our average interest rate on those outstanding borrowings for fiscal 2014 was 1.8%. As of

January31, 2015, total availability under the Revolver was $391.6 million, with no outstanding borrowings and outstanding

standby letters of credit of $8.3 million. We are currently in compliance withthe requirements of theRevolver.

In September 2007, our Luxembourgsubsidiary entered into adiscretionary $20 million Uncommitted Line of Credit (the

“Line of Credit”) with Bank of America. There is no term associated with the Line of Credit and Bank of America may withdraw

the facility at any time without notice. The Line of Credit is available to our foreign subsidiaries for use primarily as abank

overdraft facility for short-term liquidity needs and for the issuance of bank guarantees and letters of credit to support operations.

As of January 31, 2015, there were no cash overdrafts outstanding under the Line of Credit and bank guarantees outstanding totaled

$2.9 million.

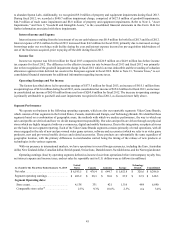

Uses of Capital

Our future capital requirements will depend upon the timing and extent of our ongoing investments in our Technology Brands

businesses, our other strategic initiatives, and the number of new stores we open and the timing of those openings within agiven

fiscal year.Weopened49Video Game Brands stores and opened or acquired 284 Technology Brands stores in fiscal 2014, and

we expect to open or acquire approximately 400-600 stores in fiscal 2015, including significant investments in our Technology

Brands businesses. Capital expenditures for fiscal 2015 are projected to be approximately $150-170 million, to be used primarily

to fund continued growth of our Technology Brands businesses, distribution and information systems and other digital initiatives

in support of our operations and new store openings and store remodels.

We used cash to expand our operations through acquisitions. During fiscal 2014, fiscal 2013 and fiscal 2012, we used $89.7

million,$77.4 million and $1.5 million, respectively,for acquisitions, primarily related to the growth of our Technology Brands

business.

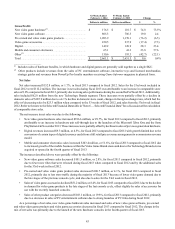

Since January 2010, our Board of Directors has authorized several share repurchase programs authorizing our management

to repurchase our Class ACommonStock. Since the beginning of fiscal 2011, each individual authorization has been for $500

million.Our general practice is to seek Board of Directors’ approval for anew authorization before the existing one is fully used

to ensure that we are always able to repurchase shares. For fiscal 2012, we repurchased 19.9 million shares for an average price

per share of $20.60 and atotal of $409.4 million.For fiscal 2013, we repurchased 6.3 million shares for an average price per share

of $41.12 and atotal of $258.3 million.For fiscal 2014, we repurchased 8.4 million shares for an average price per share of $39.50

and atotal of $333.4 million. Between February 1, 2015 and March 19, 2015, we have repurchased 0.5 million shares at an average

price per share of $38.26 for atotal of $18.9million and have $428.4 million remaining under our latest authorization from

November 2014.

In February 2012, our Board of Directors approved the initiation of aquarterly cash dividend to our stockholders of Class A

Common Stock. We paidatotal of $0.80per shareindividends in fiscal 2012 and atotal of $1.10per shareinfiscal 2013. In fiscal

2014, we paid dividends of $1.32 per share of Class ACommon Stock, totaling approximately $148.8 million for the year.On

March 3, 2015, our Board of Directors authorized an increase in our annual cash dividend from $1.32 to $1.44 per share of Class

ACommon Stock.Futuredividends will be subjecttoapprovalbyour BoardofDirectors.

50