GameStop 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

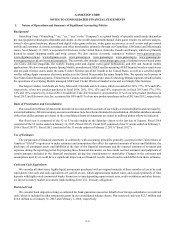

Income Taxes

Income tax expense includes federal, state, local and international income taxes. Income taxes are accounted for utilizing an

asset and liability approach and deferred tax assets and liabilities are recognized for the tax consequences of temporary differences

between the financial reporting basis and the tax basis of existing assets and liabilities using enacted tax rates. Deferred tax assets

and liabilities are measured using the enacted tax rates expected to apply to taxable income in the years in which those temporary

differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of achangeintax rates is

recognized in the period that includes the enactment date. Valuation allowances are recorded to reduce deferred tax assets to the

amount that will more likely than not be realized. In accordance with GAAP,wemaintain liabilities for uncertain tax positions

until examination of the tax year is completed by the applicable taxing authority,available review periods expire or additional

facts and circumstances cause us to change our assessment of the appropriate accrual amount. See Note 13, "Income Taxes,"for

additional information.

We plan on permanently reinvesting our undistributed foreign earnings outside the United States. Where foreign earnings are

permanently reinvested, no provision for federal income or foreign withholding taxes is made. Should we have undistributed

foreign earnings that are not permanently reinvested, United States income tax expense and foreign withholding taxes will be

provided for at the time the earningsare generated.

Lease Accounting

We lease retail stores, warehouse facilities, office space and equipment. These are generally leased under noncancelable

agreements that expire at various dates through 2034 with various renewal options for additional periods. The agreements, which

have been classified as operating leases, generally provide for minimum and, in some cases, percentage rentals and require us to

pay all insurance, taxes and other maintenance costs. Leases with step rent provisions, escalation clauses or other lease concessions

are accounted for on astraight-line basis over the lease term, which includes renewal option periods when we are reasonably

assured of exercising the renewal options and includes “rent holidays” (periods in which we are not obligated to pay rent). Cash

or lease incentives received upon entering into certain store leases (“tenant improvement allowances”) are recognized on astraight-

line basis as areduction to rent expense over the lease term, which includes renewal option periods when we are reasonably assured

of exercising the renewal options. We record the unamortized portion of tenant improvement allowances as apartofdeferred rent.

We do not have leases with capital improvement funding. Percentage rentals are based on sales performance in excess of specified

minimums at various stores and are accounted for in the period in which the amount of percentage rentals can be accurately

estimated.

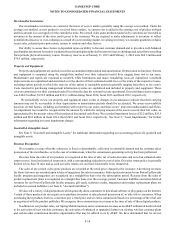

Foreign Currency Translation

We have determined that the functional currencies of our foreign subsidiaries are the subsidiaries’ local currencies. The assets

and liabilities of the subsidiaries are translated at the applicable exchange rate as of the end of the balance sheet date and revenue

and expenses are translated at an average rate over the period. Currency translation adjustments are recorded as acomponent of

other comprehensive income. Transaction and derivative net gains are included in selling, general and administrative expenses

and were $2.5 million, $3.3 million and $2.5 million for the 52 weeks ended January 31, 2015, the 52 weeks ended February 1,

2014 and the 53 weeks ended February 2, 2013, respectively.The foreign currency transaction gains and losses are primarily due

to the decrease or increase in the value of the U.S. dollar compared to the functional currencies of the countries in which we operate

internationally.The foreign currency transaction gains and losses are primarily due to fluctuations in the value of the U.S. dollar

compared to the Australian dollar,Canadian dollar and Euro.

We use forward exchange contracts, foreign currency options and cross-currency swaps (together,the “foreign currency

contracts”) to manage currency risk primarily related to foreign-currency denominated intercompany assets and liabilities and

certain other foreign currency assets and liabilities. These foreign currency contracts are not designated as hedges and, therefore,

changes in the fair values of these derivatives are recognized in earnings, thereby offsetting the current earnings effect of the re-

measurement of related intercompany loans and foreign currency assets and liabilities. See Note 6, "Fair Value Measurements and

Financial Instruments," for additional information regarding our foreign currency contracts.

New Accounting Pronouncements

In May 2014, aspart of its ongoing efforts to assist in the convergence of U.S. GAAPand International Financial Reporting

Standards(“IFRS”), the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2014-09

related to revenue recognition. The new guidance sets forth anew five-step revenue recognition model which replaces the prior

revenue recognition guidance in its entirety and is intended to eliminate numerous industry-specific pieces of revenue recognition

guidance that have historically existed in U.S. GAAP.The underlying principle of the new standard is that abusiness or other

organization will recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-12