GameStop 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

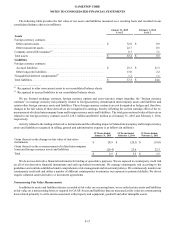

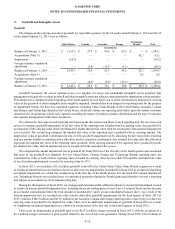

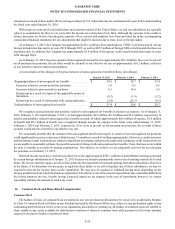

5. Computation of NetIncome (Loss) per Common Share

Basic net income (loss) per common share is computed by dividing the net income (loss) available to common stockholders

by the weighted-average number of common shares outstanding during the period. Diluted net income (loss) per common share

is computed by dividing the net income (loss) available to common stockholders by the weighted-average number of common

shares outstanding and potentially dilutive securities outstanding during the period. Potentially dilutive securities include stock

options and unvested restricted stock outstanding during the period, using the treasury stock method. Potentially dilutive securities

are excluded from the computations of diluted earnings per share if their effect would be antidilutive. Areconciliation of shares

used in calculating basic and diluted net income (loss)per common share is as follows:

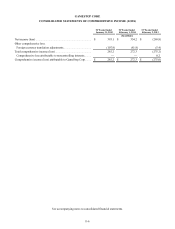

52 Weeks Ended

January 31, 2015

52 Weeks Ended

February 1, 2014

53 Weeks Ended

February 2, 2013

(In millions, except per sharedata)

Net income (loss) attributable to GameStop Corp. ..................... $393.1 $354.2 $(269.7)

Weighted-average common shares outstanding .......................... 112.2117.2 126.4

Dilutive effect of options and restricted shares on common

stock ............................................................................................ 1.01.2 —

Common shares and dilutive potential commonshares.............. 113.2118.4 126.4

Net income (loss) per common share:

Basic............................................................................................ $3.50 $3.02 $(2.13)

Diluted......................................................................................... $3.47 $2.99 $(2.13)

The weighted-average outstanding shares of Class ACommonStock for basic and diluted net loss per common share during

the 53 weeks ended February 2, 2013 were the same as we incurred anet loss from continuing operations during that period and

any effect on loss per share would have been antidilutive.

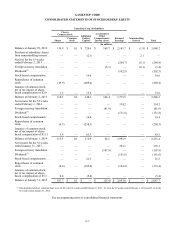

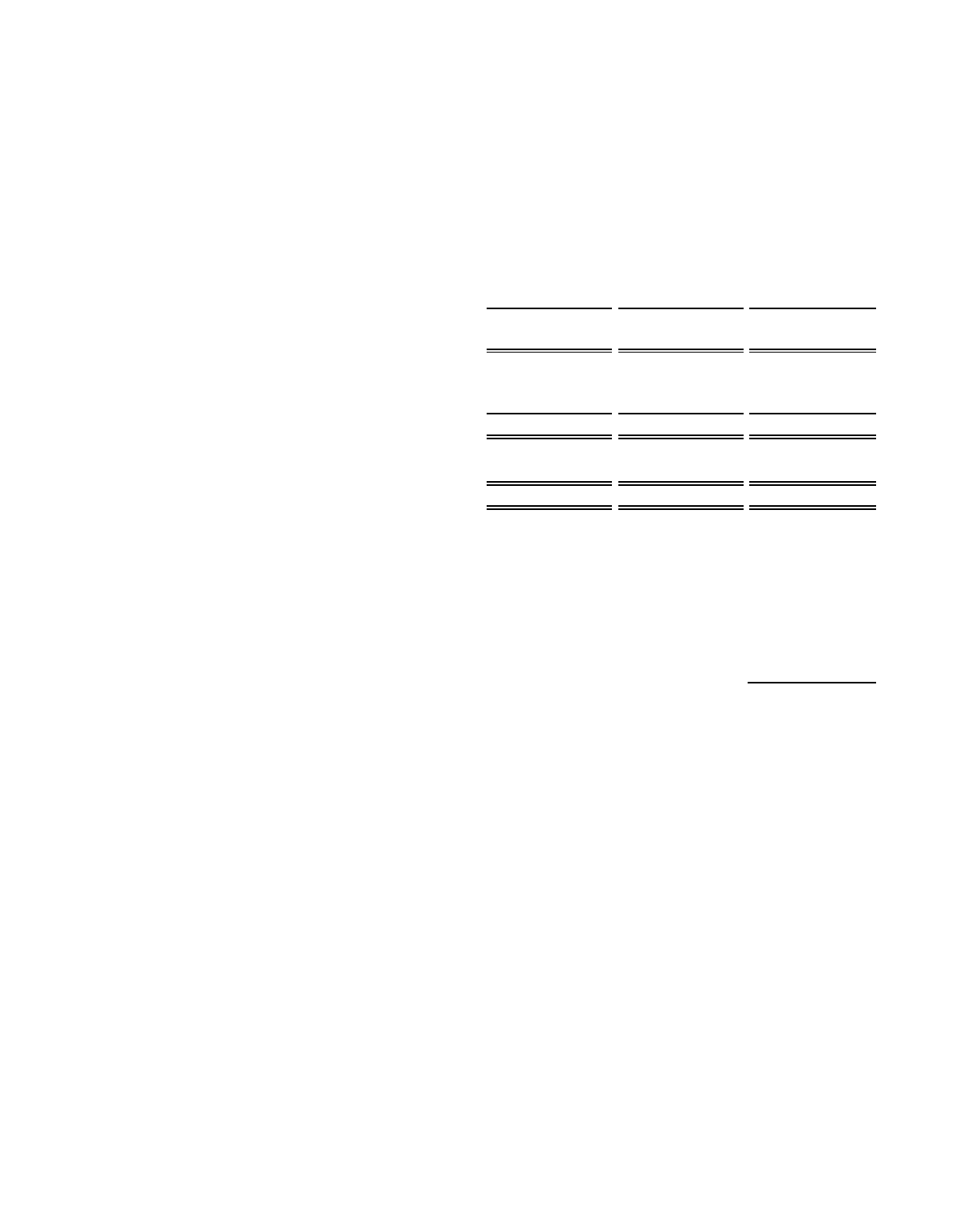

The following table contains information on share-based awards of Class ACommonStock which were excluded from the

computation of diluted earnings per sharebecause their effects were antidilutive:

Anti-

Dilutive

Shares

(In millions)

52 Weeks Ended January 31, 2015 ................................................................................................................ 1.6

52 Weeks Ended February 1, 2014 ................................................................................................................ 1.5

53 Weeks Ended February 2, 2013 ................................................................................................................ 3.3

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-16

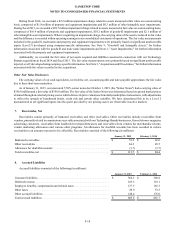

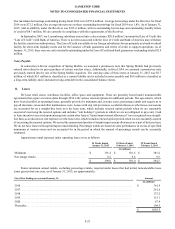

6. Fair Value Measurements and Financial Instruments

Recurring Fair Value Measurements and Derivative Instruments

Fair value is defined as the price that would be received from selling an asset or paid to transfer aliability in an orderly

transaction between market participants at the measurement date. Fair value accounting guidance applies to our foreign currency

contracts, life insurance policies we own that have acash surrender value and certain nonqualified deferred compensation liabilities

that are measured at fair value on arecurring basis in periods subsequenttoinitial recognition.

Fair value accounting guidance requires disclosures that categorize assets and liabilities measured at fair value into one of

three different levels depending on the observability of the inputs employed in the measurement. Level 1inputsare quoted prices

in active markets for identical assets or liabilities. Level 2inputsare observable inputs other than quoted prices included within

Level 1for the asset or liability,either directly or indirectly through market-corroborated inputs. Level 3inputsare unobservable

inputs for the asset or liability reflecting our assumptions aboutpricing by market participants.

We value our foreign currency contracts, our life insurance policies with cash surrender values and certain nonqualified

deferred compensation liabilities based on Level 2inputsusing quotations provided by major market news services, such as

Bloomberg and The Wall Street Journal,and industry-standard models that consider various assumptions, including quoted forward

prices, time value, volatility factors, and contractual prices for the underlying instruments, as well as other relevant economic

measures. When appropriate, valuations are adjusted to reflect credit considerations, generally based on available market evidence.