GameStop 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

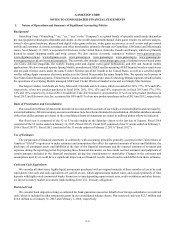

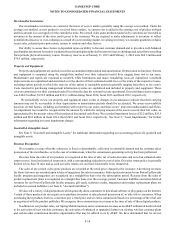

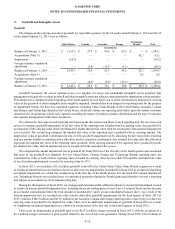

Spring Mobile. In November 2013, we purchased Spring Communications, Inc. ("Spring Mobile," or "Spring"), awireless

retailer,for apurchase price of $62.6 million. The fair values of the assets acquired and liabilities assumed in connection with the

Spring Mobile acquisition were determined based, in part, on athird-party valuation. The valuation of the assets acquired and

liabilities assumed in this acquisition is complete and there have been no changes to the values of assets acquired and liabilities

assumed in this acquisition.

The operating results of Simply Mac and Spring Mobile have been included in our consolidated financial statements beginning

on the respective closing dates of each acquisition and are reported in our Technology Brands segment. The pro forma effect

assuming these acquisitions were made at the beginning of each fiscal year presented herein is not material to our consolidated

financial statements.

Fiscal 2012

During fiscal 2012, we completed acquisitions with atotal consideration of $1.5 million, with the excess of the purchase price

over the net identifiable assets acquired, in the amount of $1.5 million recorded as goodwill. We included the results of operations

of the acquisitions, which were not material, in the financial statements beginning on the closing date of each respective acquisition.

The pro forma effect assuming these acquisitions were made at the beginning of each fiscal year is not material to our consolidated

financial statements.

See Note 9, "Goodwill and Intangible Assets," for additional information.

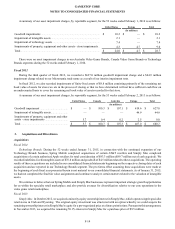

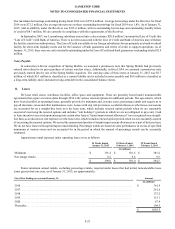

Divestitures

Fiscal 2014

GameStop Iberia. In October 2014, we entered into asale and purchase agreement to transfer certain retail locations and most

of the inventory owned by our Spain subsidiary,GameStop Iberia, to alocal video game specialty retailer.Wemade the decision

to exit these operations, which were part of our Europe segment, due to continued operating losses and limited market share. These

operations were considered immaterial for discontinued operations accounting treatment.

As aresult of the divestiture, we recorded apre-tax loss in continuing operations of $14.8 million during fiscal 2014, primarily

related to inventory write-downs, involuntary termination benefits and lease obligations, of which $7.1 million was recorded in

cost of sales and $7.7 million was recorded in selling, general and administrative expenses in our consolidated statements of

operations. As of November 1, 2014, we had transferred or otherwise ceased daily operations in all of our stores in Spain.

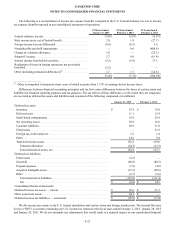

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-15

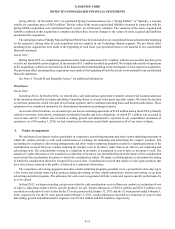

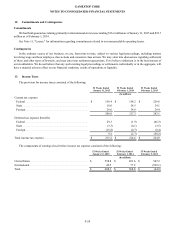

4. Vendor Arrangements

We andmost of our largest vendors participate in cooperative advertising programs and other vendor marketing programs in

which the vendors provide us with cash consideration in exchange for marketing and advertising the vendors’ products. Our

accounting for cooperative advertising arrangements and other vendor marketing programs results in asignificant portion of the

consideration received from our vendors reducing the product costs in inventory rather than as an offset to our marketing and

advertising costs. The consideration serving as areduction in inventory is recognized in cost of sales as inventory is sold. The

amount of vendor allowances to be recorded as areduction of inventory was determined based on the nature of the consideration

received and the merchandise inventory to which the consideration relates. We applyasell-through rate to determine the timing

in which the consideration should be recognized in cost of sales. Consideration received that relates to video game products that

have not yet been released to the public is deferred as areduction of inventory.

The cooperative advertising programs and other vendor marketing programs generally cover aperiod from afew days up to

afew weeks and include items such as product catalog advertising, in-store display promotions, internet advertising, co-op print

advertising and other programs. The allowance for each event is negotiated with the vendor and requires specific performance by

us to be earned.

In fiscal 2013, we began recording certain costs related to cash consideration received from our vendors as areduction of cost

of sales to align those funds with the specific products we sell. Vendor allowances of $202.4 million and $221.0 million were

recorded as areduction of cost of sales for the 52 week period ended January 31, 2015 and the 52 week period ended February 1,

2014, respectively.For the 53 week period ended February 2, 2013, vendor allowances recorded as areduction of costs of sales

and selling, general and administrative expenses were $134.8 million and $90.4 million, respectively.