GameStop 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

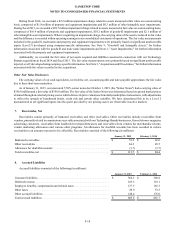

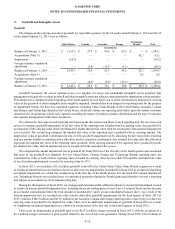

Our maximum borrowings outstanding during fiscal 2014 were $255.0 million. Average borrowings under the Revolver for fiscal

2014 were $71.2 million. Our average interest rate on those outstanding borrowings for fiscal 2014 was 1.8%. As of January 31,

2015, total availability under the Revolver was $391.6 million, with no outstanding borrowings and outstanding standby letters

of credit of $8.3 million. We arecurrently in compliance with therequirements of theRevolver.

In September 2007, our Luxembourgsubsidiary entered into adiscretionary $20.0 million Uncommitted Line of Credit (the

“Line of Credit”) with Bank of America. There is no term associated with the Line of Credit and Bank of America may withdraw

the facility at any time without notice. The Line of Credit is available to our foreign subsidiaries for use primarily as abankoverdraft

facility for short-term liquidity needs and for the issuance of bank guarantees and letters of credit to support operations. As of

January 31, 2015, there were no cash overdrafts outstanding under the Line of Credit and bank guarantees outstanding totaled $2.9

million.

Notes Payable

In connection with our acquisition of Spring Mobile, we assumed apromissorynotethatSpringMobile had previously

entered into related to its prior purchase of certain wireless stores. Additionally,infiscal 2014 we assumed apromissorynote

previously entered into by one of the Spring Mobile acquirees. The carrying value of these notes at January 31, 2015 was $5.7

million, of which $5.1 million is classified as acurrent liability and is included in notes payable and $0.6 million is classified as

along-term liability and is includedinlong-term debt in theconsolidated balance sheets.

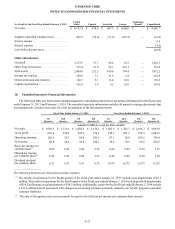

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-23

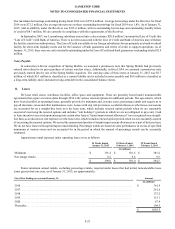

11.Leases

We lease retail stores, warehouse facilities, office space and equipment. These are generally leased under noncancelable

agreements that expire at various dates through 2034 with various renewal options for additional periods. The agreements, which

have been classified as operating leases, generally provide for minimum and, in some cases, percentage rentals and require us to

pay all insurance, taxes and other maintenance costs. Leases with step rent provisions, escalation clauses or other lease concessions

are accounted for on astraight-line basis over the lease term, which includes renewal option periods when we are reasonably

assured of exercising the renewal options and includes “rent holidays” (periods in which we are not obligated to pay rent). Cash

or lease incentives received upon entering into certain store leases (“tenant improvement allowances”) are recognized on astraight-

line basis as areduction to rent expense over the lease term, which includes renewal option periods when we are reasonably assured

of exercising the renewal options. We record the unamortized portion of tenant improvement allowances as apartofdeferred rent.

We do not have leases with capital improvement funding. Percentage rentals are based on sales performance in excess of specified

minimums at various stores and are accounted for in the period in which the amount of percentage rentals can be accurately

estimated.

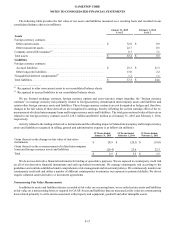

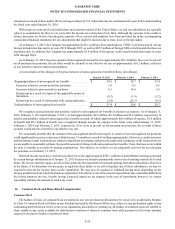

Approximate rental expenses under operating leases were as follows:

52 Weeks Ended

January 31, 2015

52 Weeks Ended

February 1, 2014

53 Weeks Ended

February 2, 2013

(In millions)

Minimum.................................................................................... $391.4 $381.6 $385.4

Percentage rentals....................................................................... 8.29.4 9.3

$399.6 $391.0 $394.7

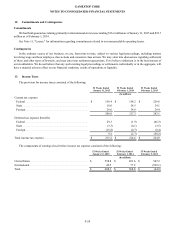

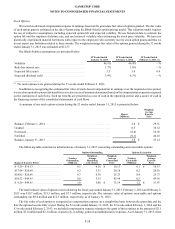

Future minimum annual rentals, excluding percentage rentals, required under leases that had initial, noncancelable lease

terms greater than one year,asofJanuary 31, 2015, areapproximately:

Fiscal Year Ending on or around January 31, Amount

(In millions)

2016............................................................................................................................................................ $361.9

2017............................................................................................................................................................ 261.6

2018............................................................................................................................................................ 175.2

2019............................................................................................................................................................ 115.1

2020............................................................................................................................................................ 67.4

Thereafter................................................................................................................................................... 104.3

$1,085.5