GameStop 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

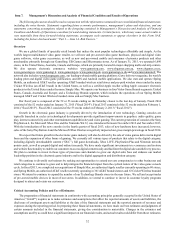

Despite currentindebtedness levels, we and oursubsidiaries may still be abletoincur additional debt. This could further

increase the risks associatedwithour leverage.

We areable to incur additional indebtedness. Although our senior credit facility and the indenture for our Senior Notes contain

restrictions on the incurrence of additional indebtedness, these restrictions are subject to anumberofqualifications and exceptions,

and the additional indebtedness incurred in compliance with these restrictions could be substantial. These restrictions also will

not prevent us from incurring obligations that do not constitute indebtedness. Such future indebtedness or obligations may have

restrictions similar to, or more restrictive than, those included in the indenture for our Senior Notes or our senior credit facility.

The incurrence of additional indebtedness could impact our financial condition and results of operations.

24

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

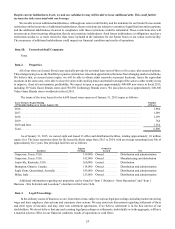

All of our stores are leased. Store leases typically provide for an initial lease term of three to five years, plus renewal options.

This arrangement gives us the flexibility to pursue extension or relocation opportunities that arise from changing market conditions.

We believe that, as current leases expire, we will be able to obtain either renewals at present locations, leases for equivalent

locations in the same area, or be able to close the stores with expiring leases and transfer enough of the sales to other nearby stores

to improve, if not at least maintain, profitability.Weexpecttoopenoracquire approximately 400-600 new stores in fiscal 2015,

including 50 VideoGame Brands stores and 350-550 Technology Brands stores. We also plan to close approximately 200-300

Video Game Brands stores worldwide in fiscal 2015.

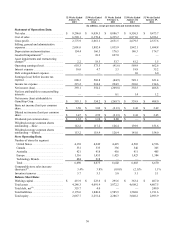

The terms of the store leases for the 6,690leased stores open as of January 31, 2015 expire as follows:

Lease Terms to ExpireDuring

(12 Months Ending on or About January 30)

Number

of Stores

2016........................................................................................................................................................................ 1,984

2017........................................................................................................................................................................ 1,589

2018........................................................................................................................................................................ 1,199

2019........................................................................................................................................................................ 764

2020 and later ......................................................................................................................................................... 1,154

Total........................................................................................................................................................................ 6,690

As of January 31, 2015, we owned eight and leased 13 office and distribution facilities, totaling approximately 1.8 million

square feet. The lease expiration dates for the leased facilities range from 2015 to 2024, with an average remaining lease life of

approximately five years. Ourprincipal facilities are as follows:

Location

Square

Footage

Owned or

Leased Use

Grapevine, Texas, USA ................................... 519,000Owned................... Distribution and administration

Grapevine, Texas, USA ................................... 182,000Owned................... Manufacturing and distribution

Louisville, Kentucky, USA.............................. 260,000Leased ................... Distribution

Brampton, Ontario, Canada............................. 119,000Owned................... Distribution and administration

Eagle Farm, Queensland, Australia ................. 185,000Owned................... Distribution and administration

Milan, Italy ...................................................... 123,000Owned................... Distribution and administration

Additional information regarding our properties can be found in “Item 1. Business -Store Operations” and “Item 1.

Business -Site Selection and Locations” elsewhere in this Form 10-K.

Item 3. Legal Proceedings

In the ordinary course of business, we are, from time to time, subject to various legal proceedings, including matters involving

wage and hour employee class actions and consumer class actions. We mayenter into discussions regarding settlement of these

and other types of lawsuits, and may enter into settlement agreements, if we believe settlement is in the best interest of our

stockholders. We do notbelieve that any such existing legal proceedings or settlements, individually or in the aggregate, will have

amaterial adverse effect on our financial condition, results of operations or cashflows.