GameStop 2014 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

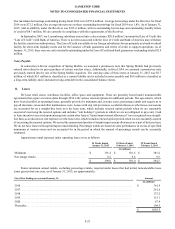

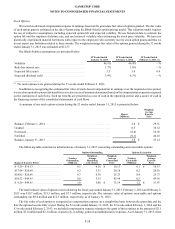

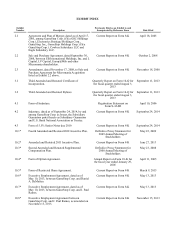

As of and for the Fiscal Year Ended February 2, 2013

United

States Canada Australia Europe

Technology

Brands Consolidated

Net sales........................................................... $6,192.4 $478.4 $607.3 $1,608.6 $—$8,886.7

Segment operating earnings (loss)................... 501.9(74.4)(71.6)(397.5) —(41.6)

Interest income ................................................ 0.9

Interest expense ............................................... (4.2)

Loss before income taxes ................................ (44.9)

Other Information:

Goodwill .......................................................... 1,153.537.796.695.3—1,383.1

Other long-lived assets .................................... 375.421.052.1291.1 —739.6

Total assets....................................................... 2,404.0252.2 416.6799.4 —3,872.2

Income tax expense ......................................... 199.87.1 11.6 6.4 —224.9

Depreciation and amortization ........................ 120.75.1 13.8 36.9 —176.5

Capital expenditures ........................................ 101.83.6 9.225.0—139.6

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-32

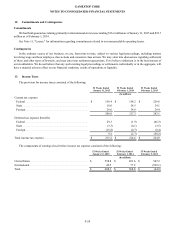

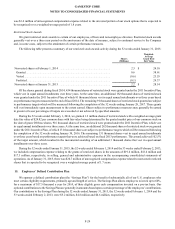

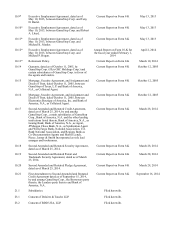

18. Unaudited QuarterlyFinancial Information

The following table sets forth certain unaudited quarterly consolidated statement of operations information for the fiscal years

ended January 31, 2015 and February 1, 2014. The unaudited quarterly information includes all normal recurring adjustments that

our management considers necessary for afair presentation of the information shown.

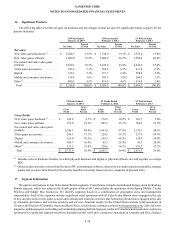

Fiscal Year Ended January 31, 2015 Fiscal Year Ended February 1, 2014

1st

Quarter

2nd

Quarter

3rd

Quarter

4th

Quarter (1)

1st

Quarter

2nd

Quarter

3rd

Quarter

4th

Quarter (1)

(Amounts in millions, except per shareamounts)

Net sales ................... $1,996.3 $1,731.4 $2,092.2 $3,476.1 $1,865.3 $1,383.7 $2,106.7 $3,683.8

Gross profit............... 626.4550.9 622.2976.4 578.3481.3 598.31,003.2

Operating earnings ... 105.936.789.8385.9 87.2 18.8 109.1358.4

Net income ............... 68.0 24.6 56.4 244.154.610.568.6220.5

Basic net income per

common share(2) ....... 0.59 0.22 0.50 2.25 0.46 0.09 0.59 1.91

Diluted net income

per common share(2) .0.59 0.22 0.50 2.23 0.46 0.09 0.58 1.89

Dividend declared

per common share .... 0.33 0.33 0.33 0.33 0.2750.275 0.2750.275

___________________

The following footnotes are discussed as pretax expenses.

(1) The results of operations for the fourth quarter of the fiscal year ended January 31, 2015 include asset impairments of $2.2

million. The results of operations for the fourth quarter of the fiscal year ended February 1, 2014 include goodwill impairments

of $10.2 million and asset impairments of $18.5 million.Additionally,results for the fiscal year ended February 1, 2014 include

a$33.6 million benefit associated with changes in accounting estimates primarily related to our loyalty programs and other

customer liabilities.

(2) The sum of the quartersmay notnecessarily be equal to the full year net income per common share amount.