GameStop 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

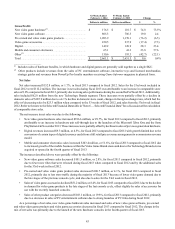

Seasonality

Our business, like that of many retailers, is seasonal, with the major portion of sales and operating profit realized during the

fourth quarter which includes the holiday selling season. Results for any quarter are not necessarily indicative of the results that

may be achieved for afullfiscal year.Quarterly resultsmay fluctuate materially depending upon, among other factors, the timing

of new product introductions and new store openings, sales contributed by new stores, increases or decreases in comparable store

sales, the nature and timing of acquisitions, adverse weather conditions, shifts in the timing of certain holidays or promotions and

changes in our merchandise mix.

52

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

We are exposed to market risk due to foreign currencyand interest rate fluctuations, each as described more fully below.

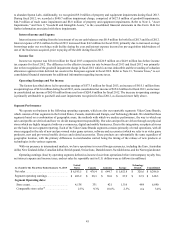

Foreign Currency Risk

We use forward exchange contracts, foreign currency options and cross-currency swaps (together,the “foreign currency

contracts”) to manage currency risk primarily related to intercompany loans denominated in non-functional currencies and certain

foreign currency assets and liabilities. The foreign currency contracts are not designated as hedges and, therefore, changes in the

fair values of these derivatives are recognized in earnings, thereby offsetting the current earnings effect of the re-measurement of

related intercompany loans and foreign currency assets and liabilities. For the fiscal year ended January 31, 2015, we recognized

a$28.9 million gain in selling, general and administrative expenses related to derivative instruments. The aggregate fair value of

the foreign currency contracts as of January 31, 2015 was anet asset of $18.4 million as measured by observable inputs obtained

from market news reporting services, such as Bloomberg and The Wall Street Journal,and industry-standard models that consider

various assumptions, including quoted forward prices, time value, volatility factors, and contractual prices for the underlying

instruments, as well as other relevant economic measures. Ahypotheticalstrengthening or weakening of 10% in the foreign

exchange rates underlying the foreign currency contracts from the market rate as of January 31, 2015 would result in againor

loss in value of theforwards, options and swapsof$13.2 million.

We do not use derivative financial instruments for trading or speculative purposes. We areexposed to counterparty credit risk

on all of our derivative financial instruments and cash equivalent investments. We manage counterparty risk according to the

guidelines and controls established under comprehensive risk management and investment policies. We continuously monitor our

counterparty credit risk and utilize anumberofdifferent counterparties to minimize our exposure to potential defaults. We do not

require collateral under derivative or investment agreements.

Interest Rate Risk

Our Revolver’s per annum interest rate is variable and is based on one of (i) the U.S. prime rate, (ii) the LIBO rate or (iii) the

U.S. federal funds rate. Our Senior Notes' per annum interest rate is fixed. We do notuse derivative financial instruments to hedge

interest rate exposure. We limitour interest rate risks by investing our excess cash balances in short-term, highly-liquid instruments

with amaturity of one year or less. We do notexpect any material losses from our invested cash balances.Additionally,ahypothetical

10% adverse movement in interest rates would not have amaterial impact on our financial condition, results of operations or cash

flows and we therefore believe that we do not have significant interest rate exposure.

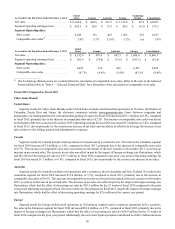

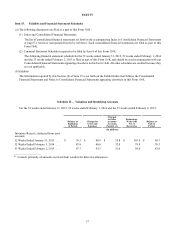

Item 8. Financial Statements and Supplementary Data

See Item 15(a)(1) and (2) of this Form 10-K.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A.Controls and Procedures

Evaluation of DisclosureControlsand Procedures

As of the end of the period covered by this report, our management conducted an evaluation, under the supervision and with

the participation of our principal executive officer and principal financial officer,ofour disclosure controls and procedures (as

defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) at the reasonable assurance level. Based on this evaluation,

our principal executive officer and principal financial officer concluded that, as of the end of the period covered by this report,

our disclosure controls and procedures are designed to provide reasonable assurance of achieving their objectives and that our