GameStop 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

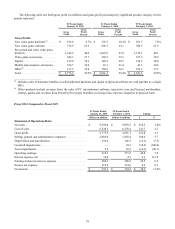

Estimate Description Judgment and/or Uncertainty Potential Impact if Results Differ

Indefinite-Lived Intangible Assets

Indefinite-lived intangible assets were

recorded as aresult of acquisitionsand

consist of our dealer agreement assets

and ourMicromania trade name. As

these intangible assets are expectedto

contribute to cash flows indefinitely,

they are not subject to amortization.

We assess our indefinite-lived

intangible assets for impairment at least

annually and whenever events or

changes in circumstances indicate that

the carrying value may not be

recoverable. Our test is completed as of

the beginning of the fourth quarter each

fiscal year.

We value our dealer agreements using a

discounted cash flow analysis known as

the Greenfield Method, which assumes

that abusiness, at its inception, owns

only dealer agreements and must make

capital expenditure, working capital and

other investments to ramp up its

operations to alevel that is comparable

to its current operations.

We value our Micromania trade name

using arelief-from-royalty approach,

which assumes the value of the trade

name is the discounted cash flows of the

amount that would be paid by a

hypothetical market participant had they

not owned the trade name and instead

licensed the trade name from another

company.

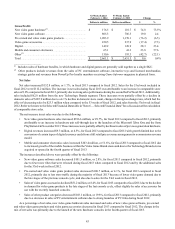

As of January 31, 2015, our indefinite-

lived intangible assets totaled $179.4

million. Refer to Note 9, "Goodwill and

Intangible Assets," to the consolidated

financial statements included in this

Form 10-K for afulldescription of our

indefinite-lived intangible assets.

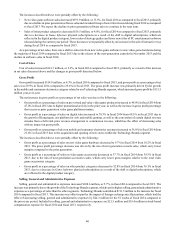

In valuing our dealer agreementassets,

considerable management judgment is

necessary to estimate the cash flows

required to build acomparable operation

and the availablefuturecash flowsfrom

these operations. Specifically,weare

required to makecertain assumptions

about the cost of investment to build a

comparable operation, projected net

sales, cost of sales, operating expenses

and income taxes, as well as the

discount rate that is applied to the

expected future cash flows to arrive at

an estimated fair value.

In valuing our Micromaniatrade name,

we are required to make certain

assumptions regarding future cash flow

projections to ensurethatsuch

projections represent reasonable market

participant assumptions, to which the

royalty rate is applied.Additionally,

management judgment is necessary in

selectinganappropriate discount rate

which is reflective of the inherent risk of

holdingastandalone intangible asset.

Changes in the assumptions utilized in

estimating the present value of the cash

flows attributable to trade names and

dealer agreementscouldmaterially

impact the fair value estimates.

Areduction in the terminal growth rate

assumption of 0.5% or an increase in the

discount rate assumption of 0.5% utilized

in the test would not have resulted in an

impairment of the dealer agreement

assets.

Areduction in the terminal growth rate

assumption of 0.5% or an increase in the

discount rate assumption of 0.5% utilized

in the test would not have resulted in an

impairment of the Micromania trade

name.

We can provide no assurance that we will

nothave impairment charges infuture

periodsasaresult of changes in our

operating results or our assumptions.

35