GameStop 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

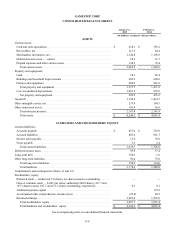

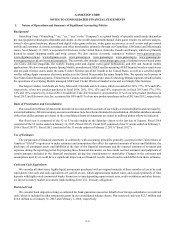

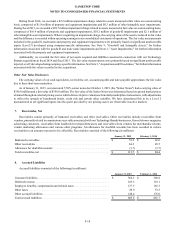

Merchandise Inventories

Our merchandise inventories are carried at the lower of cost or market generally using the average cost method. Under the

average cost method, as new product is received from vendors, its current cost is added to the existing cost of product on-hand

and this amount is re-averaged over the cumulative units. Pre-owned video game products traded in by customers are recorded as

inventory at the amount of the store credit given to the customer.Weare required to make adjustments to inventory to reflect

potential obsolescence or over-valuation as aresultofcostexceeding market. In valuing inventory,weconsiderquantities on hand,

recent sales, potential price protections, returns to vendors and other factors.

Our ability to assess these factors is dependent upon our ability to forecast customer demand and to provide awell-balanced

merchandise assortment. Inventory is adjusted based on anticipated physical inventory losses or shrinkage and actual losses resulting

from periodic physical inventory counts. Inventory reserves as of January 31, 2015 and February 1, 2014 were $69.3 million and

$76.5 million, respectively.

Property and Equipment

Property and equipment are carried at cost less accumulated depreciation and amortization. Depreciation on furniture, fixtures

and equipment is computed using the straight-line method over their estimated useful lives ranging from two to ten years.

Maintenance and repairs are expensed as incurred, while betterments and major remodeling costs are capitalized. Leasehold

improvements are capitalized and amortized over the shorter of their estimated useful lives or the terms of the respective leases,

including option periods in which the exercise of the option is reasonably assured (generally ranging from three to ten years).

Costs incurred in purchasing management information systems are capitalized and included in property and equipment. These

costs are amortized over their estimated useful lives from the date the systems become operational. Our total depreciation expense

was $144.5 million, $152.9 million and $163.1 million duringfiscal 2014, fiscal 2013 and fiscal 2012,respectively.

We periodically review our property and equipment when events or changes in circumstances indicate that their carrying

amounts may not be recoverable or their depreciation or amortization periods should be accelerated. We assess recoverability

based on several factors, including our intention with respect to our stores and those stores’ projected undiscounted cash flows.

An impairment loss would be recognized for the amount by which the carrying amount of the assets exceeds their fair value, as

approximated by the present value of their projected discounted cash flows. We recorded impairment losses of $2.2 million, $18.5

million and $8.8 million in fiscal 2014, fiscal 2013 and fiscal 2012, respectively.See Note 2, "Asset Impairments," for further

information regarding our asset impairment charges.

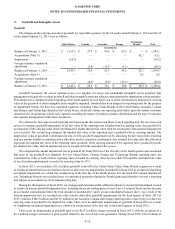

Goodwill &Intangible Assets

See Note 9, "Goodwill and Intangible Assets," for additional information regarding our accounting policies for goodwill and

intangible assets.

Revenue Recognition

We recognize revenue when the sales price is fixed or determinable, collection is reasonably assured and the customer takes

possession of the merchandise, or in the case of commissions, when thecommission-generating activityhas been performed.

Revenue from the sales of our products is recognized at the time of sale, net of sales discounts and net of an estimated sales

return reserve, based on historical return rates, with acorresponding reduction in cost of sales. Our sales return policy is generally

limited to less than 30 days and as such oursales returns are, and havehistorically been, immaterial.

The sales of pre-owned video game products are recorded at the retail price charged to the customer.Advertisingrevenues

for Game Informer are recorded upon release of magazines for sale to consumers. Subscription revenues for our PowerUp Rewards

loyalty program and magazines are recognized on astraight-line basis over the subscription period. Revenue from the sales of

product replacement plans is recognized on astraight-line basis over the coverage period. Customer liabilities and other deferred

revenues for our PowerUp Rewards loyalty program, gift cards, customer credits, magazines and product replacement plans are

included in accrued liabilities (see Note 8, "Accrued Liabilities").

We also sellavariety of digital products which generally allow consumers to download software or play games on the internet.

Certainofthese products do not require us to purchase inventory or take physical possession of, or take title to, inventory.When

purchasing these products from us, consumers pay aretail price and we earn acommission basedonapercentageofthe retailsale

as negotiated with the product publisher.Werecognize these commissions as revenue at the time of sale of these digital products.

In addition to our product sales, our Spring Mobile business earns commission revenue as an AT &T authorized dealer related

to the activation of new wireless customers, the activation of enhanced or upgraded features on existing wireless customer plans

and certain other commission incentive opportunities that may be offered to us by AT &T.Wehave determined that we are not

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-10