GameStop 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

what it expects in exchange for the goods or services. The standard also requires more detailed disclosures and provides additional

guidance for transactions that were not addressed completely in the prior accounting guidance. The ASU provides alternative

methods of initial adoption and is effective for annual periods beginning after December 15, 2016 and interim periods within those

annual periods. Early adoption is not permitted. We are currently evaluating the impact that this standard will have on our

consolidated financial statements as well as the appropriate method of adoption.

In April 2014, the FASB issued ASU 2014-08 related to reporting discontinued operations and disclosures of disposals of

components of an entity.Specifically,the ASUamends the definition of adiscontinued operation, expands disclosure requirements

for transactions that meet the definition of adiscontinued operation and requires entities to disclose additional information about

individually significant components that are disposed of or held for sale and do not qualify as discontinued operations.Additionally,

entities will be required to reclassify assets and liabilities of adiscontinued operation for all comparative periods presented in the

statement of financial position and to separately present certain information related to the operating and investing cash flows of

the discontinued operation, for all comparative periods, in the statement of cash flows. The ASU is effective for us beginning in

the first quarter of our fiscal year ending January 30, 2016 and will be adopted on aprospective basis for all disposals (except

disposals classified as held for sale prior to the adoption date) or components initially classified as held for sale in periods beginning

on or after the adoption date, with early adoption permitted. We are currently evaluating the impact that this standard will have on

our consolidated financial statements.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-13

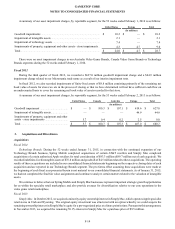

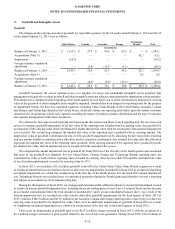

2. Asset Impairments

Fiscal 2014

We recognized impairment charges of $2.2 million in fiscal 2014 related to our evaluation of store property,equipment and

other assets in situations where the asset’s carrying value was not expected to be recovered by its future cash flows over its remaining

useful life.

Asummary of our asset impairment charges, by reportable segment, for the 52 weeks ended January 31, 2015 is as follows:

United States Canada Europe Total

(In millions)

Impairment of intangible assets ...................................... $—$—$0.3 $0.3

Impairments of property,equipment and other assets -

storeimpairments............................................................ 0.60.4 0.91.9

Total ................................................................................ $0.6 $0.4 $1.2 $2.2

There were no asset impairment charges in our Australia VideoGame Brands or Technology Brands segments during the 52

weeks ended January 31, 2015.

Fiscal 2013

We recognized impairment charges of $9.0 million in fiscal 2013 related to our evaluation of store property,equipment and

other assets in situations where the asset’s carrying value was not expected to be recovered by its future cash flows over its remaining

useful life. Additionally,wemade adecision during the fourth quarter of fiscal 2013 to abandon our Spawn Labs business and

related technology assets. As aresultofthisdecision, we recorded impairment charges of $2.1 million related to other intangible

assets and $7.4 million related to certain technology assets in connection with the exit of the Spawn Labs business, which are

reflected in the asset impairments line item in our consolidated statements of operations. Because we never integrated Spawn Labs

into our United States VideoGame Brands reporting unit, our decision to exit this business triggered an interim impairment test

that resulted in agoodwill impairment charge of $10.2 million, which is reflected in the goodwill impairments line item in our

consolidated statements of operations.