GameStop 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

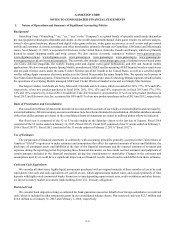

deemed the obligor on the underlying wireless services contracts that give rise to this commission revenue; therefore, commission

revenue is recognized at the point at which the commission-generating activity has been performed, which is generally driven by

customer activation. Commissions are recognized net of an allowance for chargebacks from AT&T for estimated customer

cancellations, which is periodicallyassessed and adjusted to reflect historical cancellation experience.

Revenues do not include salestaxes or other taxes collected from customers.

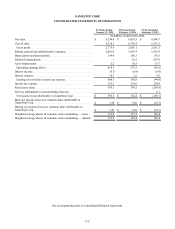

Cost of Sales and Selling, General and Administrative Expenses Classification

The classification of cost of sales and selling, general and administrative expenses varies across the retail industry.Weinclude

purchasing, receiving and distribution costs in selling, general and administrative expenses, rather than in cost of sales, in the

consolidated statements of operations. For the 52 weeks ended January 31, 2015, the 52 weeks ended February 1, 2014 and the

53 weeks ended February 2, 2013, these purchasing, receiving and distribution costs amounted to $50.3 million, $56.4 million and

$58.8 million, respectively.

We include processing fees associated with purchases made by check and credit cards in cost of sales, rather than selling,

general and administrative expenses, in the consolidated statements of operations. For the 52 weeks ended January 31, 2015,the

52 weeks ended February 1, 2014 and the 53 weeks ended February 2, 2013, these processing fees amounted to $66.4 million,

$61.5 million and $54.2 million, respectively.

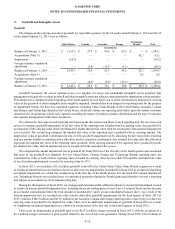

Customer Liabilities

We establish aliability upon the issuance of merchandise credits and the sale of gift cards. Revenue is subsequently recognized

when the credits and gift cards are redeemed. In addition, breakage is recognized quarterly on unused customer liabilities older

than two years to the extent that our management believes the likelihood of redemption by the customer is remote, based on

historical redemption patterns. To the extent that future redemption patterns differ from those historically experienced, there will

be variations in the recorded breakage.Breakage is recorded in cost of sales in our consolidated statements of operations.

Advertising Expenses

We expense advertising costs for newspapers and other media when the advertising takes place. Advertising expenses for

television, newspapers and other media during the 52 weeks ended January 31, 2015, the 52 weeks ended February 1, 2014 and

the 53 weeks ended February 2, 2013were$64.1 million, $57.8 million and $63.9 million, respectively.

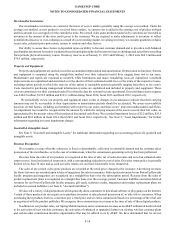

Loyalty Expenses

Our PowerUp Rewards loyalty program allows enrolled members to earn points on purchases that can be redeemed for rewards

that include discounts or merchandise. We estimate the net cost of the rewards that will be issued and redeemed and record this

cost and the associated balance sheet liability as points are accumulated by loyalty program members. The two primary estimates

utilized to record the balance sheet liability for loyalty points earned by members are the estimated redemption rate and the estimated

weighted-average cost per point redeemed. Our management uses historical redemption rates experienced under the loyalty program

as abasis to estimate the ultimate redemption rate of points earned. Aweighted-average cost per point redeemed is used to estimate

future redemption costs. The weighted-average cost per point redeemed is based on our most recent actual costs incurred to fulfill

points that have been redeemed by our loyalty program members and is adjusted as appropriate for recent changes in redemption

costs, including the mix of rewards redeemed. We continually evaluate our methodology and assumptions based on developments

in redemption patterns, cost per point redeemed and other factors. Changes in the ultimate redemption rate and weighted-average

cost per point redeemedhavethe effect of either increasing or decreasing the liability throughthe current period provision by an

amount estimated to cover the cost of all points previously earned but not yet redeemed by loyalty program members as of the end

of the reporting period.

Historically,the cost was recognized in selling, general and administrative expenses and the associated liability was included

in accrued liabilities. However,beginning in the fourth quarter of 2013, we determined that the net cost of the rewards that will

be issued and redeemed would be better presented as cost of sales. The cost of administering the loyalty program, including program

administration fees, program communications and cost of loyalty cards, is recognized in selling, general and administrative

expenses. The cost of free or discounted products recognized in cost of sales for the 52 weeks ended January 31, 2015 and the 52

weeks ended February 1, 2014 was $30.9 million and $18.2 million, respectively.The cost of free or discounted products recognized

in general and administrative expenses, as discussed above, for the 53 weeks ended February 2, 2013 was $31.2 million. The

reserve is released when loyalty program members redeem their respective points and the corresponding rewards are recorded to

cost of goods sold in the period of redemption.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-11