GameStop 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

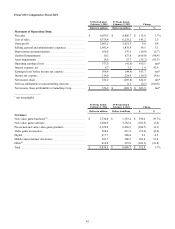

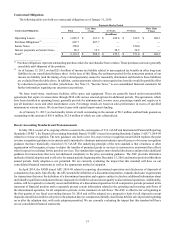

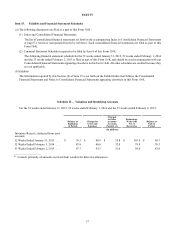

Contractual Obligations

The following table sets forth our contractualobligations as of January31, 2015:

Payments Due by Period

Contractual ObligationsTotal

Less Than

1Year 1-3 Ye ars 3-5 Ye ars

MoreThan

5Years

(In millions)

Operating Leases ................................. $1,085.5 $361.9 $436.8 $182.5 $104.3

Purchase Obligations(1) ........................ 607.7607.7 ———

Senior Notes ........................................ 350.0——350.0 —

Interest payments on Senior Notes ...... 96.3 19.3 38.5 38.5 —

Total(2) .................................................. $2,139.5 $988.9 $475.3 $571.0 $104.3

___________________

(1) Purchase obligations represent outstanding purchase orders for merchandise from vendors. These purchase orders are generally

cancelable until shipment of theproducts.

(2) As of January 31, 2015, we had $21.4 million of income tax liability related to unrecognized tax benefits in other long-term

liabilities in our consolidated balance sheet. At the time of this filing, the settlement period for the noncurrent portion of our

income tax liability (and the timing of any related payments) cannot be reasonably determined and therefore these liabilities

are excluded from the table above. In addition, certain payments related to unrecognized tax benefits would be partially offset

by reductions in payments in other jurisdictions. See Note 13, "Income Taxes,"toour consolidated financial statements for

further information regarding our uncertain tax positions.

We lease retail stores, warehouse facilities, office space and equipment. These are generally leased under noncancelable

agreements that expire at various dates through 2034 with various renewal options for additional periods. The agreements, which

have been classified as operating leases, generally provide for minimum and, in some cases, percentage rentals and require us to

pay all insurance, taxes and other maintenance costs. Percentage rentals are based on sales performance in excess of specified

minimums at various stores. We do nothaveleases with capital improvementfunding.

As of January 31, 2015, we had standby letters of credit outstanding in the amount of $8.3 million and had bank guarantees

outstanding in the amount of $16.6 million, $12.4 million of which are cash collateralized.

51

Recent Accounting Standards and Pronouncements

In May 2014, as part of its ongoing efforts to assist in the convergence of U.S. GAAP and International Financial Reporting

Standards (“IFRS”), the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2014-09

related to revenue recognition. The new guidance sets forth anew five-step revenue recognition model which replaces the prior

revenue recognition guidance in its entirety and is intended to eliminate numerous industry-specific pieces of revenue recognition

guidance that have historically existed in U.S. GAAP.The underlying principleofthe newstandard is that abusiness or other

organization will recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects

what it expects in exchange for the goods or services. The standard also requires more detailed disclosures and provides additional

guidance for transactions that were not addressed completely in the prior accounting guidance. The ASU provides alternative

methods of initial adoption and is effective for annual periods beginning after December 15, 2016 and interim periods within those

annual periods. Early adoption is not permitted. We arecurrently evaluating the impact that this standard will have on our

consolidated financial statements as well as the appropriate method of adoption.

In April 2014, the FASB issued ASU 2014-08 related to reporting discontinued operations and disclosures of disposals of

components of an entity.Specifically,the ASUamends the definition of adiscontinued operation, expands disclosure requirements

for transactions that meet the definition of adiscontinued operation and requires entities to disclose additional information about

individually significant components that are disposed of or held for sale and do not qualify as discontinued operations.Additionally,

entities will be required to reclassify assets and liabilities of adiscontinued operation for all comparative periods presented in the

statementoffinancial position and to separately present certain information related to the operating and investing cash flows of

the discontinued operation, for all comparative periods, in the statement of cash flows. The ASU is effective for us beginning in

the first quarter of our fiscal year ending January 30, 2016 and will be adopted on aprospective basis for all disposals (except

disposals classified as held for sale prior to the adoption date) or components initially classified as held for sale in periods beginning

on or after the adoption date, with early adoption permitted. We are currently evaluating the impact that this standard will have

on our consolidated financial statements.