GameStop 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

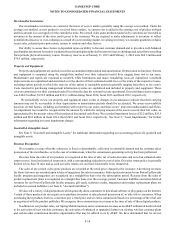

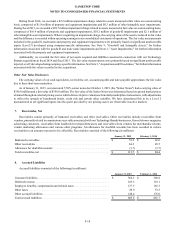

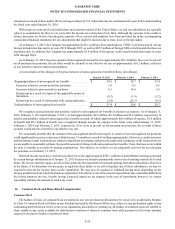

goodwill was expensed in the United States segment as aresultofthe exiting of an immaterial non-core business. Cumulative

goodwill impairment losses were $640.5 million as of January 31, 2015, of which $13.5 million, $100.3 million, $107.1 million

and $419.6 million were attributable to our United States, Canada,Australia and Europe reporting units, respectively.

Intangible Assets

Other intangible assets consist primarily of dealer agreements, trade names, leasehold rights, advertising relationships and

amounts attributed to favorable leasehold interests recorded as aresultofbusiness acquisitions. Intangible assets are recorded

apart from goodwill if they arise from acontractual right and are capable of being separated from the entity and sold, transferred,

licensed, rented or exchanged individually.The estimated useful life and amortization methodology of intangible assets are

determined based on the period in which they are expected to contribute directly to cash flows. Intangible assets that are determined

to have adefinite life are amortized over that period.

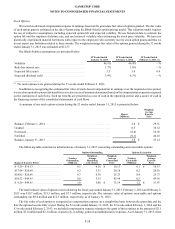

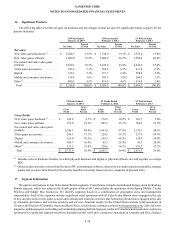

Finite-lived Intangible Assets

Leasehold rights, which were recorded as aresultofthe purchase of SFMI Micromania SAS (“Micromania”), represent the

value of rights of tenancy under commercial property leases for properties located in France. Rights pertaining to individual leases

can be sold by us to anew tenant or recovered by us from the landlord if the exercise of the automatic right of renewal is refused.

Leasehold rights are amortized on astraight-line basis over the expected lease term, not to exceed 20 years, with no residual value.

Advertising relationships, which were recorded as aresult of digital acquisitions, are relationships with existing advertisers

who pay to place ads on our digital websites and are amortized on astraight-line basis over 10 years.

Favorable leasehold interests represent the value of the contractual monthly rental payments that are less than the current

market rent at stores acquired as part of the Micromania acquisition. Favorable leasehold interests are amortized on astraight-line

basis over their remaining lease termwith no expected residual value.

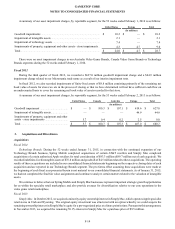

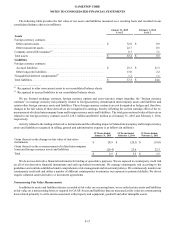

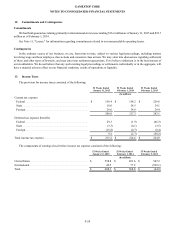

As of January 31, 2015, the total weighted-average amortization period for the remaining intangible assets, excluding goodwill,

was approximately 13 years. The intangible assets are being amortized based upon the pattern in which the economic benefits of

the intangible assets are being utilized, with no expected residual value.

Indefinite-lived IntangibleAssets

Intangible assets that are determined to have an indefinite life are not amortized, but are required to be evaluated at least

annually for impairment. If the carrying value of an individual indefinite-lived intangible asset exceeds its fair value as determined

by its discounted cash flows, such individual indefinite-lived intangible asset is written down by the amountofthe excess.

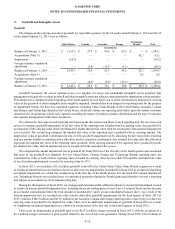

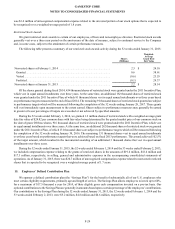

Dealer agreements were recorded as aresult of our acquisitions of Spring and Simply Mac in the fourth quarter of fiscal 2013

as well as the subsequent acquisitions completed by Spring and Simply Mac in fiscal 2014. These dealer agreements represent

Spring's exclusive agreements with AT&T tooperate AT&T stores as an “AT&T Authorized Retailer” and sell AT &T wireless

contracts in its stores and Simply Mac’s exclusive agreements with Apple to operate Apple stores under the name “Simply Mac”

and sell Apple products in its stores. The dealer agreement value recorded on our consolidated balance sheets represents avalue

associated with the rights and privileges afforded to us under these agreements. Ourdealer agreements are considered indefinite-

lived intangible assets as they are expected to contribute to cash flows indefinitely and are not subject to amortization, but are

subjecttoannual impairment testing.

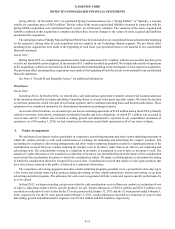

We value our Spring and Simply Mac dealer agreements using adiscounted cash flow analysis known as the Greenfield

Method, which is acommonvaluation technique in valuing dealer agreement assets. The Greenfield Method assumes that a

business, at its inception, owns only dealer agreements and makes capital expenditures, working capital and other investments

required to ramp up its operations to alevel that is comparable to its current operations. We estimate the cash flows required to

build acomparable operation and the available future cash flows from these operations, which requires us to make certain

assumptions about the cost of investment to build acomparable operation, projected net sales, cost of sales, operating expenses

and income taxes. The cash flows are then discounted using an appropriate rate that is reflective of the inherent risks and uncertainties

associated with the expected future cash flows of the business. The estimated fair values of the Spring and Simply Mac dealer

agreement assets based upon the discounted cash flows is then compared to their respective carrying values.

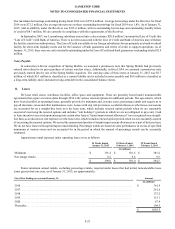

Trade names which were recorded as aresult of acquisitions, primarily Micromania, are considered indefinite-lived intangible

assets as they are expected to contribute to cash flows indefinitely and are not subject to amortization, but are subject to annual

impairment testing. The fairvalue of our Micromania trade name was calculated using arelief-from-royalty approach, which

assumes the fair value of the trade name is the discounted cash flows of the amount that would be paid by ahypothetical market

participant had they not owned the trade name and instead licensed the trade name from another company.The basis for future

cash flow projections is internal revenue forecasts, which we believe represent reasonable market participant assumptions, to which

the selected royalty rate is applied. These future cash flows are discounted using the applicable discount rate, as well as any potential

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-20