GameStop 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

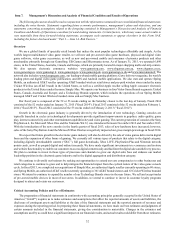

Estimate Description Judgment and/or Uncertainty Potential Impact if Results Differ

Customer Liabilities

Our PowerUp Rewards loyalty program

allows enrolled members to earn points

on purchases in our stores and on some

of our websites that can be redeemed

for rewards that include discountsor

merchandise. We estimate the net cost

of the rewards that will be issued and

redeemed and record this cost and the

associated liability as points are earned

by our loyalty program members.

Additionally,wesellgift cards to our

customers in our retail stores, through

our website and through selected third

parties. At the point of sale, aliability is

established for the value of the giftcard.

We recognize revenue from gift cards

when the card is redeemed by the

customer or the likelihood of the gift

card being redeemed by the customer is

remote, which is aconcept knowninthe

retail industry as breakage. We

determine our gift card breakage rate

based on historical redemption patterns,

which show that, after 60 months, we

can determine the portion of the initial

liability for which redemption is

remote.

Thetwo primaryestimates utilized to

record the balance sheet liability for

loyalty points earned by members are

the estimated redemption rate and the

estimated weighted-average cost per

point redeemed. We usehistorical

redemption rates experienced under our

loyalty program as abasis for estimating

the ultimate redemption rate of points

earned. Aweighted-average cost per

point redeemed is used to estimate

future redemptioncosts. The weighted-

average cost per point redeemed is

basedonour most recent actual costs

incurred to fulfill points that have been

redeemed by our loyalty program

members and is adjusted as appropriate

for recent changesinredemption costs,

including the mix of rewards redeemed.

Our estimate of the amount and timing

of gift card redemptions is based

primarily on historical transaction

experience.

We continually evaluate our methodology

and assumptions based on developments

in redemption patterns, cost per point

redeemed and other factors. Changes in

the ultimate redemption rate and

weighted-average cost per point

redeemed have the effect of either

increasing or decreasing the liability

through the current period expense by an

amount estimated to cover the cost of all

pointspreviously earned but not yet

redeemed by loyalty program members as

of the end of the reporting period.

A10% change inour customer loyalty

programredemption rate or weighted-

average cost per point redeemed at

January31, 2015 wouldhave affected net

earnings by approximately $5.5 million

and $5.5 million, respectively,infiscal

2014.

A10% change in our gift card breakage

rate at January 31, 2015 would have

affected net earnings by approximately

$11.1million in fiscal 2014.

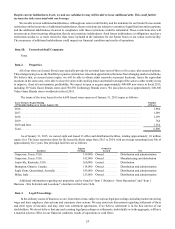

Goodwill

Our goodwill results from our

acquisitions and represents the excess

purchase price over the net identifiable

assets acquired. We are required to

evaluate our goodwill and other

indefinite-lived intangible assets for

impairment at least annually or

whenever indicators of impairmentare

present. Our annual test iscompleted as

of the beginning of the fourth fiscal

quarter,and interim tests are conducted

when circumstances indicate the

carrying value of the goodwill or other

intangible assets may not be

recoverable.

As of January 31, 2015, our goodwill

totaled $1,390.4 million. Refer to Note

9, "Goodwill and Intangible Assets," to

the consolidated financial statements

included in this Form 10-K for afull

description of our goodwill.

Considerable management judgment is

necessary to initially value intangible

assets upon acquisition and to evaluate

those assets and goodwill for

impairment going forward. We

determine fair value using widely

acceptable valuation techniques

including discounted cashflows and

market multiples analyses.

Assumptions usedinour valuations,

such as forecasted growthrates and our

cost of capital, are consistent with our

internal projections and operating plans.

Variations in any of the assumptions used

in valuing our intangible assets and in our

impairment analysis may result in

different calculations of fair values that

could result in amaterial impairment

charge.

Basedonthe results of our annual

impairment test in fiscal 2014, the fair

valuesfor ourUnited States, Canada,

Europe and Technology Brands reporting

unitsexceeded their respective carrying

valuesbymorethan30% and the fair

value of ourAustraliareporting unit

exceeded its carrying value by more than

15%. Areduction in the terminal growth

rate assumption of 0.5% or an increasein

the discount rate assumption of 1.0%

utilized in the test for each respective

reporting unit would not have resulted in

an impairment.

We can provide no assurance that we will

nothave impairment charges in future

periodsasaresult of changes in our

operating results or our assumptions.

34