GameStop 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In 2005, we adopted arights agreement under which one right (a “Right”) was attached to each outstanding share of our

common stock. Each Right entitles the holder to purchase from us one ten-thousandth of ashare of aseries of preferred stock,

designated as Series AJuniorParticipating Preferred Stock (the “Series APreferred Stock”), at aprice of $100.00 per one one-

thousandth of ashare.The Rights expiredonOctober 28, 2014, and accordingly,atJanuary 31, 2015, there were no shares of

Series APreferred Stock issued or outstanding.

ShareRepurchase Activity. SinceJanuary 2010, our Board of Directors has authorized several share repurchase programs

authorizing our management to repurchase our Class ACommonStock. Since the beginning of fiscal 2011, each individual

authorization has been $500 million. Our typical practice is to seek Board of Directors’ approval for anew authorization before

the existing one is fully used to ensure we are always able to repurchase shares. Repurchased shares are subsequently retired.

Share repurchases are generally recorded as areduction to additional paid-in capital; however,inthe event that share repurchases

would cause additional-paid in capital to be reduced below zero, any excess is recorded as areduction to retained earnings.

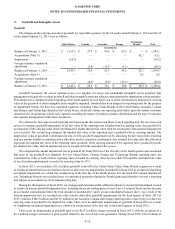

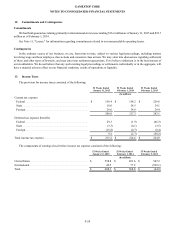

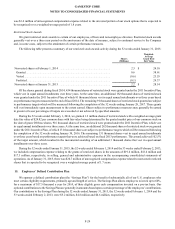

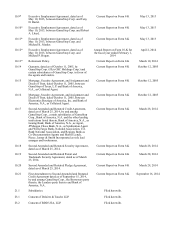

The following table summarizes our share repurchase activity during the 52 weeks ended January 31, 2015, the 52 weeks

ended February 1, 2014 and the 53 weeks ended February 2, 2013:

Period

Total

Number of

Shares

Purchased

Average

PricePaid per

Share

Aggregate Value of

Shares Repurchased

During the Period

(in millions) (in millions)

52 weeks ended January 31, 2015 .............................................................. 8.4 $39.50 $333.4

52 weeks ended February 1, 2014 .............................................................. 6.3 $41.12 $258.3

53 weeks ended February 2, 2013 .............................................................. 19.9 $20.60 $409.4

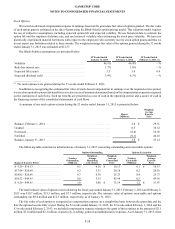

Between February 1, 2015 and March 19, 2015, we have repurchased 0.5 million shares at an average price per share of

$38.26 for atotal of $18.9 million and have $428.4 million remaining under our latest authorization from November 2014.

Dividends. In February 2012, our Board of Directors approved the initiation of aquarterly cash dividend to our stockholders

of Class ACommon Stock. We paid atotal of $0.80 per share in dividends in fiscal 2012 and atotal of $1.10 per share in fiscal

2013. In fiscal 2014, we paid dividends of $1.32 per share of Class ACommonStock, totaling approximately $148.8 million. On

March 3, 2015, our Board of Directors authorized an increase in our annual cash dividend from $1.32 to $1.44 per share of Class

ACommon Stock. Future dividends will be subject to approval by our Board of Directors.

Share-Based Compensation

Effective June 2013, our stockholders voted to adopt the Amended and Restated 2011Incentive Plan (the “Amended 2011

Incentive Plan”) to provide for issuance under the 2011Incentive Plan of our Class ACommon Stock. TheAmended 2011Incentive

Plan provides amaximum aggregate amount of 9.25 million shares of Class ACommon Stock with respect to which options may

be granted and provides for agrant of cash, granting of incentive stock options, non-qualified stock options, stock appreciation

rights, performance awards, restricted stock and other share-based awards, which may include, without limitation, restrictions on

the right to vote such shares and restrictions on the right to receive dividends on such shares. The options to purchase Class A

common shares are issued at fair market value of the underlying shares on the date of grant. In general, the options vest and become

exercisable in equal annual installments over athree-year period, commencing one year after the grant date, and expire ten years

from the grant date. Shares issued upon exercise of options are newly issued shares. Options and restricted shares granted after

June 21, 2011are issued under the 2011Incentive Plan.

Effective June 2009, our stockholders voted to amend the Third Amended and Restated 2001 Incentive Plan (the “2001

Incentive Plan”) to provide for issuance under the 2001 Incentive Plan of our Class ACommon Stock. The 2001 Incentive Plan

provided amaximum aggregate amount of 46.5 million shares of Class ACommon Stock with respect to which options may have

been granted and provided for the granting of incentive stock options, non-qualified stock options, and restricted stock, which may

have included, without limitation, restrictions on the right to vote such shares and restrictions on the right to receive dividends on

such shares.The options to purchase Class Acommon shares were issued at fair market value of the underlying shares on the date

of grant. In general, the options vested and became exercisable in equal annual installments over athree-year period, commencing

one year after the grant date, and expired ten years from the grant date. Shares issued upon exercise of options are newly issued

shares.Options and restricted shares granted on or before June 21,2011were issued under the 2001 Incentive Plan.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-27