GameStop 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

statements as aresultofthese audits.Weare no longer subject to U.S. federal income tax examination for years before and including

the fiscal year ended January 30, 2010.

With respect to state and local jurisdictions and countries outside of the United States, we and our subsidiaries are typically

subject to examination for three to six years after the income tax returns have been filed. Although the outcome of tax audits is

always uncertain, we believe that adequate amounts of tax, interest and penalties have been provided for in the accompanying

consolidated financial statements for any adjustments that might be incurred due to state, localorforeign audits.

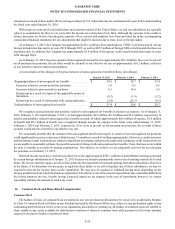

As of January 31, 2015, the Company has approximately $12.1 million of net operating loss ("NOL") carryforwards in various

foreign jurisdictions that expire in years 2018 through 2035, as well as $85.2 million of foreign NOL carryforwards that have no

expiration date. In addition, the Company has approximately $3.8 million of foreign tax credit carryforwards that expire in years

2022 through 2024.

As of January 31, 2015, the gross amount of unrecognized tax benefits was approximately $21.4 million. If we were to prevail

on all uncertain tax positions, the net effect would be abenefit to our effective tax rate of approximately $16.2 million, exclusive

of any benefits related to interest and penalties.

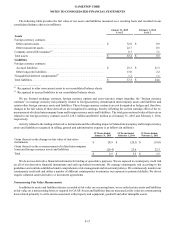

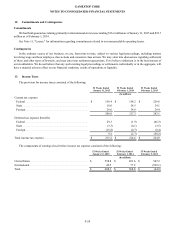

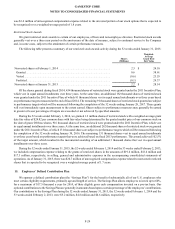

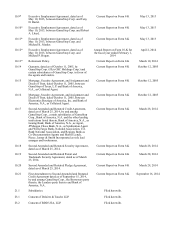

Areconciliation of the changes in the gross balances of unrecognized tax benefits follows (in millions):

January 31, 2015 February 1, 2014 February 2, 2013

Beginning balance of unrecognized tax benefits ......................... $20.6$ 28.7 $25.4

Increases related to current period tax positions ....................... 1.00.5 0.5

Increases related to prior period tax positions........................... 6.116.66.3

Reductions as aresult of alapse of the applicable statute of

limitations .................................................................................. (0.5) (1.9) (3.2)

Reductions as aresult of settlements with taxing authorities.... (5.8) (23.3) (0.3)

Ending balance of unrecognized tax benefits .............................. $21.4$ 20.6 $28.7

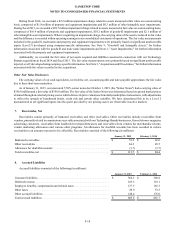

We recognize accrued interest and penalties related to unrecognized tax benefits in income tax expense. As of January 31,

2015, February 1, 2014 and February 2, 2013, we had approximately $4.6 million, $6.1 million and $5.4 million, respectively,in

interest and penalties related to unrecognized tax benefits accrued, of which approximately $0.6 million of expense, $1.6 million

of benefit and $2.3 million of benefit were recognized through income tax expense in the fiscal years ended January 31, 2015,

February 1, 2014 and February 2, 2013, respectively.Ifwewere to prevail on all uncertain tax positions, the reversal of these

accruals would also be abenefit to oureffective tax rate.

It is reasonably possible that the amount of the unrecognized benefit with respect to certain of our unrecognized tax positions

could significantly increase or decrease within the next 12 months as aresultofsettling ongoing audits. However,asaudit outcomes

and the timing of audit resolutions are subject to significant uncertainty,and giventhe nature and complexity of the issues involved,

we are unable to reasonably estimate the possible amount of change in the unrecognized tax benefits, if any,thatmay occur within

the next 12 months as aresult of ongoing examinations. Nevertheless, we believe we are adequately reserved for our uncertain

tax positions as of January 31, 2015.

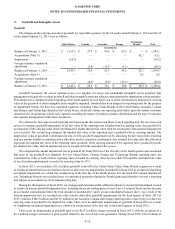

Deferred income taxes have not been provided for on the approximately $595.1 million of undistributed earnings generated

by certain foreign subsidiaries as of January 31, 2015 because we intend to permanently reinvest such earnings outside the United

States. We do not currently require, nor do we have plans for,the repatriation of retained earnings from these subsidiaries. However,

in the future, if we determine it is necessary to repatriate these funds, or we sell or liquidate any of these subsidiaries, we may be

required to provide for income taxes on the repatriation. We may also be required to withhold foreign taxes depending on the

foreign jurisdiction from which the funds are repatriated. The effective rate of tax on such repatriations may materially differ from

the federal statutory tax rate, thereby having amaterial impact on tax expense in the year of repatriation; however,wecannot

reasonably estimate the amount of such atax event.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-26

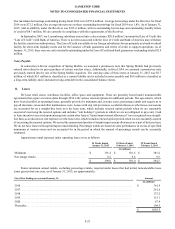

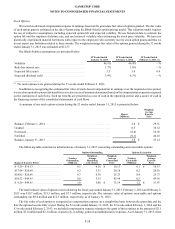

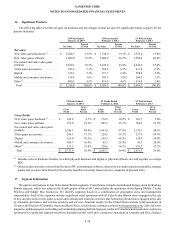

14. Common Stock and Share-Based Compensation

Common Stock

The holders of Class ACommon Stock are entitled to one vote per share on all matters to be voted on by stockholders. Holders

of Class ACommon Stock will share in any dividend declared by the Board of Directors, subject to any preferential rights of any

outstanding preferred stock. In the event of our liquidation, dissolution or winding up, all holders of common stock are entitled to

shareratably in any assets available for distribution to holders of shares of common stock after payment in full of any amounts

required to be paid to holders of preferred stock.