GameStop 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

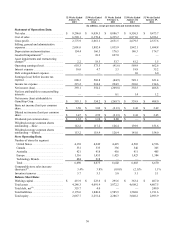

___________________

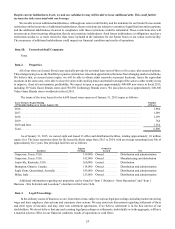

(1) Results for fiscal 2013 include agoodwill impairment charge of $10.2 million related to our decision to abandon our

investment in Spawn Labs. Results for fiscal 2012 include charges related to goodwill impairments of $627.0 million

resulting from our interim goodwill impairment tests performed during the third quarter of fiscal 2012. See Note 9, "Goodwill

and Intangible Assets," to our consolidated financial statements for further information regarding our goodwill impairment

charges.

(2) Results for fiscal 2014 include impairment charges of $2.2 million, comprised of $1.9 million of property and equipment

impairments and $0.3 million of intangible asset impairments. Results for fiscal 2013 include impairments of $18.5 million,

of which $7.4 million and $2.1 million were related to certain technology assets and other intangible assets, respectively,

as aresultofour decision to abandon our investment in Spawn Labs and the remaining $9.0 million was related to property

and equipment impairments resulting from our evaluation of store property,equipment and other assets. Results for fiscal

2012 include charges related to asset impairments of $53.7 million, of which $44.9 million relates to the impairment of

the Micromania trade name and $8.8 million relates to other impairment charges from the evaluations of store property,

equipment and other assets. Results for fiscal 2011include charges related to asset impairments and restructuring charges

of $81.2 million, of which $37.8 million relates to the impairment of the Micromania trade name, $22.7 million relates to

the impairment of investments in non-core businesses and $20.7 million relates to other impairments, termination benefits

and facility closure costs. Results for fiscal 2010 include impairment charges resulting from our evaluation of store property,

equipment and other assets.

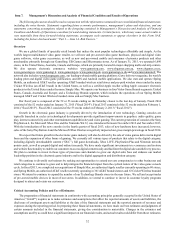

(3) Comparable store sales is ameasure commonly used in the retail industry and indicates store performance by measuring

the growth in sales for certain stores for aparticular period over the corresponding period in the prior year.Our comparable

storesales are comprised of sales from our VideoGame Brands stores operating for at least 12 full months as well as sales

related to our websites and sales we earn from sales of pre-owned merchandise to wholesalers or dealers. Comparable

storesales for our international operating segments exclude the effect of changes in foreign currency exchange rates. The

calculation of comparable store sales for the 52 weeks ended January 31, 2015 compares the 52 weeks for the period ended

January31, 2015 to themostclosely comparable weeks for the prior year period. The method of calculating comparable

storesales varies across the retail industry.Asaresult, our method of calculating comparable store sales may not be the

same as otherretailers’ methods. Our Technology Brands stores are excluded from the calculation of comparable store

sales.Wedonot consider comparable store sales to be ameaningfulmetric in evaluating the performance of our Technology

Brands stores due to the frequently changing nature of revenue streams and commission structures associated with this

segmentofour business. We believe our calculation of comparable store sales best represents our strategy as amulti-

channel retailer who provides its consumers several ways to access its products.

(4) On September 24, 2014, we issued $350.0 million aggregate principal amount of unsecured 5.50% senior notes due October

1, 2019 (the "Senior Notes"). The Senior Notes bear interest at the rate of 5.50% per annum with interest payable semi-

annually in arrears on April 1and October 1ofeach year beginning on April 1, 2015. The Senior Notes were sold in a

private placement and will not be registered under the U.S. Securities Act of 1933. The Senior Notes were offered in the

U.S. to “qualified institutional buyers” pursuant to the exemption from registration under Rule 144A of the Securities Act

and in exempted offshore transactions pursuant to Regulation Sunder the Securities Act. See Note 10, "Debt," to our

consolidated financial statements for additional informationregarding the Senior Notes.

31