GameStop 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

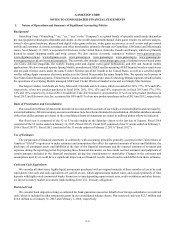

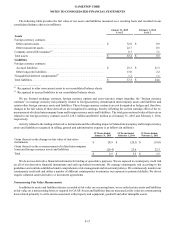

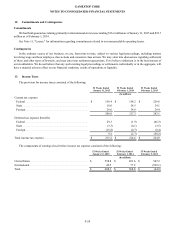

Asummary of our asset impairment charges, by reportable segment, for the 52 weeks ended February 1, 2014 is as follows:

United States Europe Total

(In millions)

Goodwill impairments .................................................................................. $10.2$ —$ 10.2

Impairment of intangible assets .................................................................... 2.1—2.1

Impairment of technology assets .................................................................. 7.4—7.4

Impairments of property,equipment and other assets -store impairments .. 4.34.7 9.0

Total .............................................................................................................. $24.0$ 4.7$ 28.7

There were no asset impairment charges in our Australia VideoGame Brands, Canada VideoGame Brands or Technology

Brands segments during the 52 weeks ended February 1, 2014.

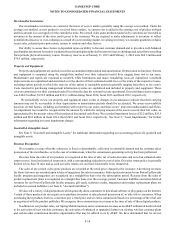

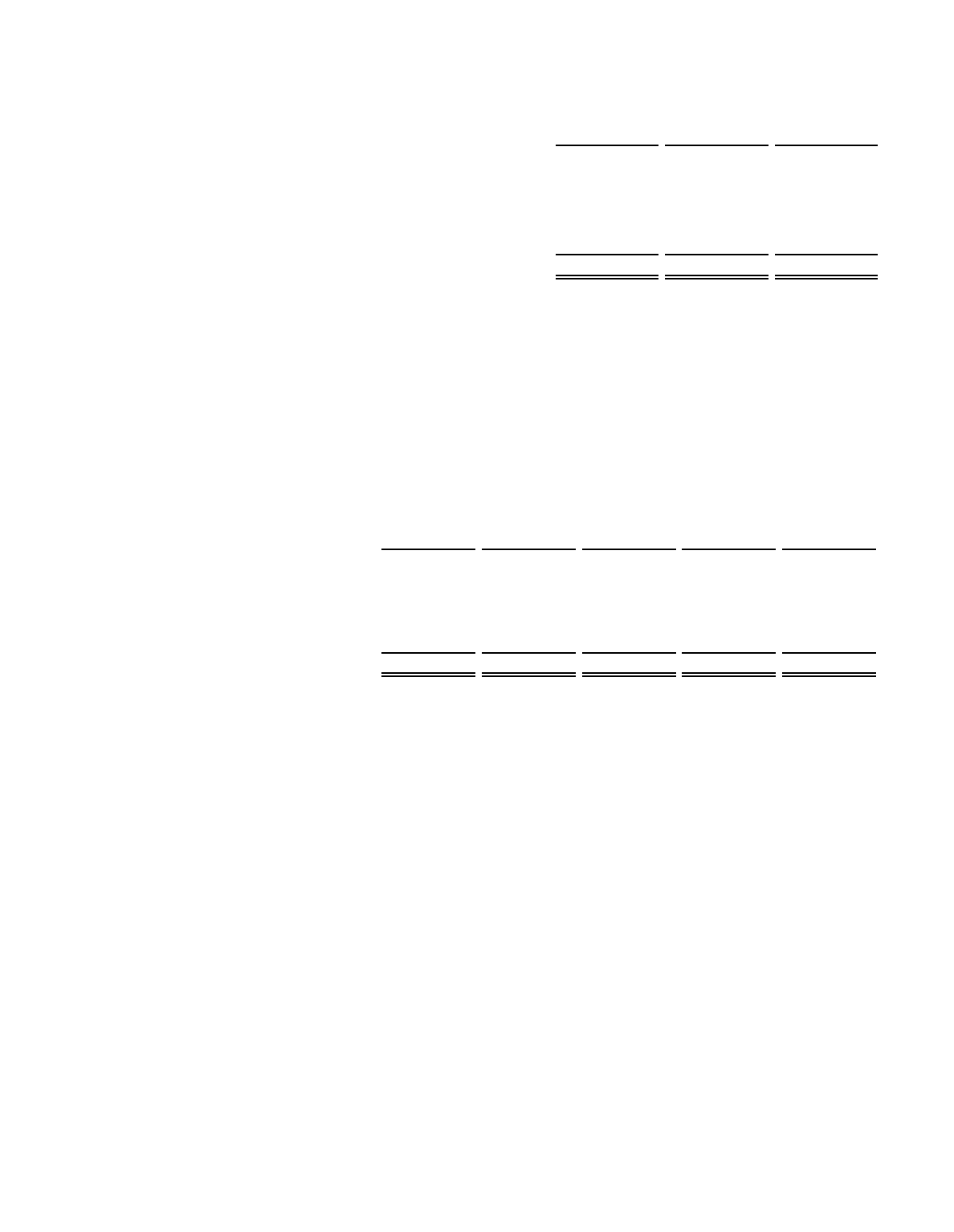

Fiscal 2012

During the third quarter of fiscal 2012, we recorded a$627.0million goodwill impairment charge and a$44.9 million

impairment charge related to our Micromania trade name as aresult of our interim impairmenttests.

In fiscal 2012, we also recorded impairments of finite-lived assets of $8.8 million consisting primarily of the remaining net

book value of assets for stores we are in the process of closing or that we have determined will not have sufficient cash flow on

an undiscounted basis to cover the remaining net book value of assets recorded for that store.

Asummary of our asset impairment charges, by reportable segment, for the 53 weeks ended February 2, 2013 is as follows:

United States Canada Australia Europe Total

(In millions)

Goodwill impairment ....................................... $—$100.3 $107.1 $419.6 $627.0

Impairment of intangible assets........................ ———44.9 44.9

Impairments of property,equipment and other

assets -store impairments ................................ 5.70.4 0.22.5 8.8

Total.................................................................. $5.7 $100.7 $107.3 $467.0 $680.7

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-14

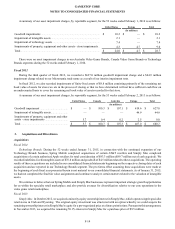

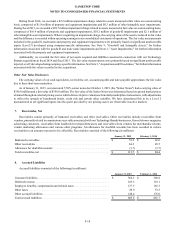

3. Acquisitions and Divestitures

Acquisitions

Fiscal 2014

Technology Brands. During the 52 weeks ended January 31, 2015, in connection with the continued expansion of our

Technology Brands business, Spring Mobile completed acquisitions of certain AT&T resellers and Simply Mac completed

acquisitions of certain authorized Apple retailers for total consideration of $93.3 million ($89.7 million net of cash acquired). We

recorded indefinite-livedintangible assets of $76.8 million and goodwill of $4.5 million related to these acquisitions. The operating

results of these acquisitions are included in our consolidated financial statements beginning on the respective closing dates of each

acquisition and are reported in our Technology Brands segment. The pro forma effect assuming these acquisitions were made at

the beginning of each fiscal year presented herein is not material to our consolidated financial statements. As of January 31, 2015,

we had not completed the final fair value assignments and continue to analyze certain matters related to the valuation of intangible

assets.

We continue to believe that our Spring Mobile and Simply Mac businesses represent important strategic growth opportunities

for us within the specialty retail marketplace and also provide avenues for diversification relative to our core operations in the

video game retail marketplace.

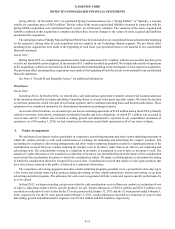

Fiscal 2013

Simply Mac. In October 2012, we acquired aminority equity ownership interest in Simply Mac, which operatesApple specialist

retail stores in Utah and Wyoming. Theoriginalequity investment was structured with an option whereby we could acquire the

remaining ownership interest in Simply Mac's equity for apre-negotiated price at afuturepoint intime. Pursuant to this arrangement,

in November 2013, we acquired the remaining50.1% interestinSimply Mac for apurchase price of $9.5 million.