GameStop 2014 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Video Game Industry

Based upon estimates compiled by various market research firms, including NPD Group, Inc. ("NPD") and International

Development Group ("IDG"), we estimate that the combined market for new physical video game products and PC entertainment

software was approximately $21.5 billion in 2014 in the countries in which we operate.

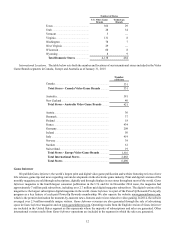

Market Market Size (in billions) Data Source

United States................ $13.1 NPD

Canada ......................... 1.0NPD

Australia ...................... 1.1NPD

Europe.......................... 6.3IDG

Total............................. $21.5

The electronic game industry referred to above consists of new physical video game products, such as hardware, video game

and PC software and accessories, but excludes sales of pre-owned video game products, which are not currently measured by any

third party research firms. Additionally,based on estimates compiled by various market research firms, we estimate that the market

in North America for content in digital format (full game and add-on content downloads for console and PC, subscriptions, mobile

games and social network games) was between $8 billion and $10 billion in 2014.

New Video Game Products.Video game products appeal to awide array of consumers, from avid gamers spending many

hours per week playing console gaming systems to casual game players enjoying social and mobile games on smart phones, tablets

and other devices. The average game player is 31 years old, 71% of gamers are age 18 or older and 48% are female. We expect

the following trends in sales of video game products:

•Video Game Hardware. Gaming consoles are typically launched in cycles as technological developments provide significant

improvements in graphics, audio quality,gameplay,internet connectivity,socialfeatures and other entertainment

capabilities beyond video gaming. The most recent cycle of consoles (referred to as “next generation”) includes the Sony

PlayStation 4and Microsoft Xbox One, which both launched in most of the countries in which we operate in November

2013, and the Nintendo WiiU,which launched in November 2012. The demand for the previous generation hardware has

been in decline since 2011and we expect that demand will continue to decline as consumers continue to move to the next

generation consoles.

In addition, portable handheld video game devices have evolved to the Nintendo 3DS and 2DS, which were introduced

in 2011and 2013,respectively,and the Sony PlayStation Vita, which was introduced in February 2012. The market for

handheld devices has declined in recent years as the proliferation of smart-phones, tablets and other mobile devices offer

video game players alternative ways to play games.

•Video Game Software. Sales of video game software generally increase as gaming platforms mature and gain wider

acceptance. Sales of video game software are dependent upon manufacturers and third-party publishers developing and

releasing game titles for existing game platforms. In recent years the number of new games introduced each year has

generally declined and as aresult, the market for video game sales has also declined. With the introduction of the next

generation consoles, we expect the number of new games introduced to increase and we expect demand for software for

those devices to grow and demand for software for the previous generation of consoles to continue to decline.

•Video Game Accessories. Sales of video game hardware also drive sales of video game accessories for use with the hardware

and software. The most common video game accessories are controllers and gaming headsets. We expect demand for video

game accessories for use on the next generation of consoles to increase as the installed base of these consoles increases.

We expect the demand for accessories for use with the previous generation of consoles to decline as the sales of those

consoles decline.

Pre-owned and Va lue VideoGameProducts. The installed base of video game hardware platforms continues to increase each

year and continues to fuel the market for pre-owned video game hardware and software. Based on reports published by NPD, we

believe that, as of December 2014, the installed base of next generation and the most recent previous generation video game

hardware systems in the United States, based on original sales, totaled approximately 217 million units of handheld and console

video game systems and grew by 16 million units in 2014. According to IDG, the installed base of active hardware systems of the

same generations as of December 2014 in Europe was approximately 172 million units and grew by 14 million units in 2014.

Hardware manufacturers and third-party software publishers have produced awide variety of software titles for each of these

hardware platforms. Based on internal estimates, we believe that 2.1 billion console video game and portable game units have

been sold over the last 10 years. This fact, combined with the growth of the next-generation video game hardware and software,

drives ongoing demand for pre-owned video game products. We believe that we are the leader in sales of pre-owned and value

video game products.

4