GameStop 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

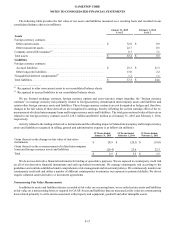

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-9

1. NatureofOperations and Summary of Significant Accounting Policies

Background

GameStop Corp. (“GameStop,” “we,” “us,” “our,” or the “Company”) is aglobal family of specialty retail brands that makes

the most popular technologies affordable and simple. As the world's largest multichannel video game retailer,wesell new and pre-

owned video game hardware, physical and digital video game software, video game accessories, as well as new and pre-owned

mobile and consumer electronics products and other merchandise primarily through our GameStop, EB Games and Micromania

stores. As of January 31, 2015, we operated 6,690 stores, in the United States, Australia, Canada and Europe, which are primarily

located in major shopping malls and strip centers. We also operate electronic commerce websites www.gamestop.com,

www.ebgames.com.au,www.ebgames.co.nz,www.gamestop.ca,www.gamestop.it,www.gamestop.ie,www.gamestop.de,

www.gamestop.co.uk andwww.micromania.fr. Thenetwork also includes: www.kongregate.com,aleading browser-based game

site; Game Informer magazine, the world's leading print and digital video game publication; and iOS and Android mobile

applications. We also own and operate Spring Mobile, an authorized AT&T reseller operating AT &T branded wireless retail stores

and pre-paid wireless stores under the name Cricket Wireless (an AT &T brand) in the United States, as well as acertified Apple

reseller selling Apple consumer electronic products in the United States under the name Simply Mac. We operate our business in

four Video Game Brands segments: United States, Canada,Australia and Europe; and aTechnology Brands segment, which includes

the operations of our Spring Mobile managed AT&T and Cricket Wireless branded stores and our Simply Mac business.

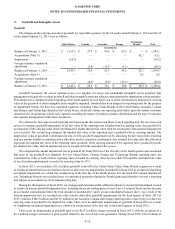

Our largest vendors worldwide are Sony,Microsoft, Nintendo and Activision, which accounted for 24%, 17%, 11%and 10%,

respectively,ofour newproduct purchases in fiscal 2014, 20%, 15%, 12% and 10%, respectively,infiscal 2013 and 17%, 13%,

14% and 16%, respectively,infiscal 2012. In addition, Take-Two Interactive accounted for 11%ofour newproduct purchases in

fiscal 2013, and ElectronicArts, Inc. accounted for 10% and 11%ofour newproduct purchases in fiscal 2013 and 2012, respectively.

Basis of Presentation and Consolidation

Our consolidated financial statements include our accounts and the accounts of our wholly-owned subsidiaries and our majority-

owned subsidiaries.All intercompany accounts and transactions have been eliminated in consolidation.All dollar and share amounts

(other than dollar amounts per share) in the consolidated financialstatements are stated in millions unless otherwise indicated.

Our fiscal year is composed of the 52 or 53 weeks ending on the Saturday closest to the last day of January.Fiscal 2014

consisted of the 52 weeks ended on January 31, 2015 ("fiscal 2014"). Fiscal 2013 consisted of the 52 weeks ended on February 1,

2014 ("fiscal 2013"). Fiscal 2012 consisted of the 53 weeks ended on February 2, 2013 ("fiscal 2012").

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of

America (“GAAP”) requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities, the

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and

expenses during the reporting period. In preparing these financial statements, we have made our best estimates and judgments of

certain amounts included in the financial statements, giving due consideration to materiality.Changes in the estimates and

assumptions used by us could haveasignificant impact on our financial results. Actual results could differ from those estimates.

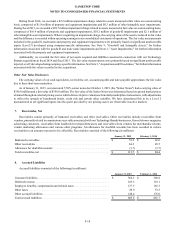

Cash and Cash Equivalents

We consider all short-term, highly-liquid instruments purchased with an original maturity of three months or less to be cash

equivalents. Our cash and cash equivalents are carried at cost, which approximates market value, and consist primarily of time

deposits with highly rated commercial banks. From time to time depending upon interest rates, credit worthiness and other factors,

we invest in money market investmentfunds holding direct U.S. Treasury obligations.

Restricted Cash

We consider bank deposits serving as collateral for bank guarantees issued on behalf of our foreign subsidiaries as restricted

cash, which is included in other noncurrent assets in our consolidated balance sheets. Our restricted cash was $12.7 million and

$16.4 million as of January 31, 2015 and February 1, 2014, respectively.