GameStop 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

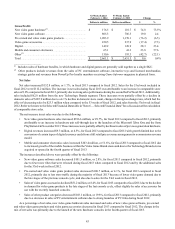

of Senior Notes in September 2014. The cash flows used in financing activities in fiscal 2013 were primarily for the repurchase

of $258.3 million of treasury shares and the payment of dividends on our Class ACommonStock of $130.9 million. The cash

flows used in financing activities in fiscal 2012 were primarily for the repurchase of $409.4 million of treasury shares and the

payment of dividends on our Class ACommonStock of $102.0 million. The cash flows used in financing activities in fiscal 2014,

fiscal 2013 and fiscal 2012 were also impacted by cash provided by the issuance of shares associated with stock option exercises

of $0.7 million,$58.0 million and $11.6 million, respectively.

Sources of Liquidity

We utilize cash generated from operations and have funds available to us under our Revolver,aswell as the proceeds from

the September 24, 2014 issuance of our Senior Notes, to cover seasonal fluctuations in cash flows and to support our various

growth initiatives. Our cash and cash equivalents are carried at cost and consist primarily of time deposits with commercial banks.

Issuance of 5.50% Senior Notes due 2019. On September 24, 2014, we issued $350.0 million aggregate principal amount of

unsecured 5.50% Senior Notes due October 1, 2019. The Senior Notes bear interest at the rate of 5.50% per annum with interest

payable semi-annually in arrears on April 1and October 1ofeach year beginning on April 1, 2015. The Senior Notes were sold

in aprivate placement and will not be registered under the U.S. Securities Act of 1933. The Senior Notes were offered in the U.S.

to “qualified institutional buyers” pursuant to the exemption from registration under Rule 144A of the Securities Act and in

exempted offshore transactions pursuant to Regulation Sunder the Securities Act.

The Senior Notes were issued pursuant to an indenture dated as of September 24, 2014, by and among the Company,certain

subsidiary guarantors named therein and U.S. Bank National Association, as trustee and will mature on October 1, 2019. The net

proceeds from the offering of $343.7 million were used to pay down the remaining outstanding balance of our revolving credit

facility,which is described more fully below,and will be used for general corporate purposes, which may include acquisitions,

dividends and stock buybacks. The outstanding balance of the Senior Notes at January 31, 2015 was $350.0 million. We incurred

fees and expenses related to the Senior Notes offering of $6.3 million, which were capitalized during the third quarter of fiscal

2014 and will be amortized as interest expenseover the term of the notes.

The indenture governing the Senior Notes does not contain financial covenants but does contain covenants which place certain

restrictions on us and our subsidiaries, including limitations on asset sales, additional liens, investments, stock repurchases,

dividends, distributions, the incurrence of additional debt and the repurchase debt that is junior to the Senior Notes. These covenants

are subject to certain exceptions and qualifications.

The indenture contains customary events of default, including payment defaults, breaches of covenants, failure to pay certain

judgments and certain events of bankruptcy,insolvencyand reorganization. If an event of default occurs and is continuing, the

principal amount of the Senior Notes, plus accrued and unpaid interest, if any,may be declared immediately due and payable.

These amounts automatically become due and payable if an event of default relating to certain events of bankruptcy,insolvency

or reorganization occurs.

Revolving Credit Facility. On January 4, 2011, we entered into a$400million credit agreement, which we amended and

restated on March 25, 2014 and further amended on September 15, 2014 (the “Revolver”). The Revolver is afive-year,asset-

based facility that is secured by substantially all of our assets and the assets of our domestic subsidiaries. Availability under the

Revolver is subject to amonthly borrowing base calculation. The Revolver includes a$50 million letter of credit sublimit. Prior

to the March 2014 amendments, the Revolver was scheduled to mature in January 2016. The amendments extended the maturity

date to March 25, 2019; increased the expansion feature under the Revolver from $150 million to $200 million, subject to certain

conditions; and revised certain other terms, including areduction of the fee we are required to pay on the unused portion of the

total commitment amount. We believe the extension of the maturity date of the Revolver to March 2019 helps to limit our exposure

to potential tightening or other adverse changes in the credit markets. The September 15, 2014 amendment amended certain

covenants to permit the issuance of the Senior Notes.

Borrowing availability under the Revolver is limited to aborrowing base which allows us to borrow up to 90% of the appraisal

value of the inventory,ineach case plus 90% of eligible credit card receivables, net of certain reserves. The borrowing base

provides for borrowing up to 92.5% of the appraisal value during the fiscal months of August through October.Letters of credit

reduce the amount available to borrow under the Revolver by an amount equal to the face value of the letters of credit. Our ability

to pay cash dividends, redeem options and repurchase shares is generally permitted, except under certain circumstances, including

if either 1) excess availability under the Revolver is less than 30%, or is projected to be within 12 months after such payment or

2) excess availability under the Revolver is less than 15%, or is projected to be within 12 months after such payment, and the fixed

charge coverage ratio, as calculated on apro-forma basisfor the prior 12 months is 1.1:1.0 or less. In the event that excess availability

under the Revolver is at any time less than the greater of (1) $30 million or (2) 10% of the lesser of the total commitment or the

borrowing base, we will be subject to afixed charge coverage ratio covenant of 1.0:1.0.

The Revolver places certain restrictions on us and our subsidiaries, including limitations on asset sales, additional liens,

investments, loans, guarantees, acquisitions and the incurrence of additional indebtedness. Absent consent from our lenders, we

maynot incur more than $1 billion of senior secured debt and $750 million of additional unsecured indebtedness to be limited to

49