GameStop 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

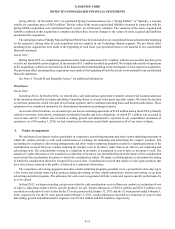

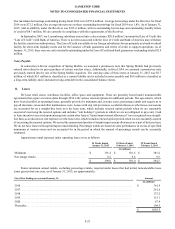

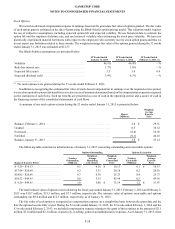

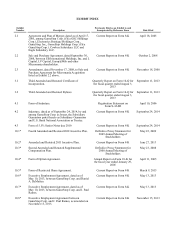

The following is areconciliation of income tax expense (benefit) computed at the U.S. Federal statutory tax rate to income

tax expense (benefit) reported in our consolidated statements of operations:

52 Weeks Ended

January 31, 2015

52 Weeks Ended

February 1, 2014

53 Weeks Ended

February 2, 2013

Federal statutory tax rate............................................................. 35.0% 35.0%35.0%

State income taxes, net of federal benefit ................................... 2.01.9 (27.7)

Foreign income tax rate differential............................................ (0.4) (0.5) 5.6

Nondeductible goodwill impairments......................................... —0.6 (488.6)

Change in valuationallowance ................................................... 1.8—(22.5)

Subpart Fincome ........................................................................ 2.74.8 (61.4)

Interest income from hybrid securities........................................ (5.2) (5.8) 73.3

Realization of losses in foreign operations not previously

benefited...................................................................................... (2.2) ——

Other (including permanent differences)(1) ................................. 1.71.7 (14.6)

35.4%37.7% (500.9)%

___________________

(1) Other is comprised of numerous items, none of which is greater than 1.75% of earnings before income taxes.

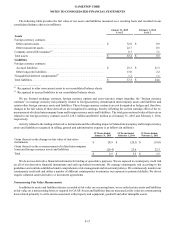

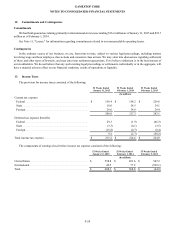

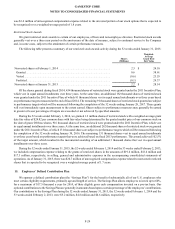

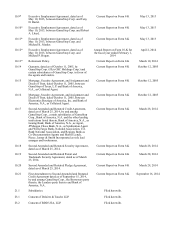

Differences between financial accounting principles and tax laws cause differences between the bases of certain assets and

liabilities for financial reporting purposes and tax purposes. The tax effects of these differences, to the extent they are temporary,

are recorded as deferred tax assets and liabilities and consisted of the following components (in millions):

January 31, 2015 February 1, 2014

Deferred tax asset:

Inventory ................................................................................................................ $27.4$ 18.8

Deferred rents......................................................................................................... 11.1 12.4

Stock-based compensation ..................................................................................... 16.0 26.4

Net operating losses ............................................................................................... 30.8 16.8

Customer liabilities ................................................................................................ 29.9 31.9

Fixed assets ............................................................................................................ —21.9

Foreign tax credit carryover ................................................................................... 5.21.4

Other....................................................................................................................... 14.8 9.4

Total deferred tax assets ......................................................................................... 135.2139.0

Valuation allowance........................................................................................... (24.3) (13.3)

Total deferred tax assets, net.............................................................................. 110.9125.7

Deferred tax liabilities:

Fixed assets ............................................................................................................ (4.3) —

Goodwill................................................................................................................. (88.8) (80.3)

Prepaid expenses .................................................................................................... (3.8) (4.9)

Acquired intangible assets...................................................................................... (17.3) (20.6)

Other....................................................................................................................... (2.7) (5.6)

Total deferred tax liabilities............................................................................... (116.9)(111.4)

Net ..................................................................................................................... $(6.0) $14.3

Consolidated financial statements:

Deferred income tax assets —current...................................................................... $65.6$ 51.7

Other noncurrent assets............................................................................................. $24.3$ —

Deferred income tax liabilities —noncurrent .......................................................... $(95.9) $(37.4)

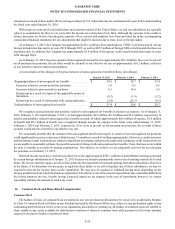

We file income tax returns in the U.S. federal jurisdiction and various states and foreign jurisdictions. The Internal Revenue

Service (“IRS”) is currently examining our U.S. income tax returns for the fiscal years ended February 2, 2013, January 28, 2012

and January 29, 2011. We do notanticipate any adjustments that would result in amaterial impact on our consolidated financial

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-25