GameStop 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In total, there are approximately 300 districts. Our international operations are managed by asenior executive. The stores in Europe

are managed by asenior vice president and three vice presidents, who each manage aregion or country in the European segment.

We also employ avicepresident in Europe who assists the regions in leveraging the purchasing and merchandising of our products.

Our stores in Australia and Canada areeach managed by avice president.

We operate the Technology Brands stores with afield management and store management structure similar to that of our

Video Game Brands stores. Our Spring MobileAT&T branded stores are managed by asenior vice president of stores who manages

three vice presidents. These vice presidents manage nine regional directors, each of whom manages between four and eight district

managers. These district managers manage between five and 13 stores. Our Spring Mobile managed Cricket Wireless branded

stores are managed by avicepresident whooversees three regional managers, each of whom manages ageographic market

containing between 14 and 30 stores. Simply Mac stores operate with avicepresident of stores overseeing eight district managers,

each of whom supervises betweensix and 12 store managers.

Customer Service

Our store personnel provide value-added services to each customer,suchasmaintaining lists of regular customers and reserving

new releases for customers with adownpayment to ensure product availability.Inaddition, our store personnel readily provide

product reviews and ratings to ensure customers are making informed purchasing decisions and inform customers of available

resources, including Game Informer and our e-commerce sites, to increase acustomer’s enjoyment of the product upon purchase.

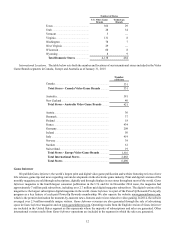

Vendors

We purchase substantially all of our new products worldwide from over 80 manufacturers, software publishers and several

distributors. Purchases from the top ten vendors accounted for approximately 85% of our new product purchases in fiscal 2014.

Sony,Microsoft, Nintendo and Activision accounted for 24%, 17%, 11%and 10%, respectively,ofour newproduct purchases

during fiscal 2014. We have established price protections and return privileges with our primary vendors in order to reduce our

risk of inventory obsolescence. In addition, we have few purchase contracts with trade vendors and generally conduct business

on an order-by-order basis, apractice that is typical throughout the industry.Webelieve that maintaining and strengthening our

long-term relationships with our vendors is essential to our operations and continued expansion. We believethatwehavevery

good relationships with our vendors.

Competition

The electronic game industry is intensely competitive and subject to rapid changes in consumer preferences and frequent new

product introductions. We competewith mass merchants and regional chains; computer product and consumer electronics stores;

other video game and PC software specialty stores; toy retail chains; direct sales by software publishers; and online retailers and

game rental companies. Videogameproducts are also distributed through other methods such as digital delivery.Wealso compete

with sellers of pre-owned and value video game products. Additionally,wecompete with other forms of entertainment activities,

including casual and mobile games, movies, television, theater,sporting events and family entertainment centers.

In the U.S., we compete with Wal-Mart Stores, Inc. (“Wal-Mart”); Target Corporation (“Target”); Amazon.com, Inc.

(“Amazon.com”); and Best Buy Co., Inc. (“Best Buy”), among others. Throughout Europe we compete with major consumer

electronics retailers such as Media Markt, Saturn and FNAC, major hypermarket chains like Carrefour and Auchan, and online

retailer Amazon.com. Competitors in Canada include Wal-Mart, Best Buy and its subsidiary Future Shop. In Australia, competitors

include K-Mart, Target and JB HiFi stores.

Our Spring Mobile AT &T branded stores compete with AT &T corporate-owned stores, other AT&T authorized resellers, mass

market retailers such as Wal-Mart, Best Buy and Target, among others, as well as other pre-paid and post-paid wireless carriers

and their distribution channels, including Verizon, Sprint and T-Mobile. Our Simply Mac stores compete with Apple, including

online and corporate owned Apple stores, mass-market retailers as noted above, and other authorized Apple resellers. Our Spring

Mobile managed Cricket Wireless branded stores compete with the pre-paid and post-paid wireless service offerings of AT &T,

Verizon, T-Mobile, Sprint and other prepaid brands including Boost, GoPhone and MetroPCS.

Seasonality

Our business, like that of many retailers, is seasonal, with the major portion of our sales and operating profit realized during

the fourth fiscal quarter,which includes the holiday selling season. During fiscal 2014, we generated approximately 37% of our

sales during the fourth quarter.During fiscal 2013, we generated approximately 41% of our salesduring thefourthquarter.

15