GameStop 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our senior management has discussed the development and selection of these critical accounting policies, as well as the significant

accounting policies disclosed in Note 1, "Nature of Operations and Summary of Significant Accounting Policies," to our

consolidated financial statements, with the Audit Committee of our Board of Directors. We believe the following accounting

policies are the most critical to aid in fully understanding and evaluating our reporting of transactions and events, and the estimates

these policies involve require our most difficult, subjective or complexjudgments.

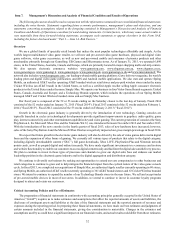

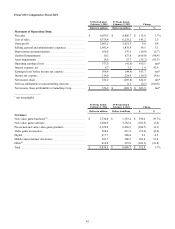

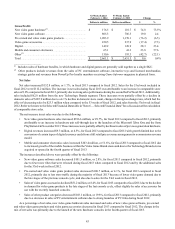

Estimate Description Judgment and/or Uncertainty Potential Impact if Results Differ

Valuation of Merchandise Inventories

Our merchandise inventories are carried

at the lower of cost or market generally

using the average cost method. Under

the average cost method, as new

product is received from vendors,its

current cost is added to the existingcost

of product on-hand and this amount is

re-averaged over the cumulative units.

Pre-owned video game products traded

in by customers are recorded as

inventory at the amount of the store

credit given to the customer.

In valuing inventory,weare required to

make assumptionsregarding the

necessity of reserves required to value

potentially obsolete or over-valued

items at the lower of cost or market. We

consider quantities on hand, recent

sales, potential price protections and

returns to vendors, among other factors,

when making these assumptions.

Our ability to gauge these factors is

dependentuponour ability to forecast

customer demand and to provide awell-

balanced merchandise assortment. Any

inability to forecast customer demand

properly couldleadtoincreased costs

associated with write-downs of inventory

to reflect volumes or pricing of inventory

which we believe represents the net

realizable value.

A10% change in our obsolescence

reserve percentage at January 31, 2015

would have affected net earnings by

approximately $3.1 million in fiscal 2014.

Cash Consideration Received from Vendors

We participate in cooperative

advertising programs and other vendor

marketing programs in which our

vendors provide us with cash

consideration in exchange for marketing

and advertising the vendors’ products.

The cooperative advertising programs

and other vendor marketing programs

generally cover aperiod from afew

weeks up to amonth andinclude items

such as product in-store display

promotions and placement, internet

advertising, co-op print advertisingand

other programs. The allowance for each

event is negotiated with the vendorand

requires specific performance by us to

be earned.

Our accounting for cooperative

advertising arrangements and other

vendor marketingprograms results in a

significantportion of the consideration

received from ourvendors reducing the

productcosts in inventory rather than as

an offset to our marketing and

advertising costs. The consideration

servingasareduction in inventory is

recognized in costofsales as inventory

is sold.

We estimate the amountofvendor

allowances to be deferred as areduction

of inventory based on the nature of the

consideration received and the

merchandise inventory to which the

consideration relates. We apply asell-

through rate to determine the timingin

which the consideration shouldbe

recognized incostofsales.

Consideration receivedthatrelates to

videogameproductsthathave not yet

been releasedtothe public isdeferred.

Although we consider our advertisingand

marketing programs to be effective, we

do notbelieve that we would be able to

incur the same level of advertising

expenditures ifthe vendorsdecreased or

discontinued their allowances.

Additionally,ifactual results are not

consistent with our estimated deferrals

and sell-through rates, we may be

exposed to additional adjustments that

could materially impact our gross profit

rates and inventory balances.

A10% difference in our vendor

allowances deferral at January 31, 2015

would haveaffected net earnings by

approximately $0.2million in fiscal 2014.

33